Q3 2022 Newsletter

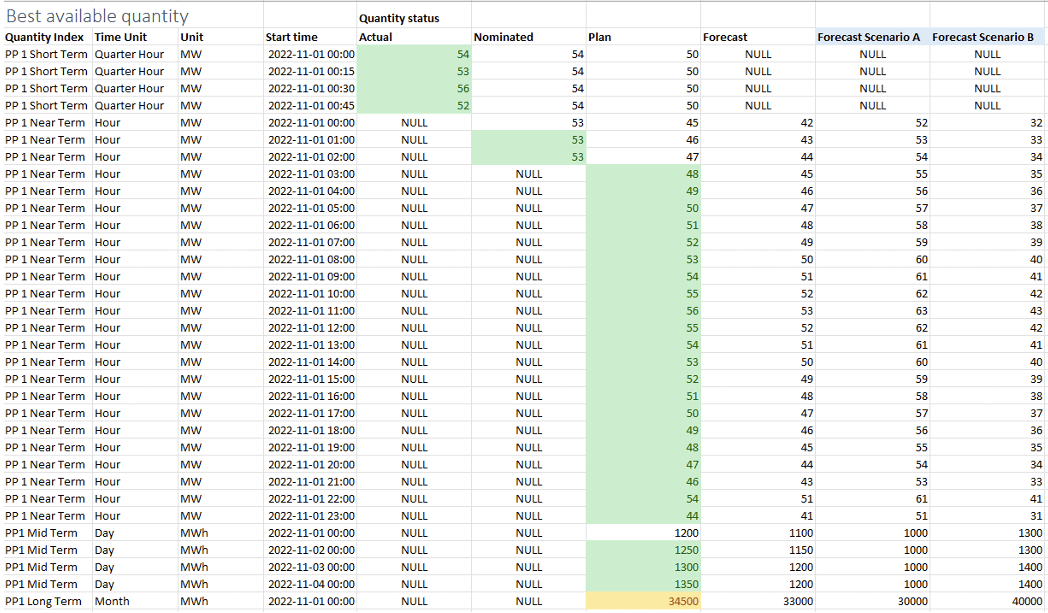

Quantity Statuses

Quantity Index Logic

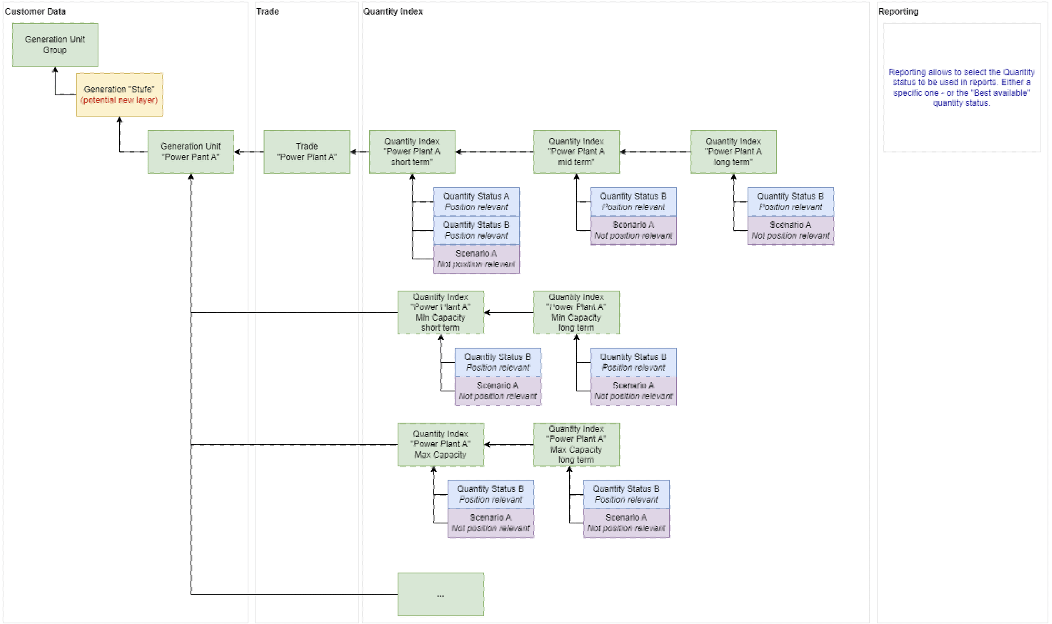

Power Plant Modelling

Power Plant Modelling

Power Plant Modelling

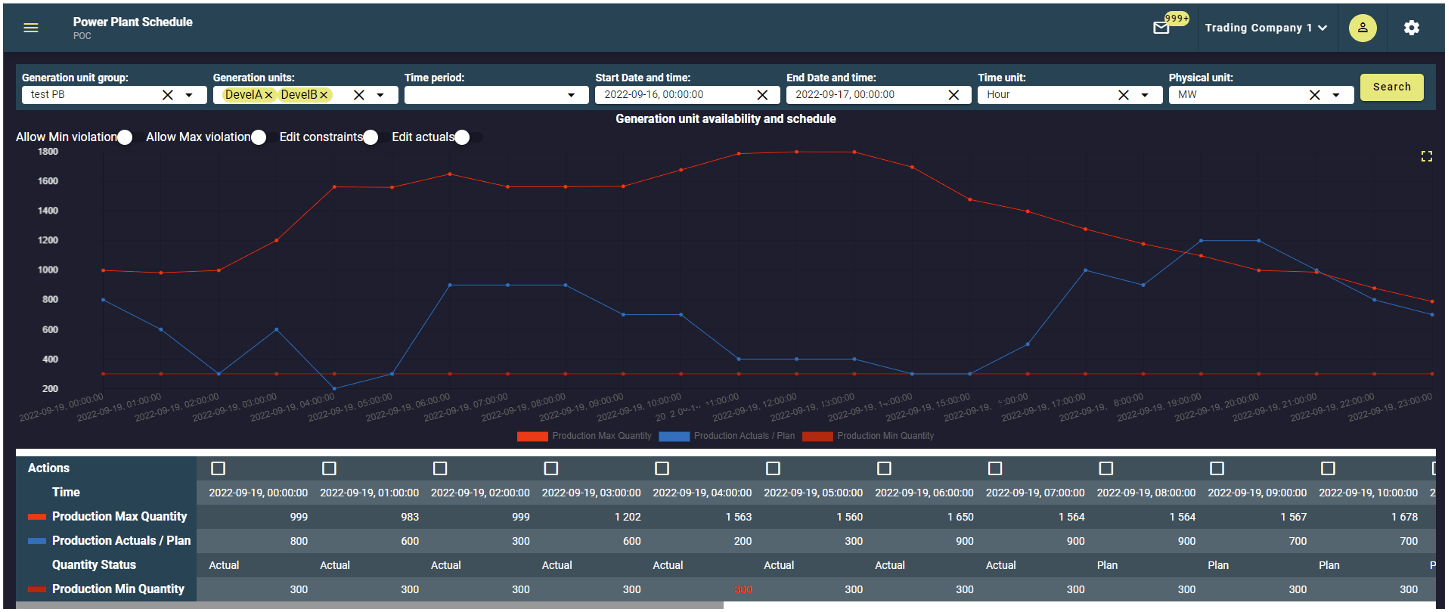

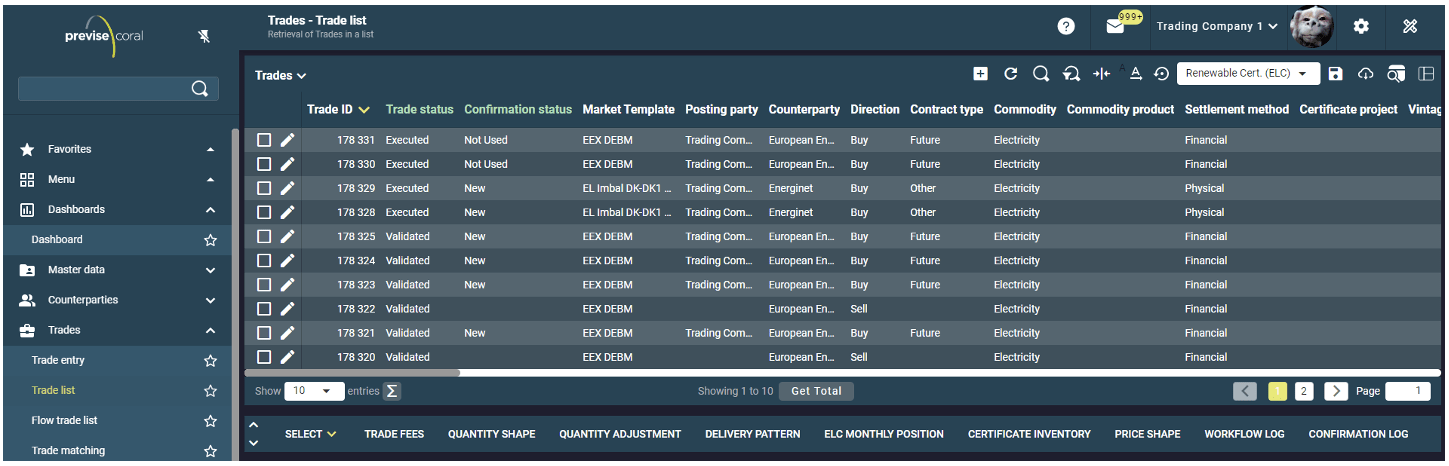

New User Interface

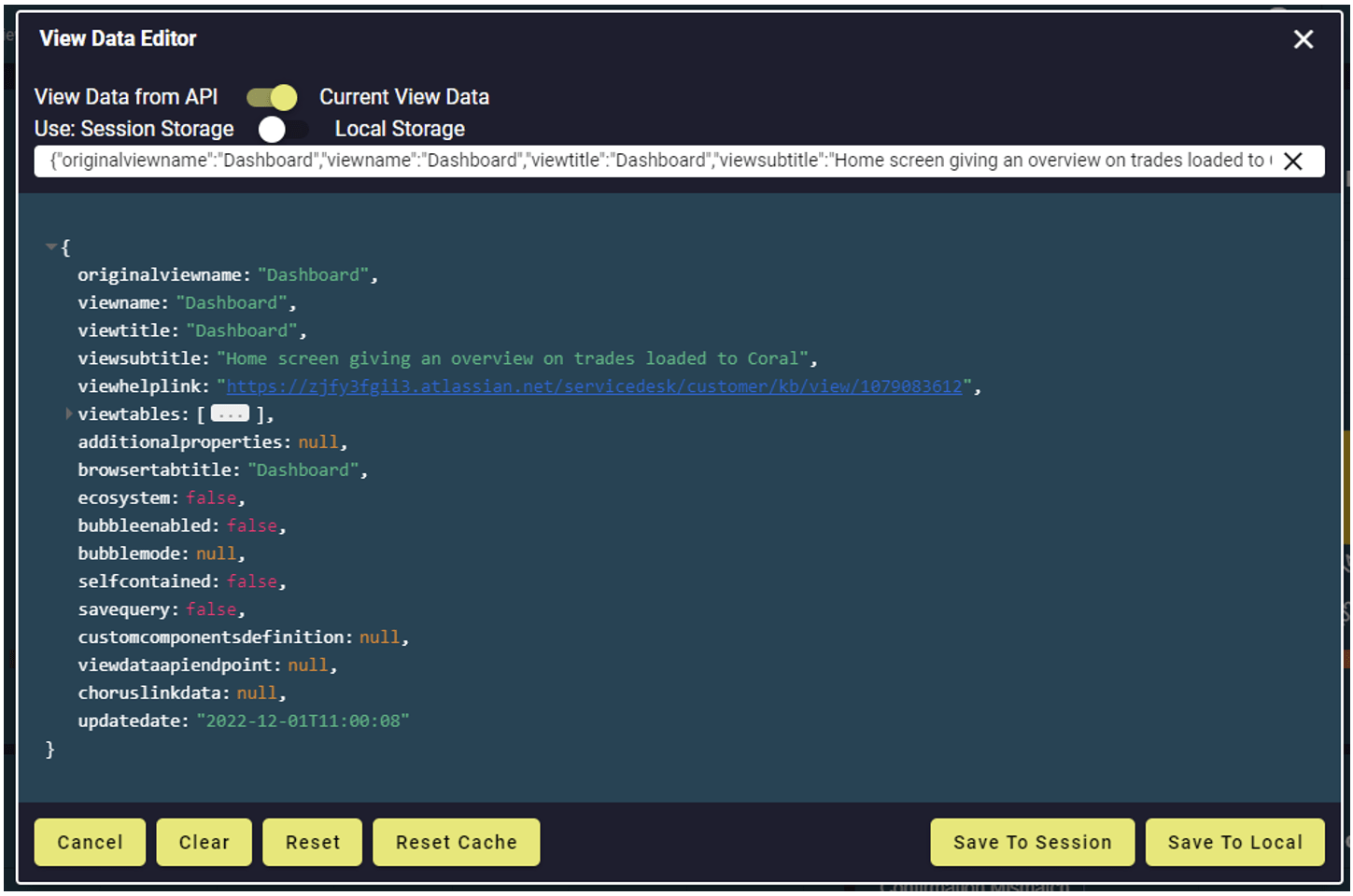

UI Editor

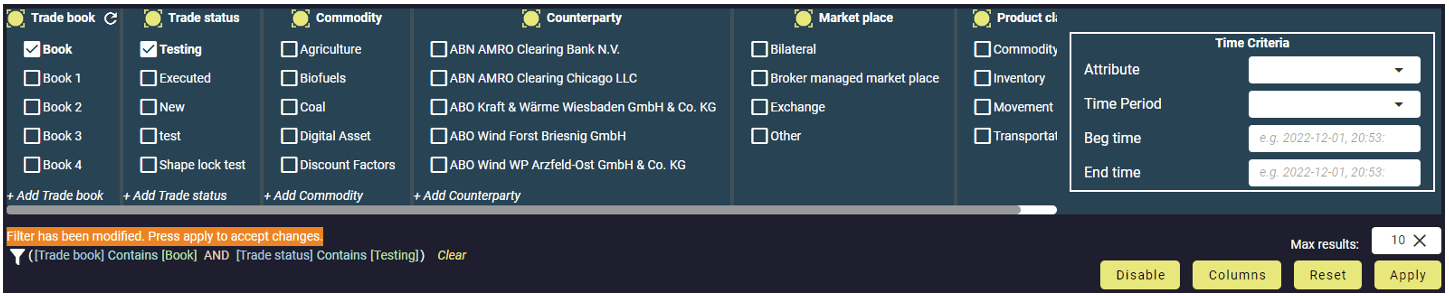

Dynamic Filters

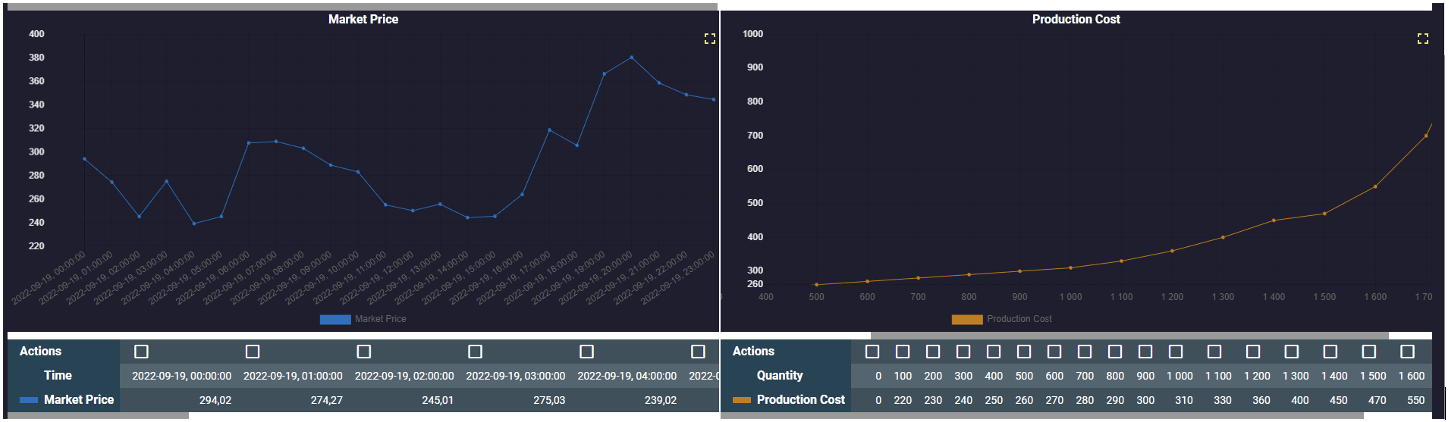

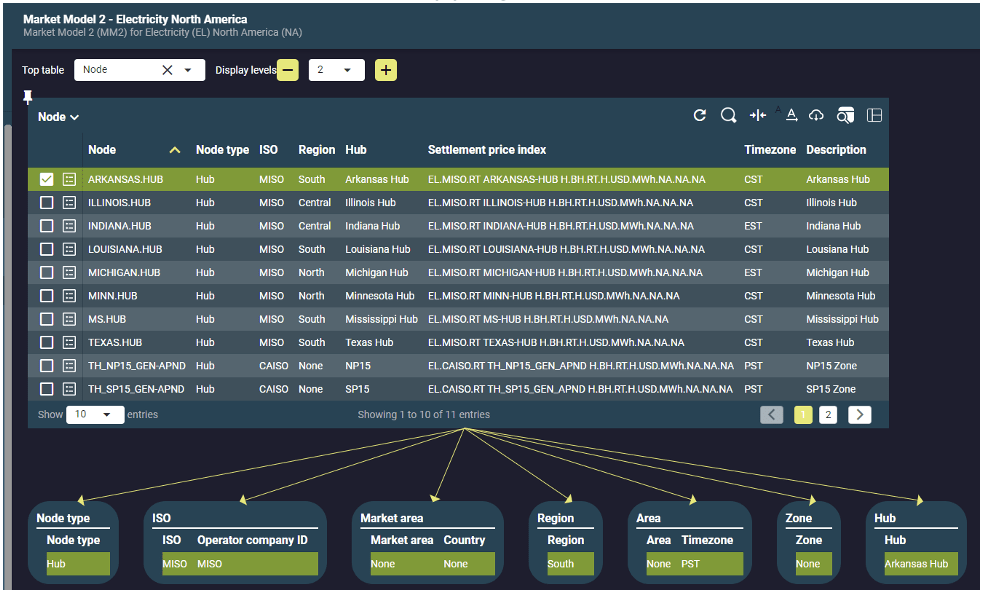

Market Model 2

Trade Cascading

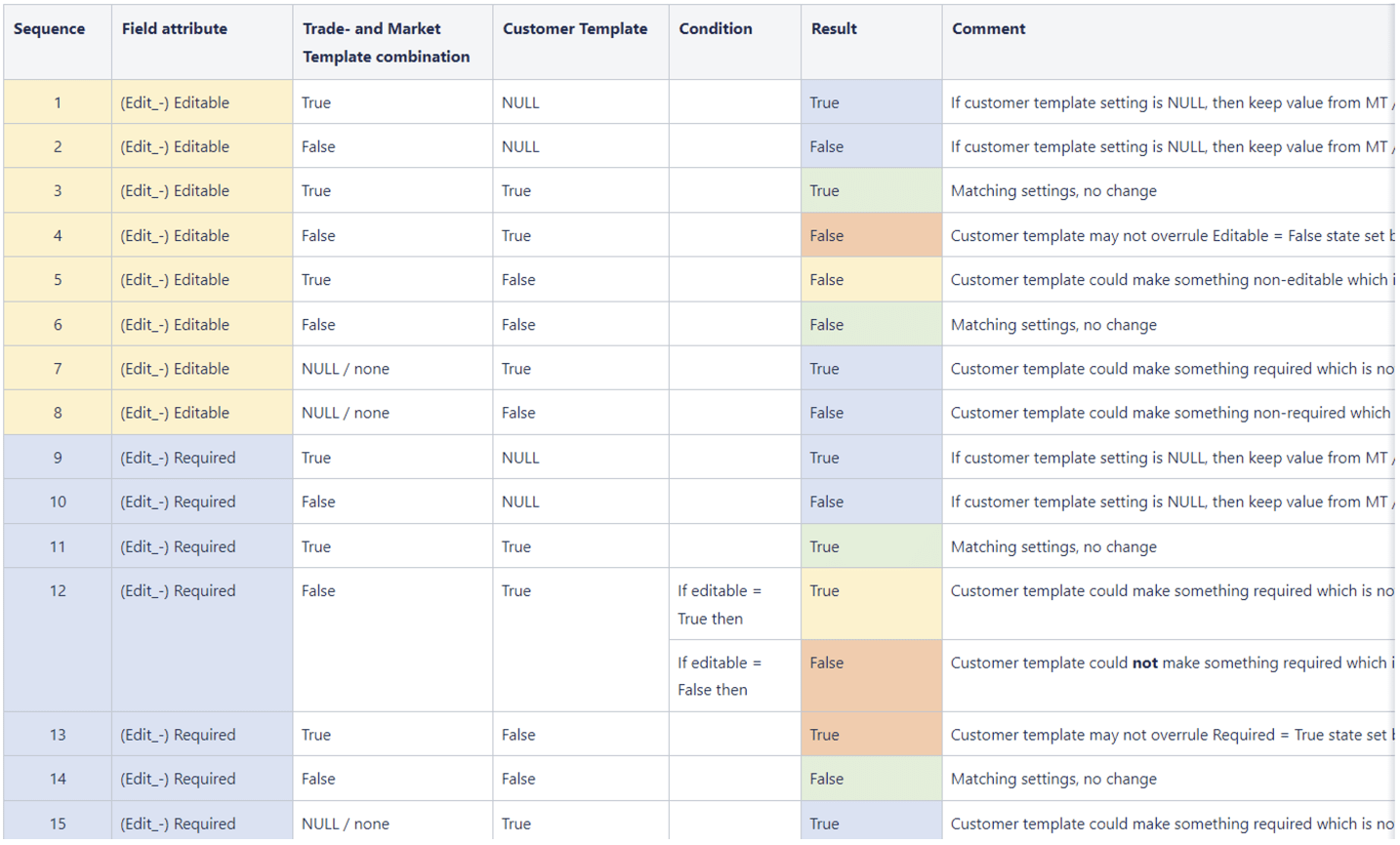

Template Engine

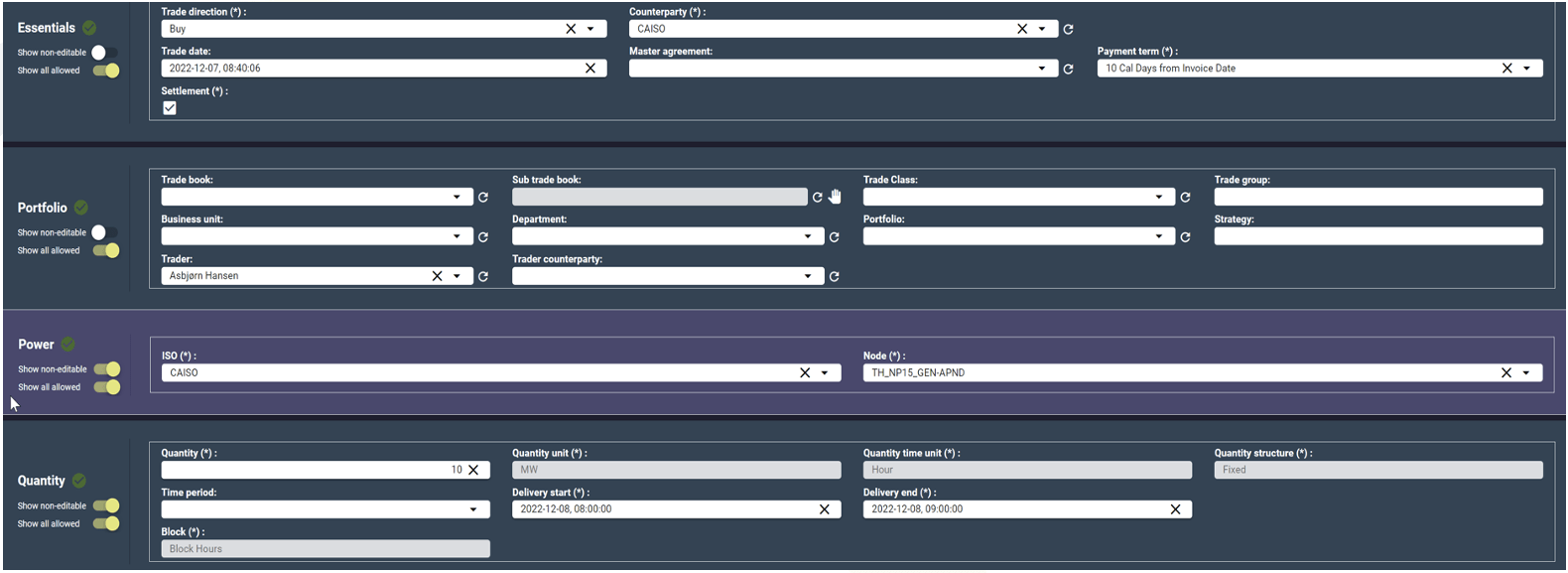

US Virtuals

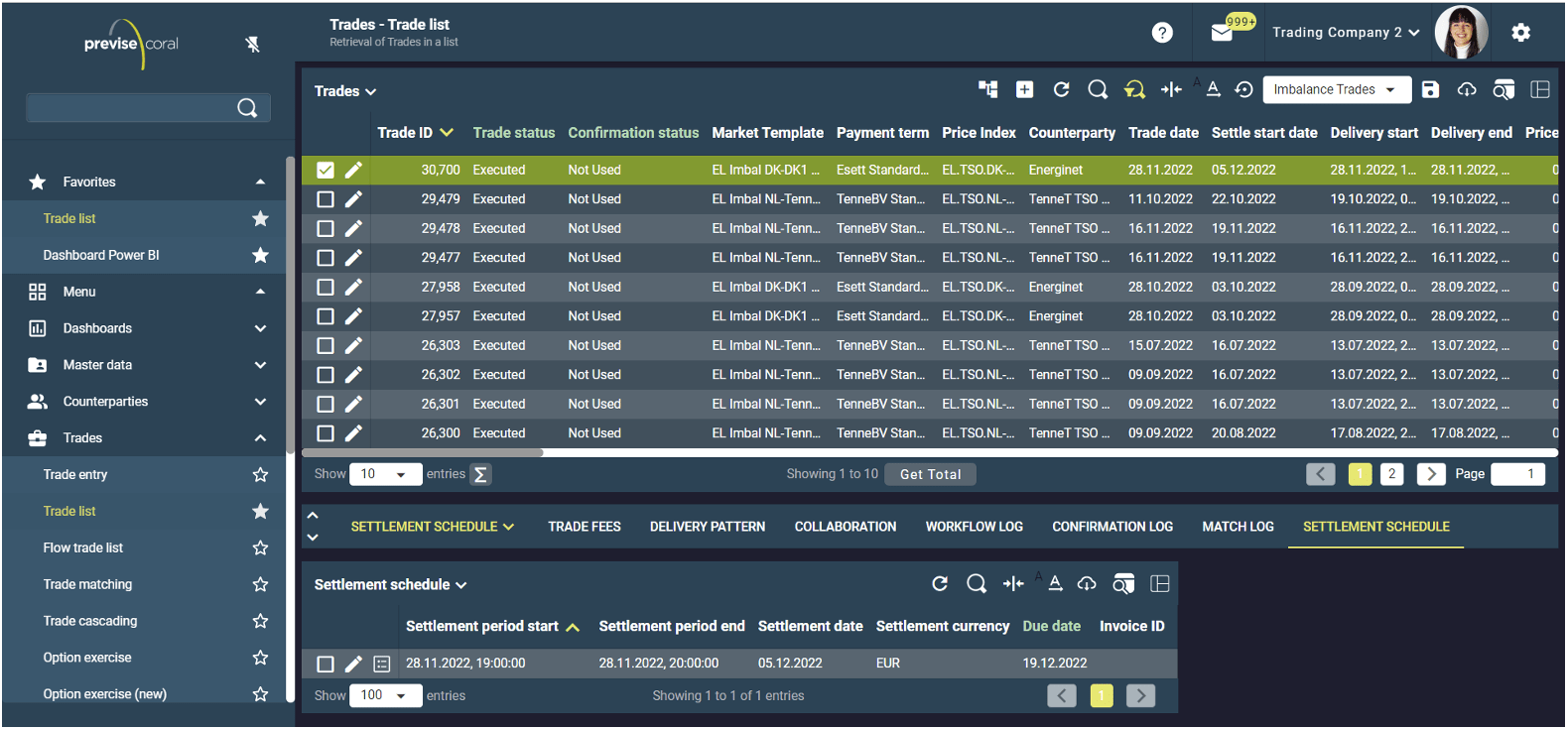

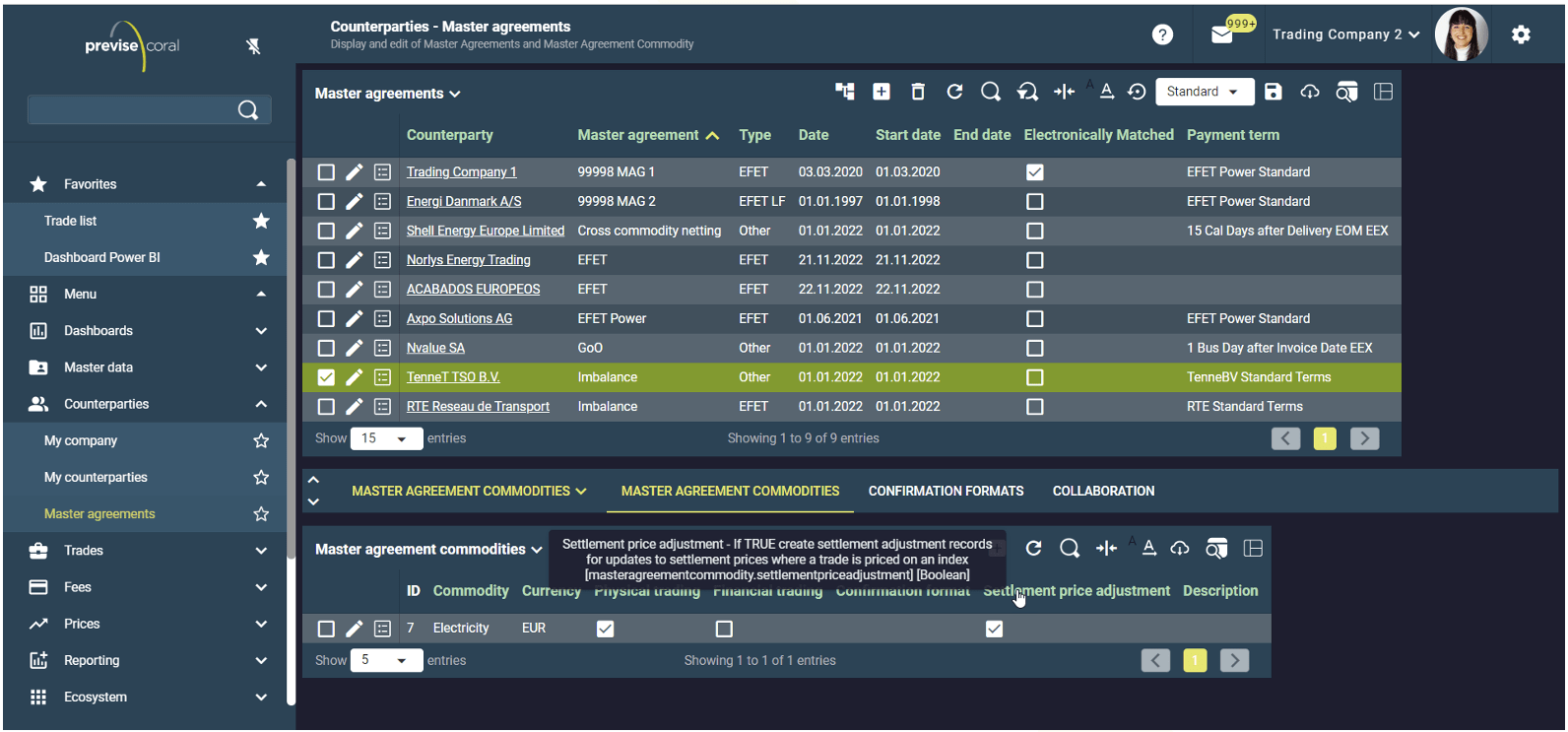

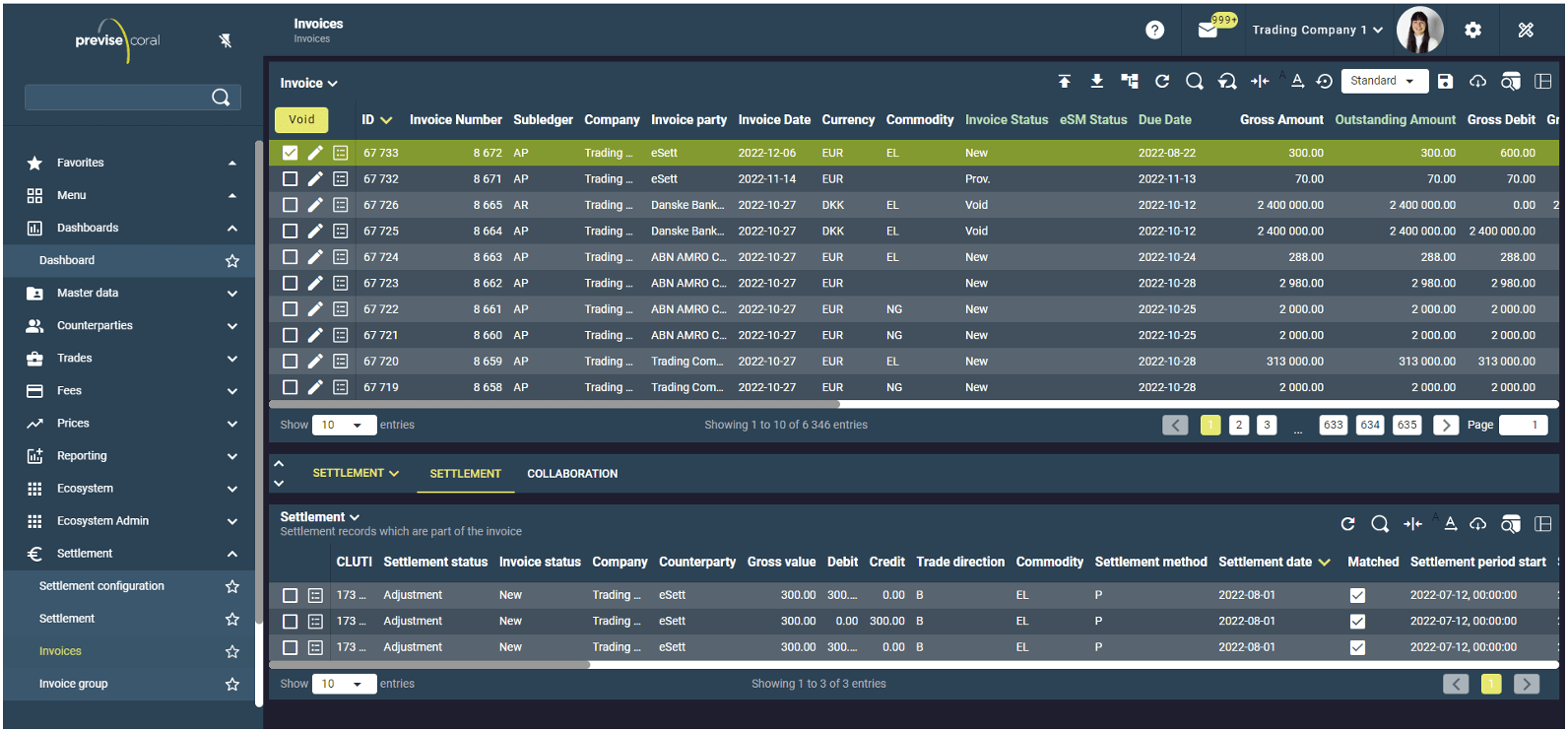

Settlement Parameters I

Settlement Parameters II

Settlement Parameters III

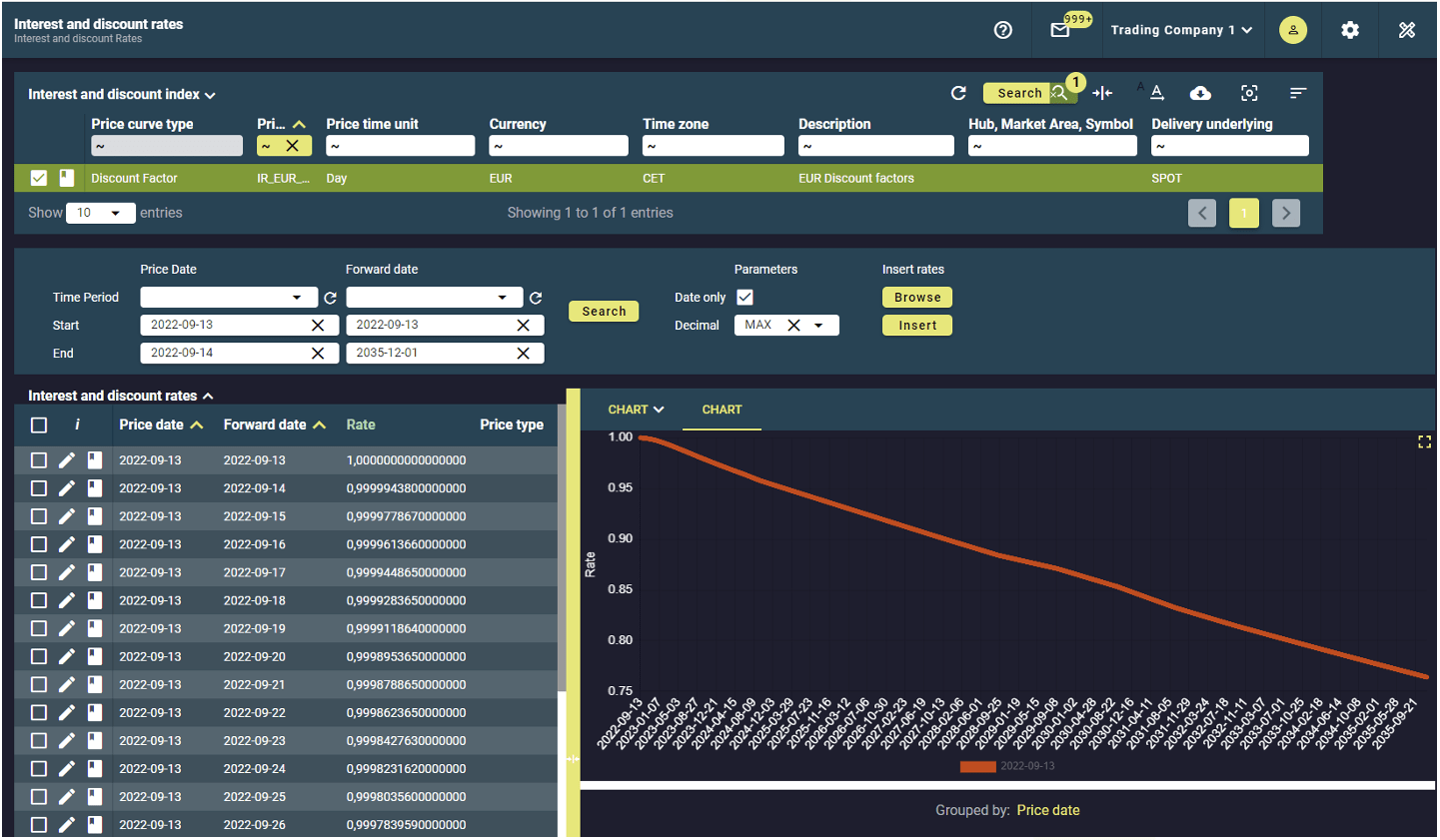

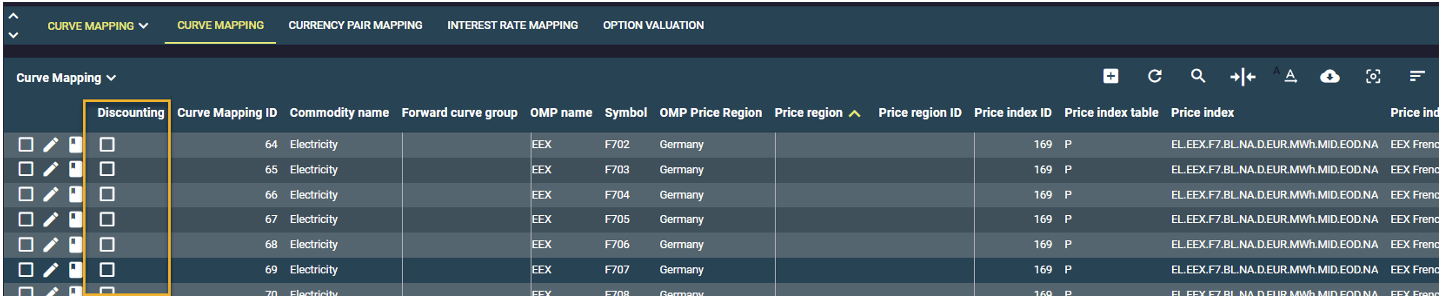

Discounting I

Discounting II

Discounting III

Inventory I

Inventory II

Inventory III

Views Link I

Views Link II

Q2 2022 Newsletter

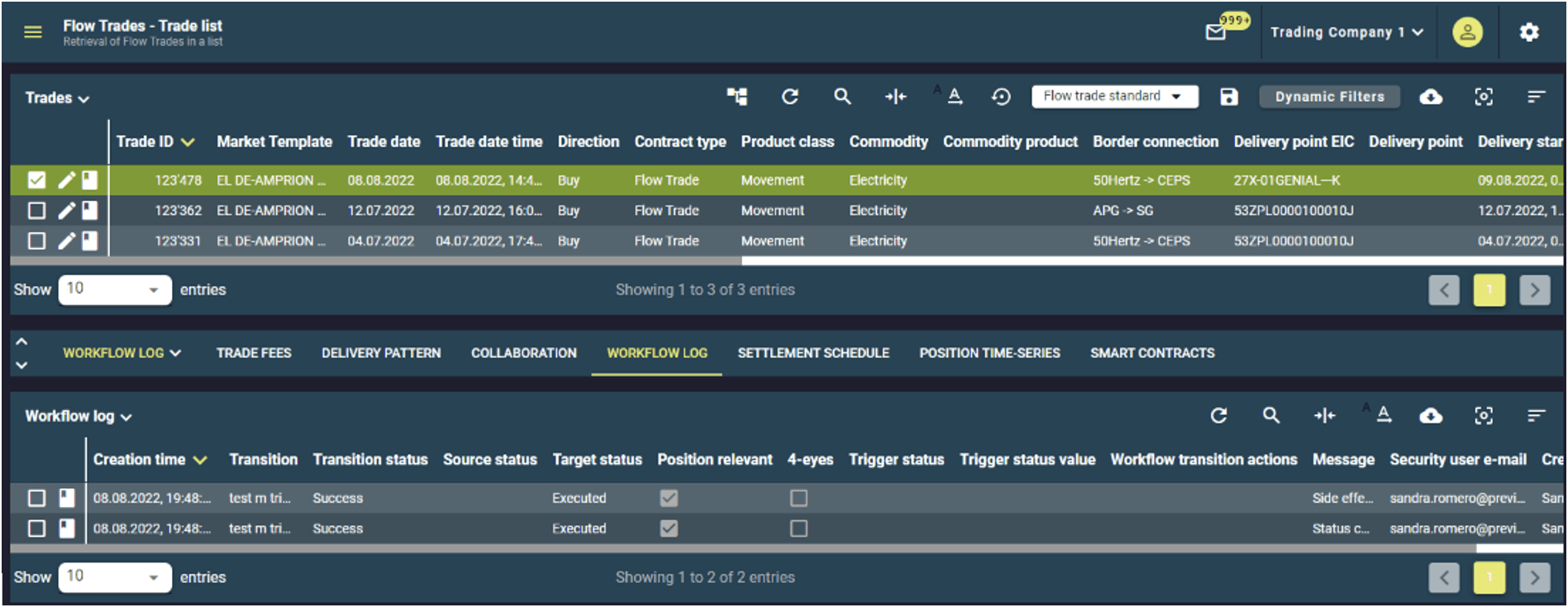

Flow Trades

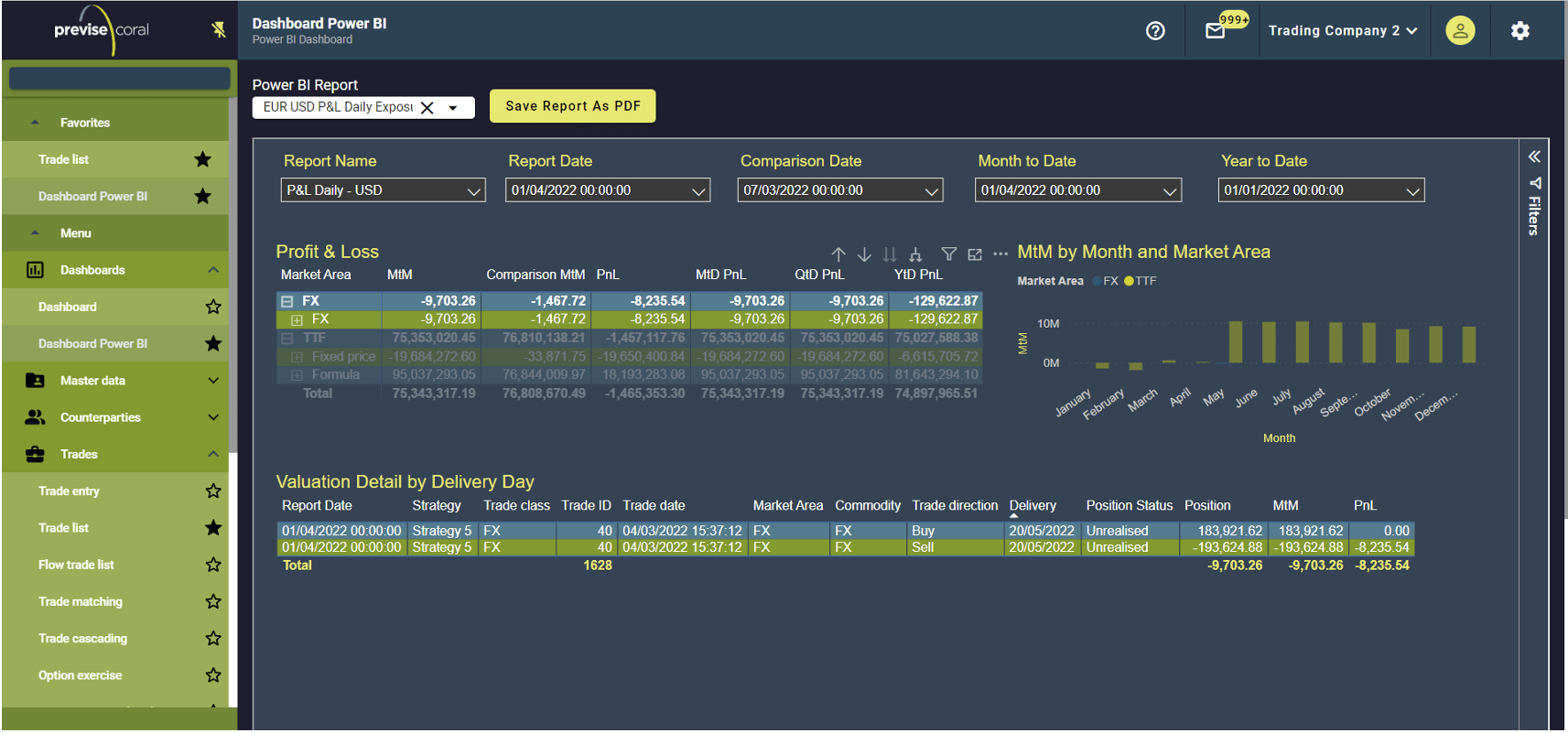

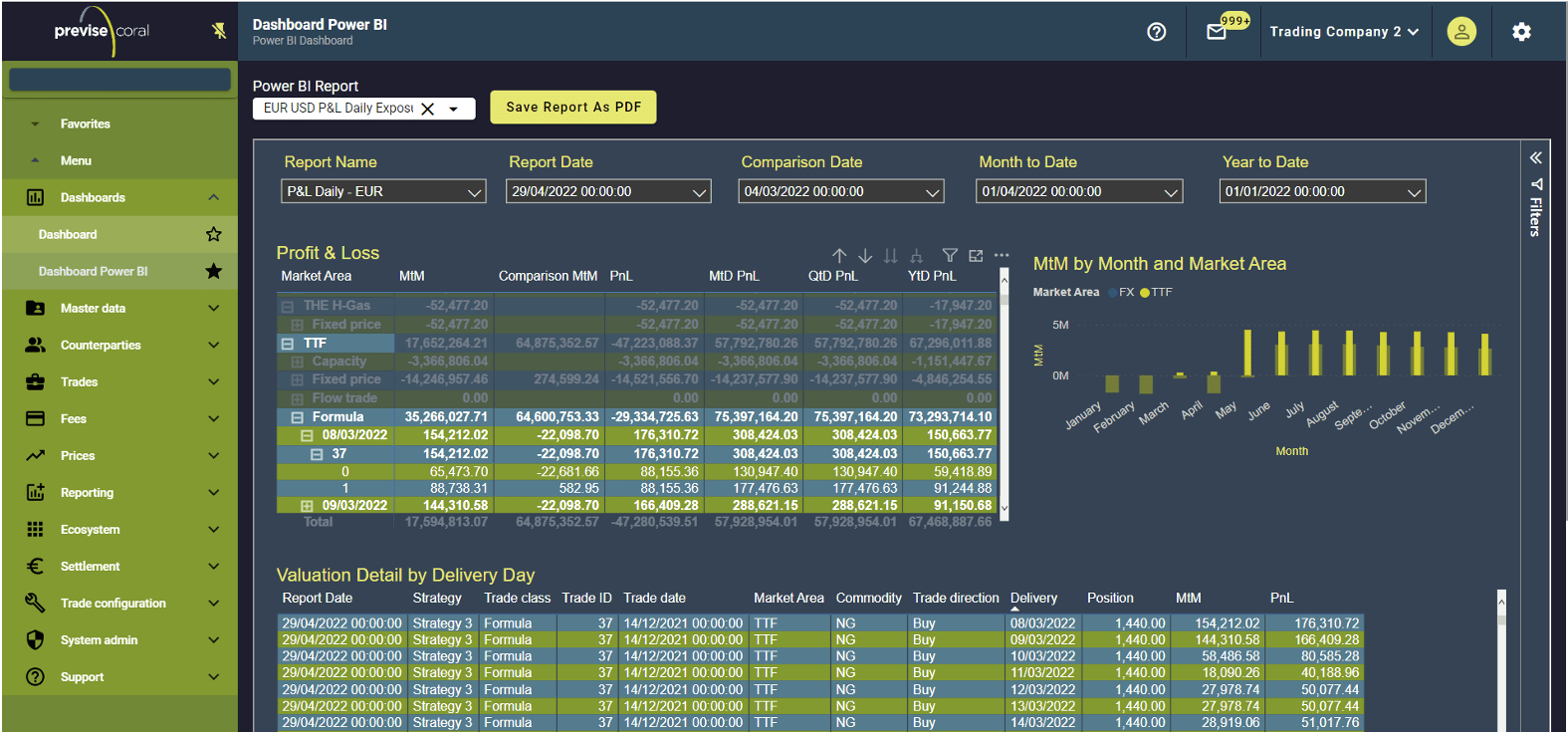

FX Trades and FX Hedging

FX Exposure

Invoice Document Creation

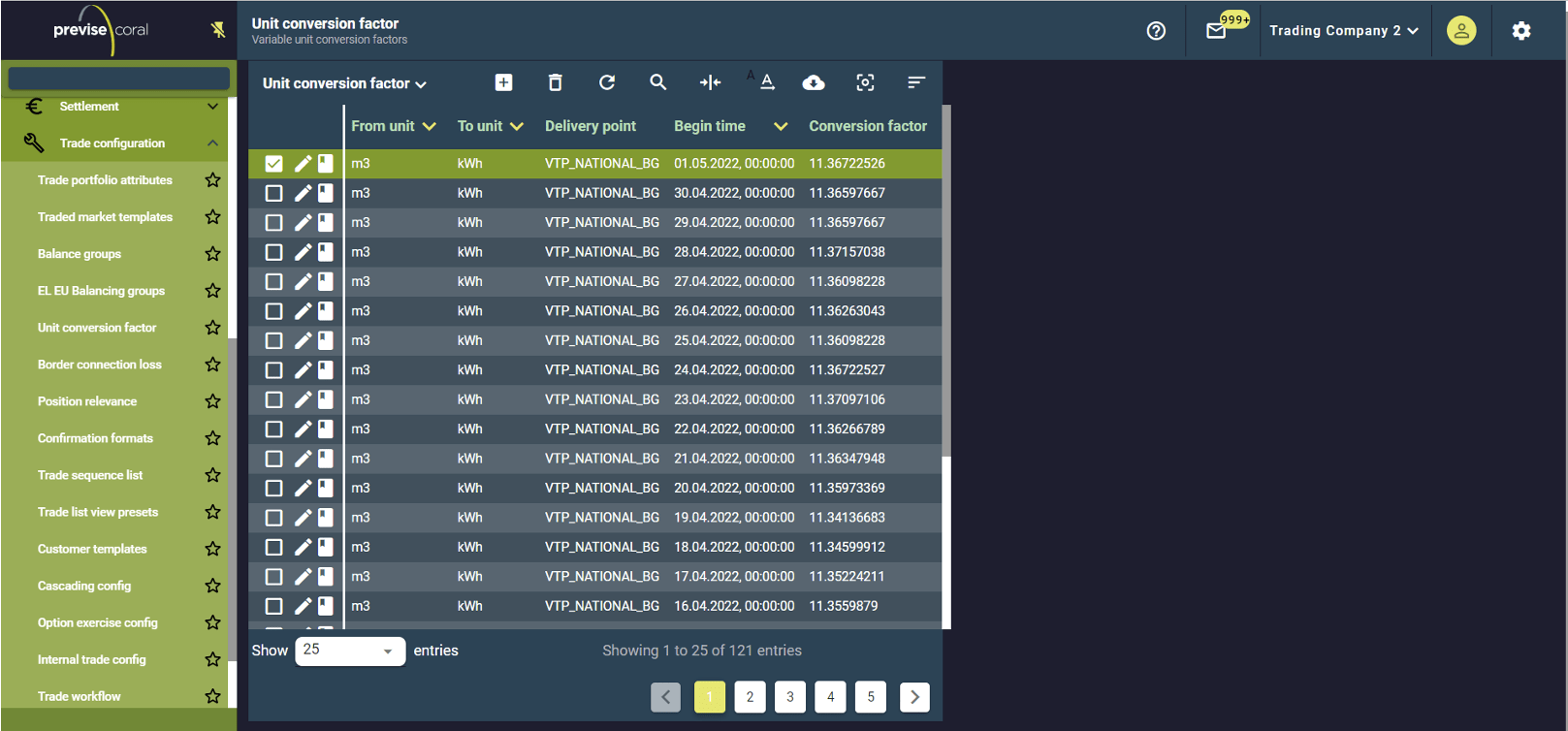

Unit Conversion Factors

Price Exposure from Formulas

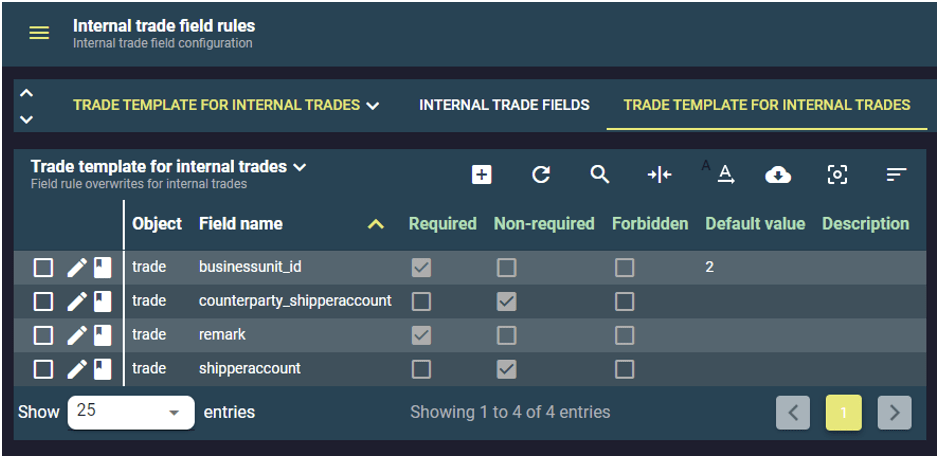

Internal Trade Templates

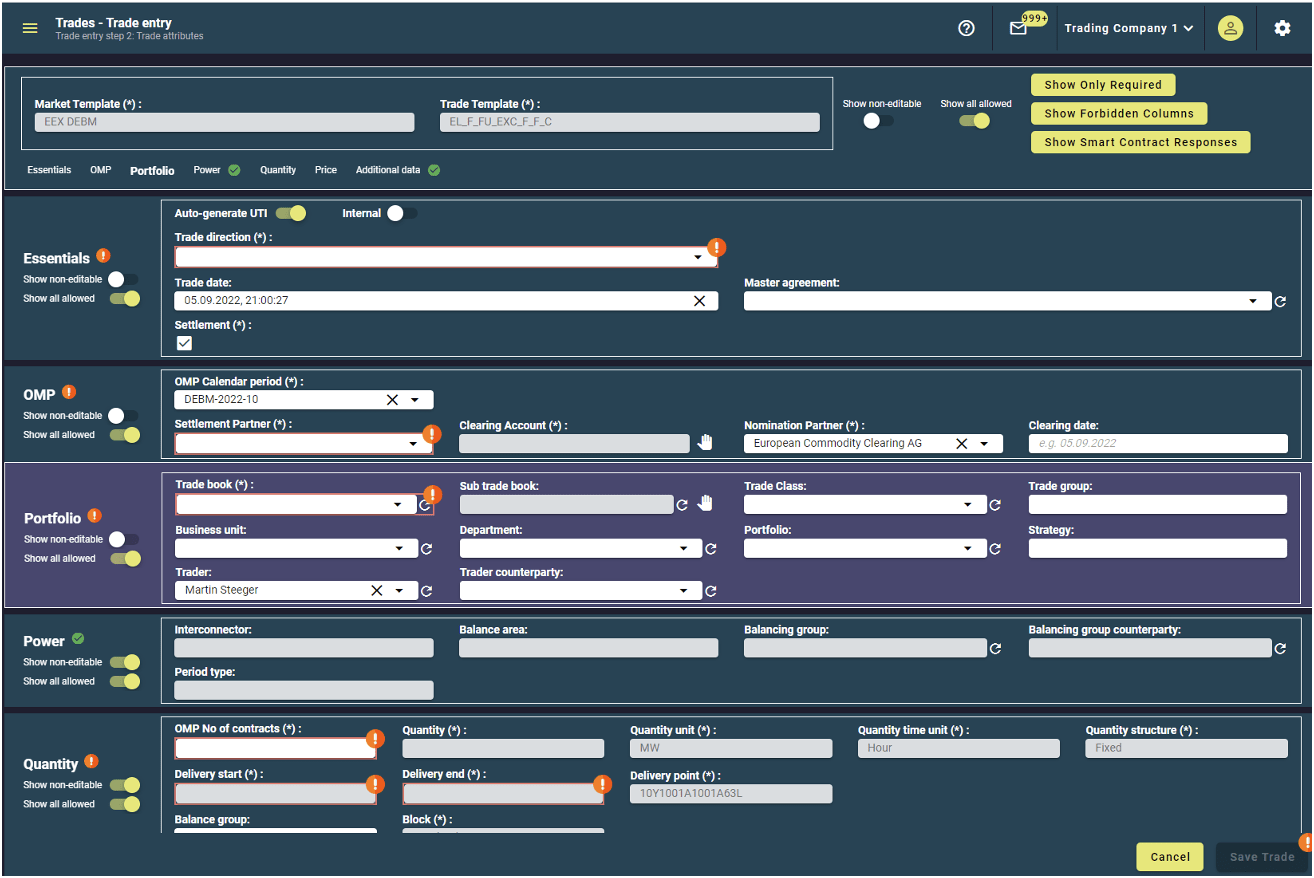

Trade Capture – Fields Re-Ordered

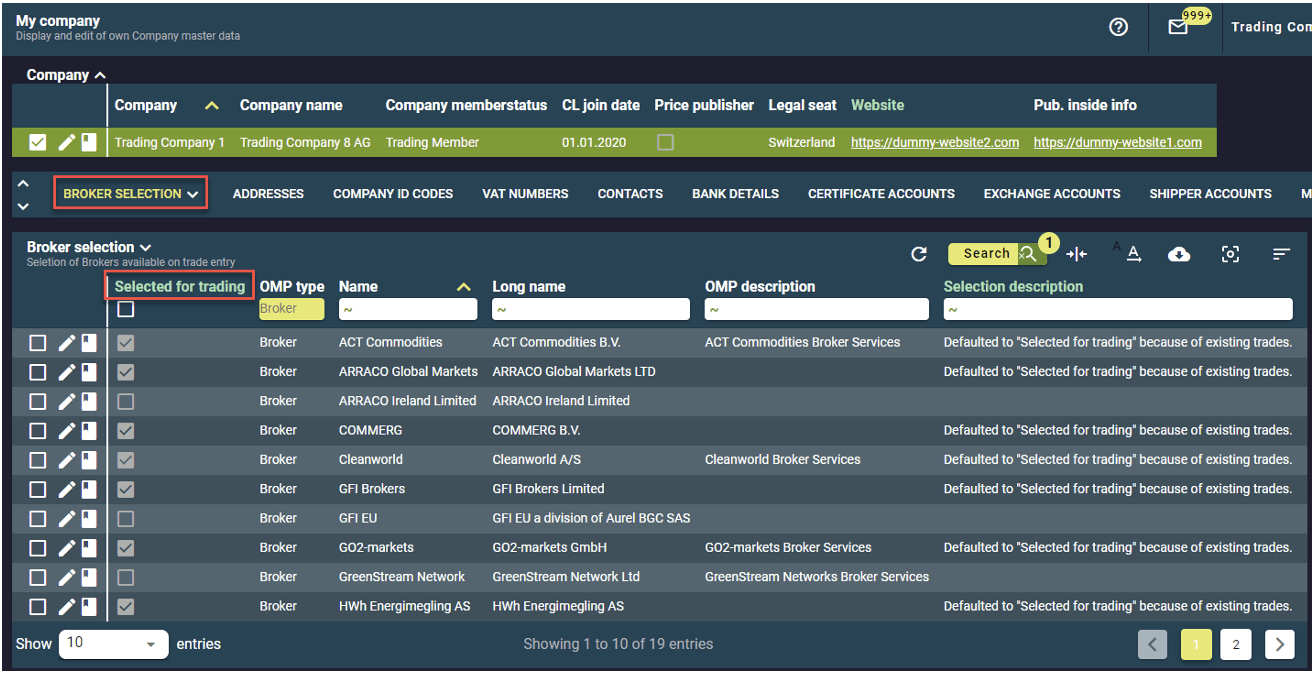

Broker Selection

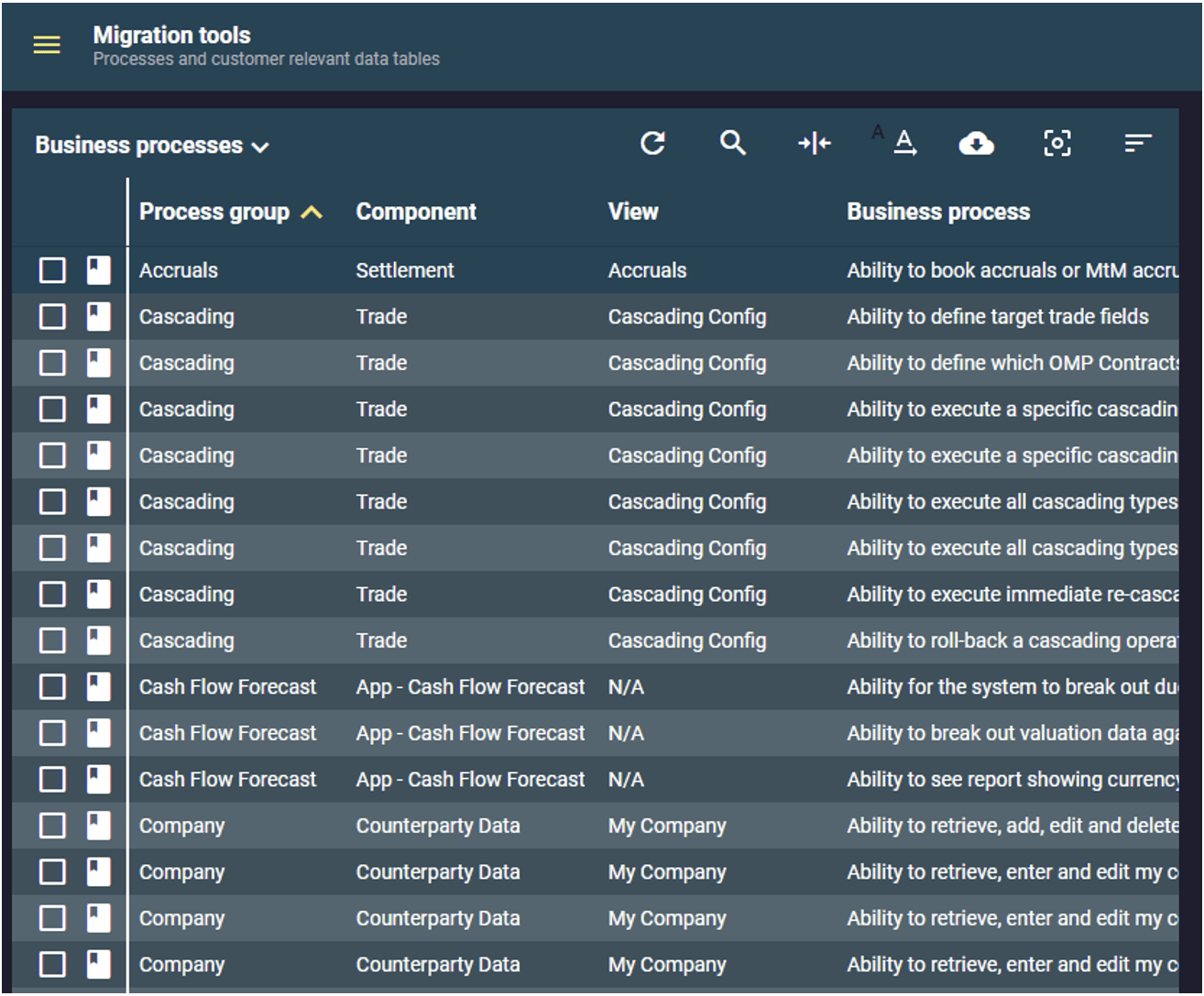

Migration Tools – Process Model

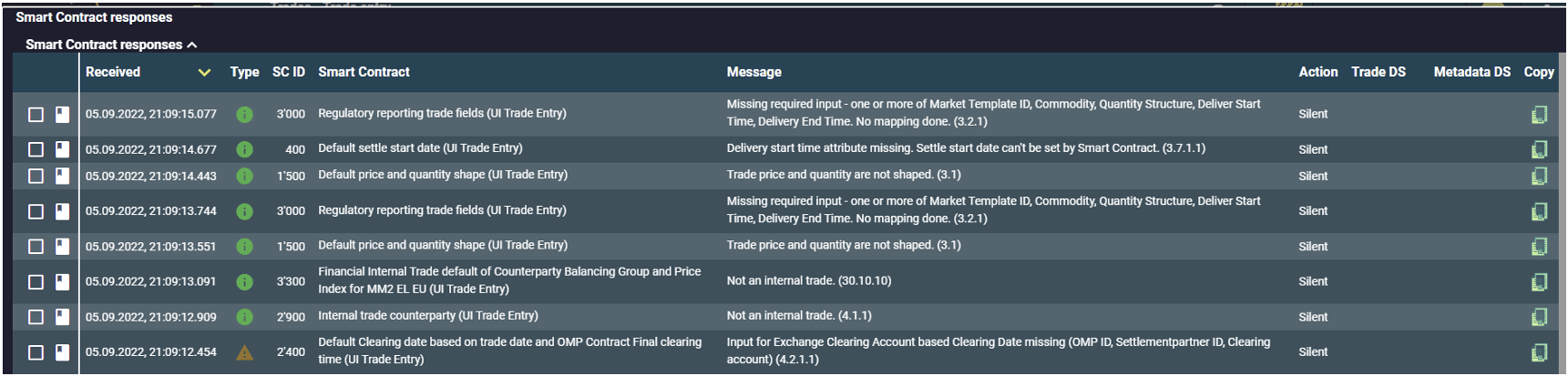

Smart Contract Responses

Q1 2022 Newsletter

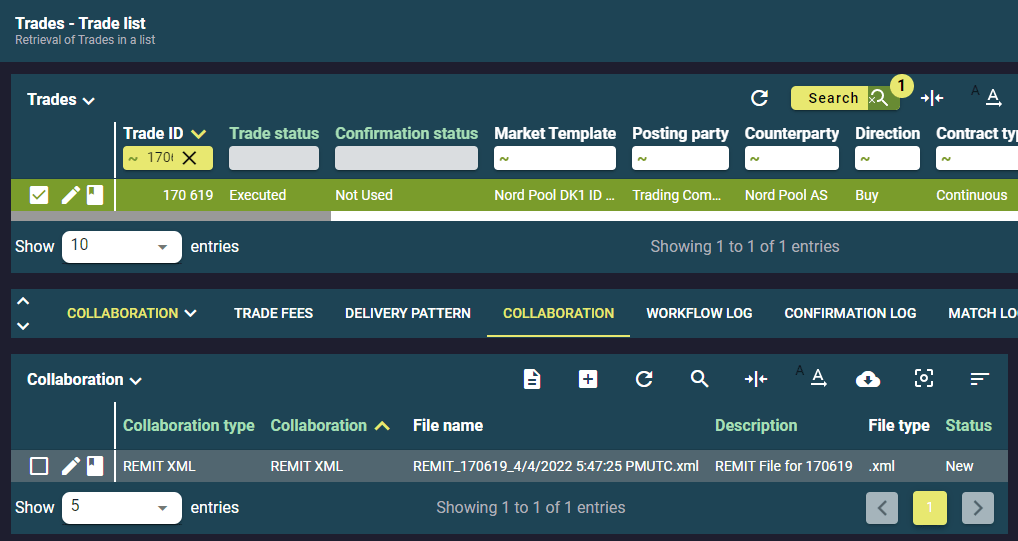

REMIT File Creation

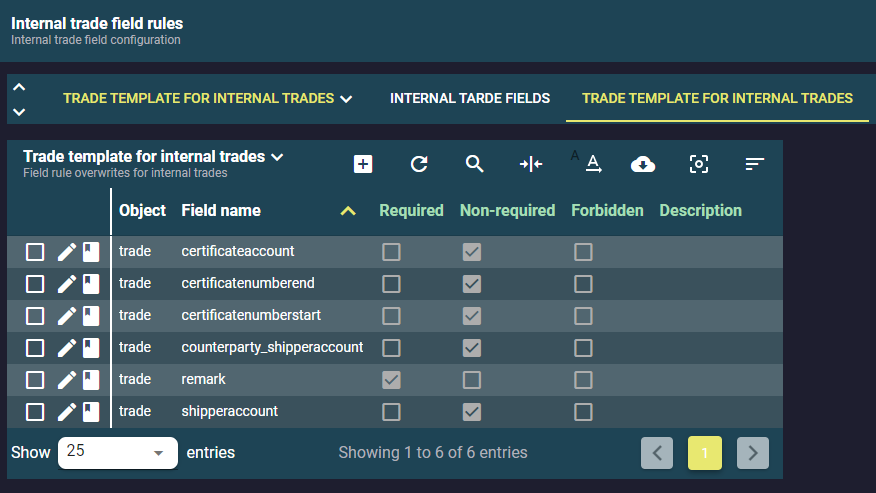

Internal Trade Template

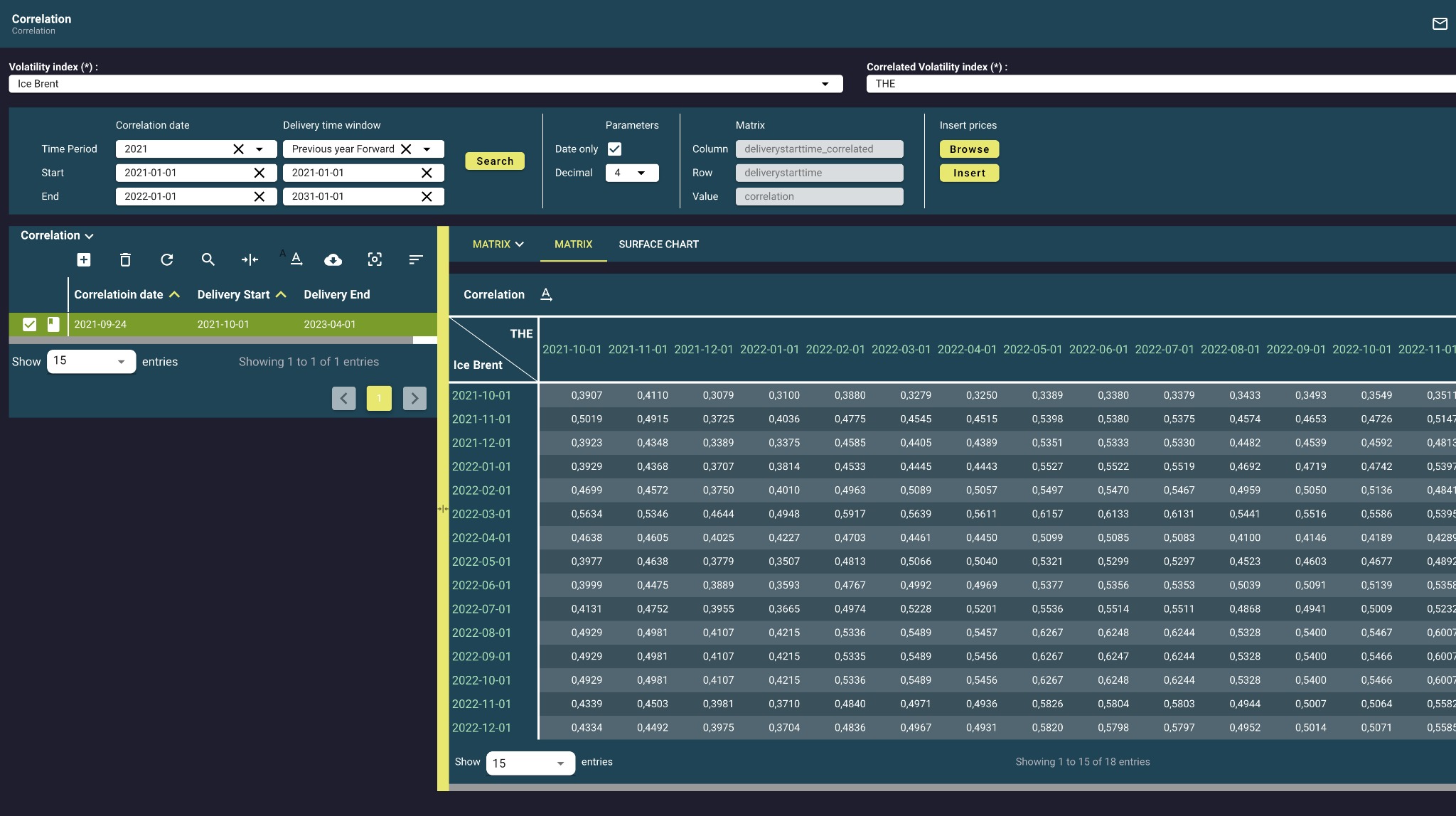

Correlation – Ice Brent vs THE – Asymmetric Matrix

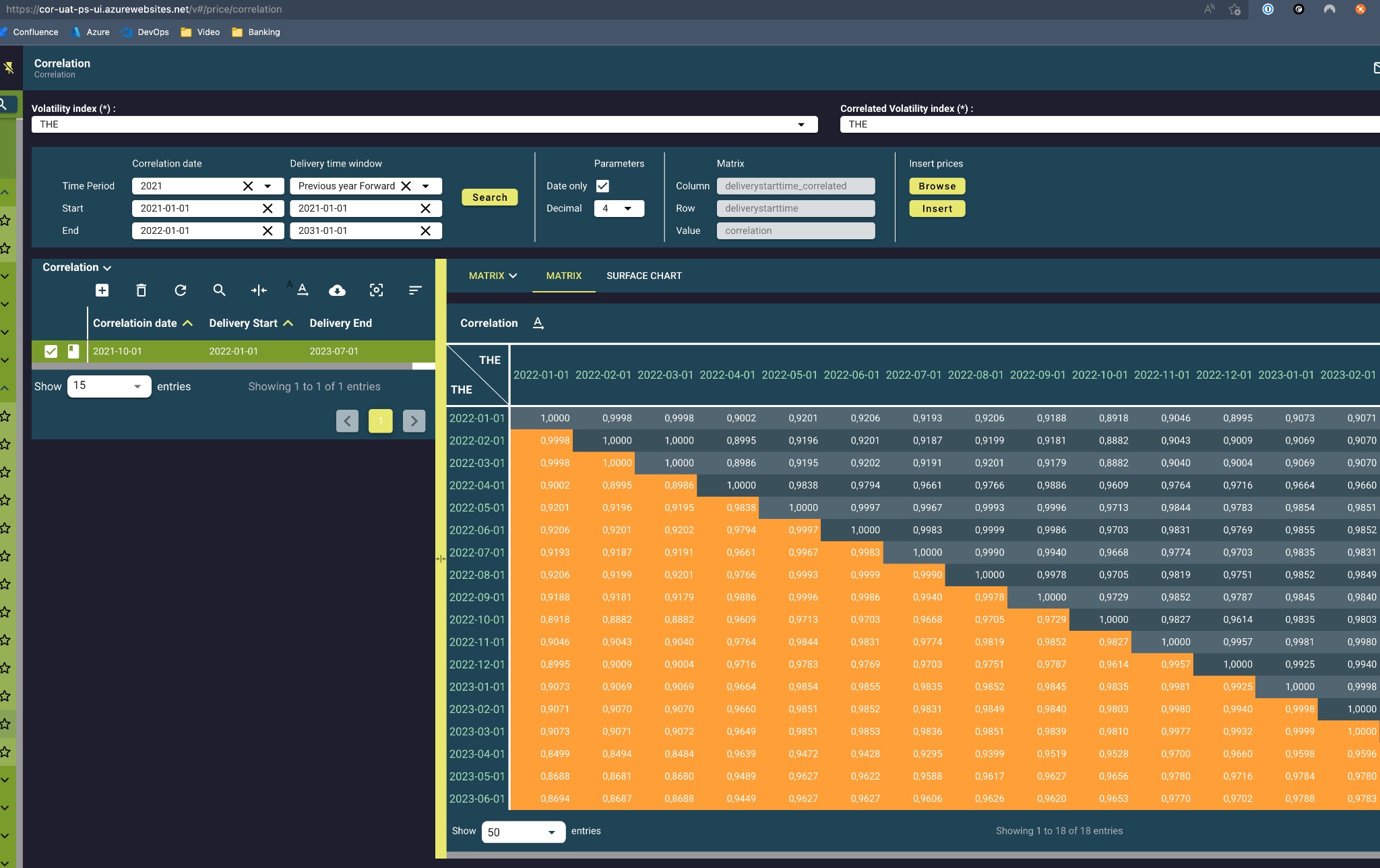

Correlation – THE vs THE – Symmetric Matrix

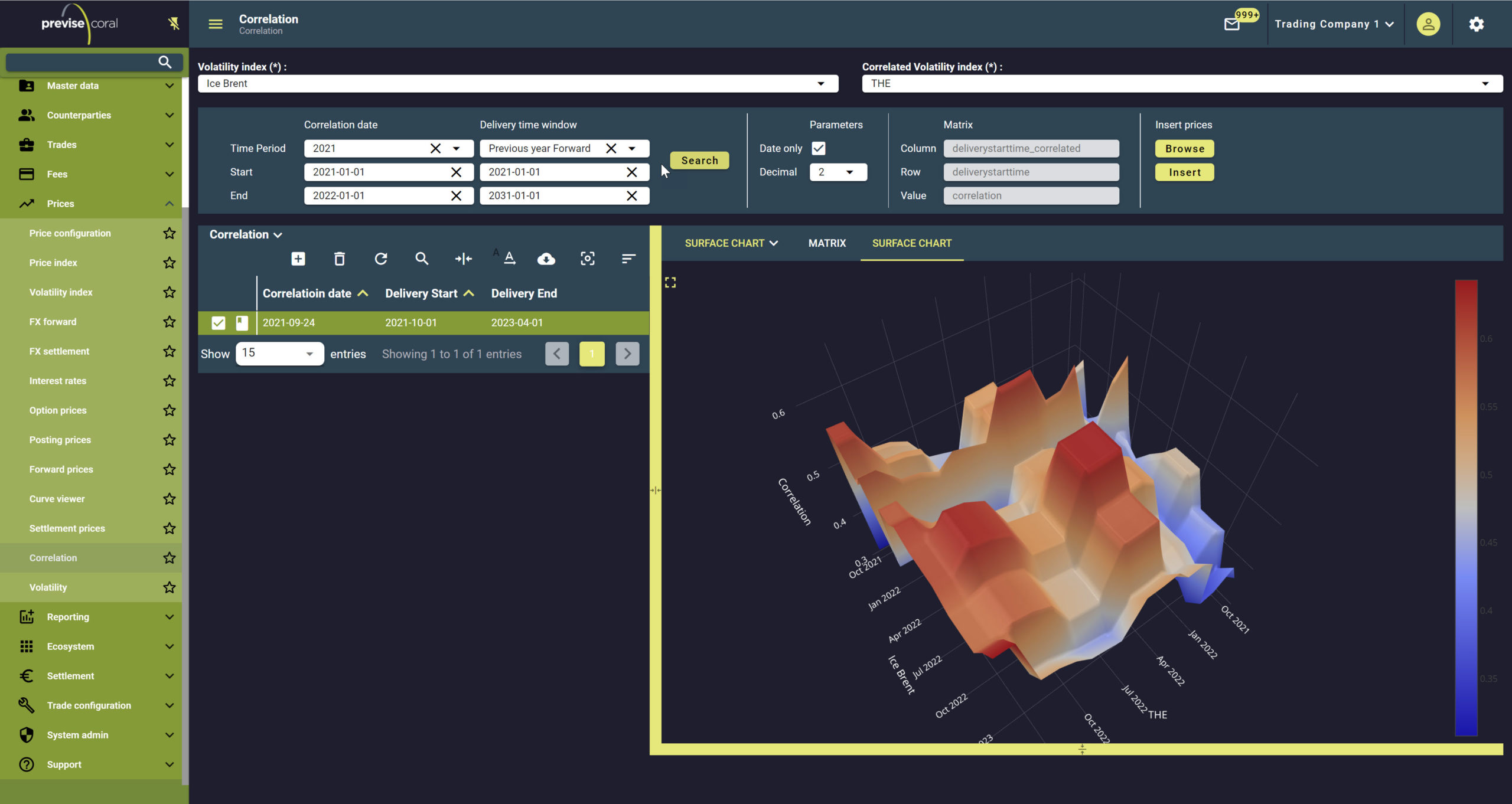

Correlation – Ice Brent vs THE – Surface Chart

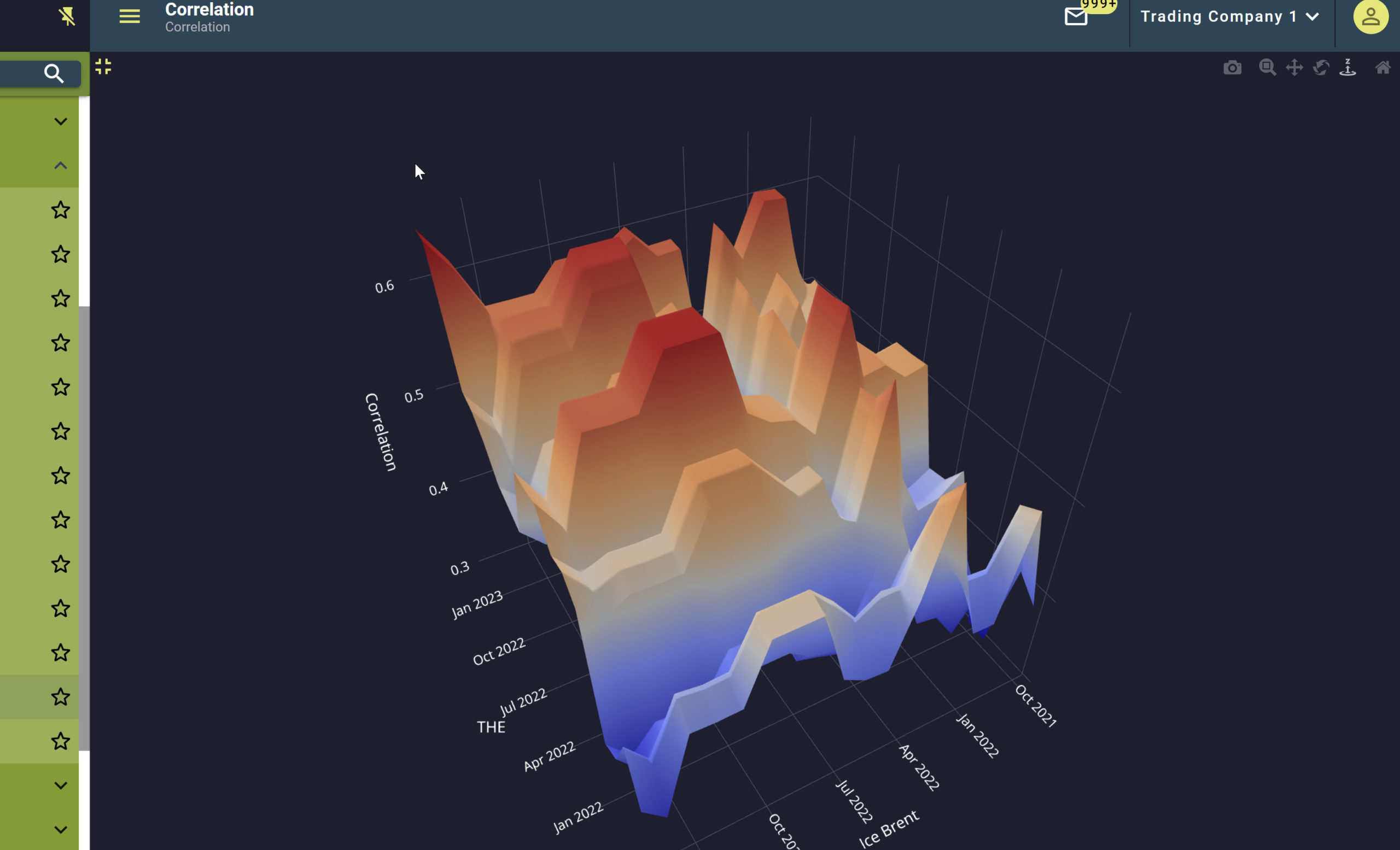

Correlation – Ice Brent vs THE – Surface Chart Maximized

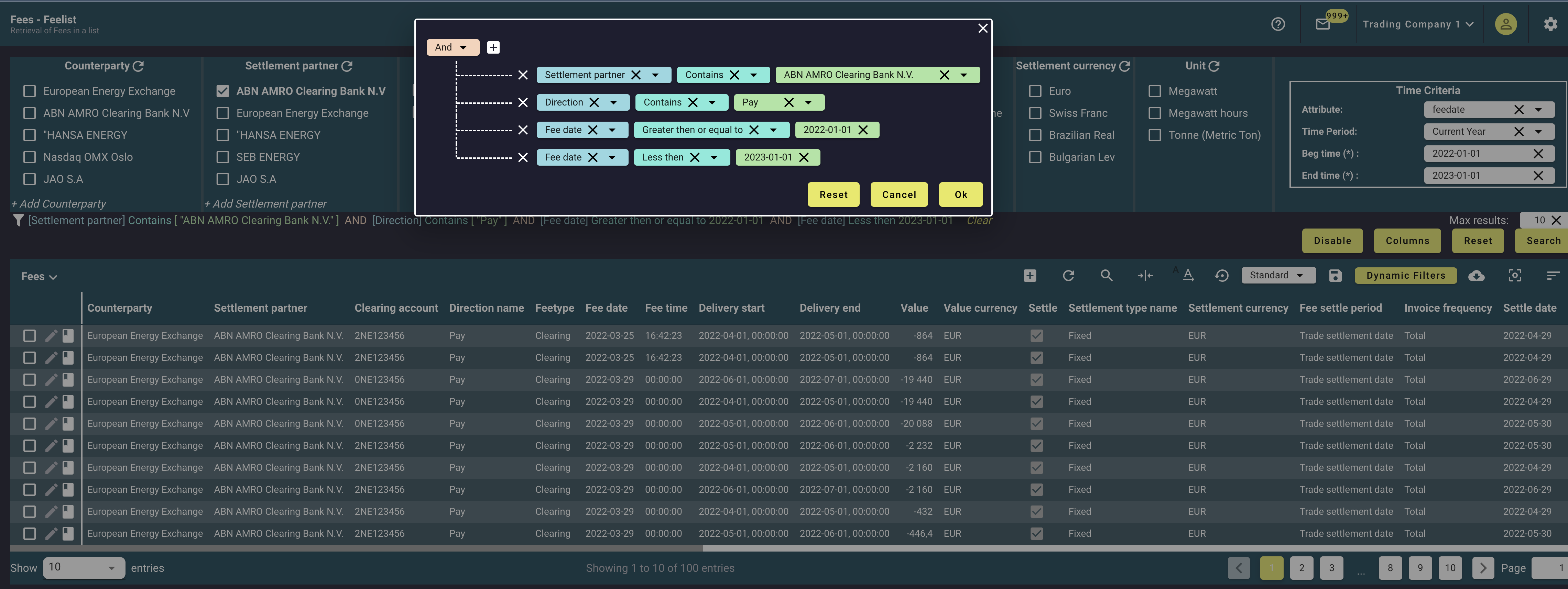

Dynamic Filter – Tree Designer

Dynamic Filter

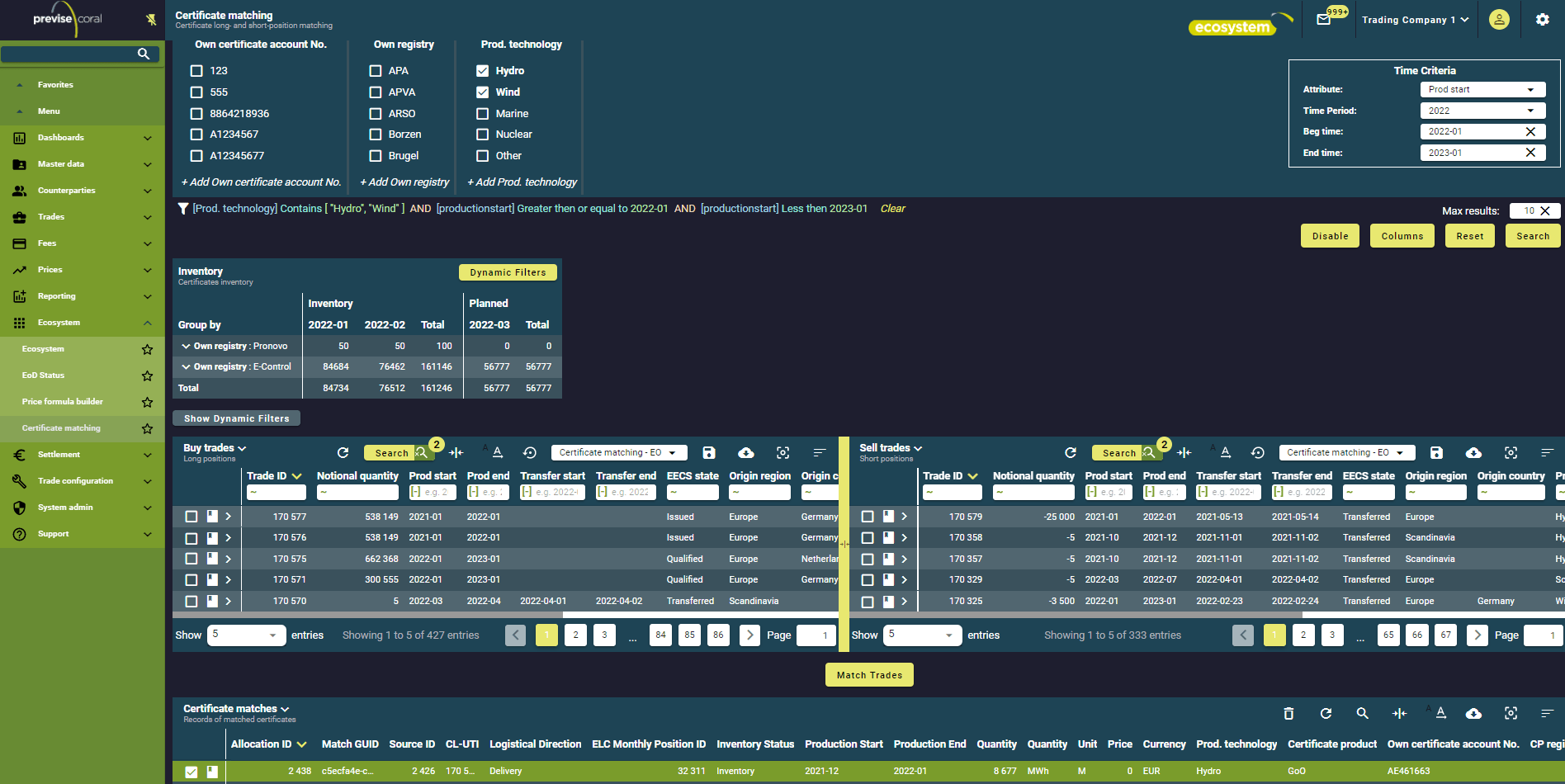

Certificate Matching View

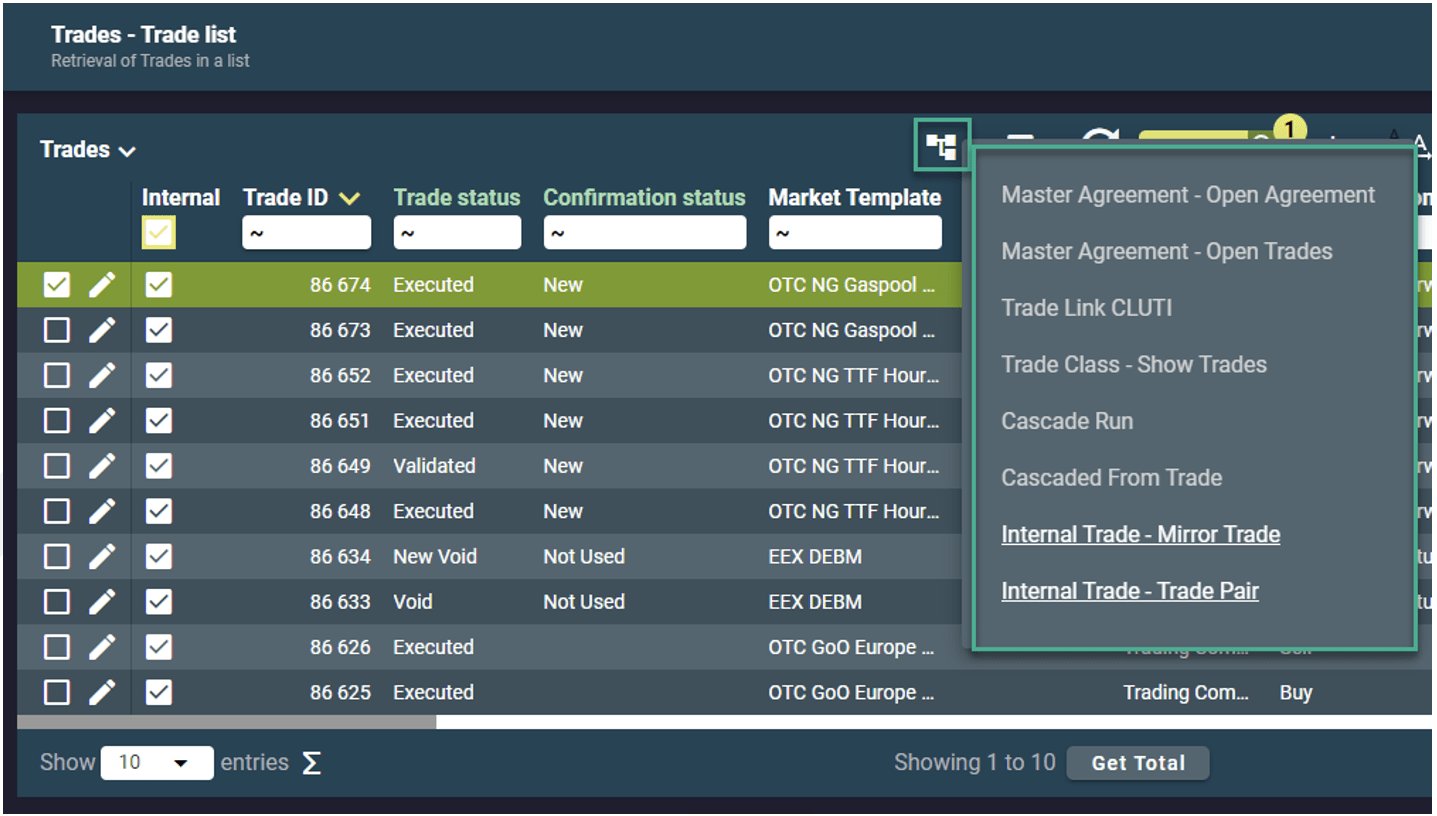

Certificate Matching – Trade Link

Quantity Shape

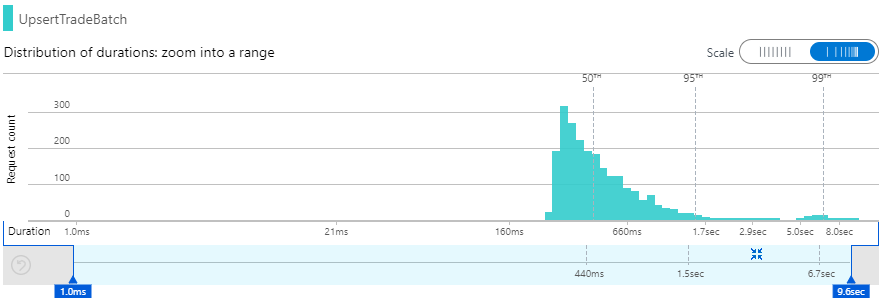

Trade Load Performance

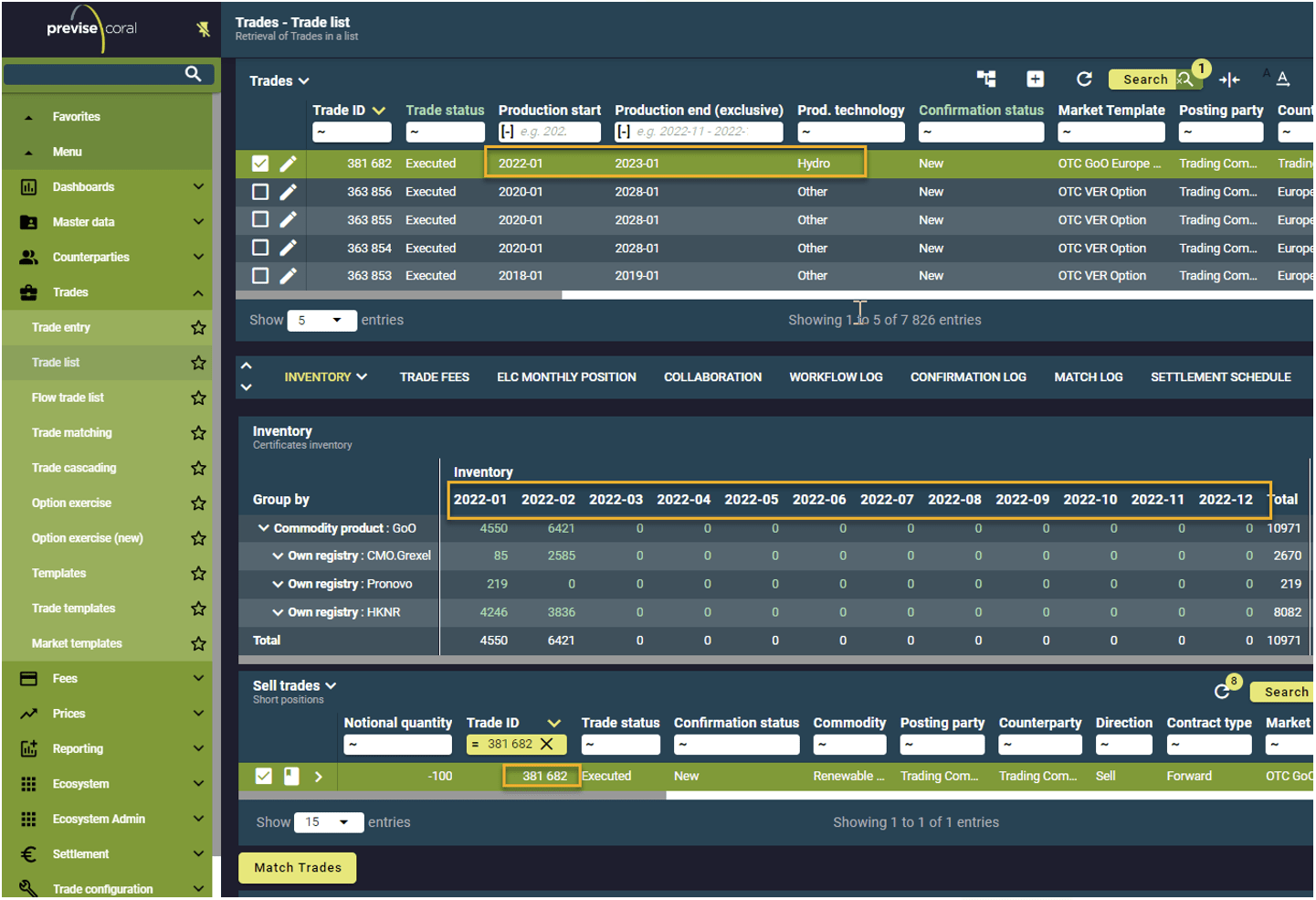

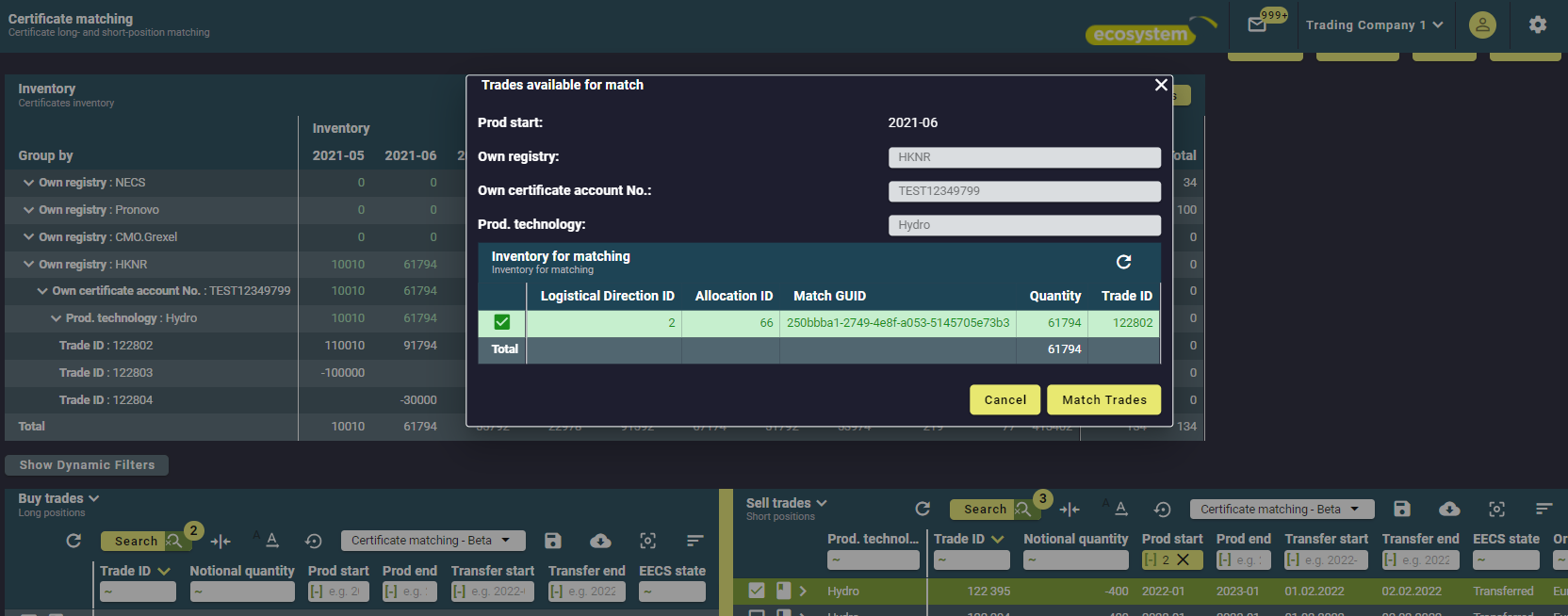

GoO Certificate Matching

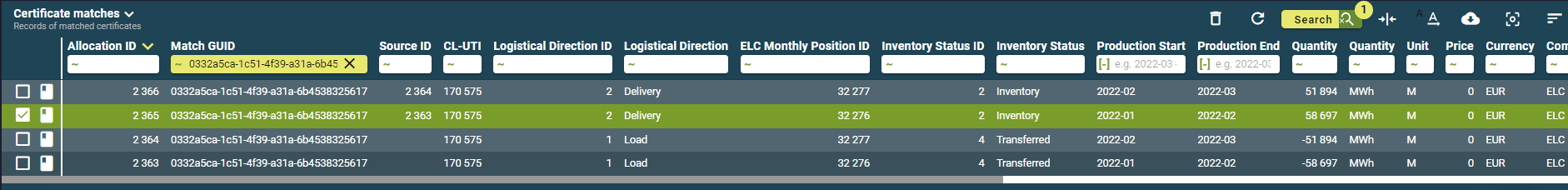

BUY and SELL Trades matched & Inventory Movements created

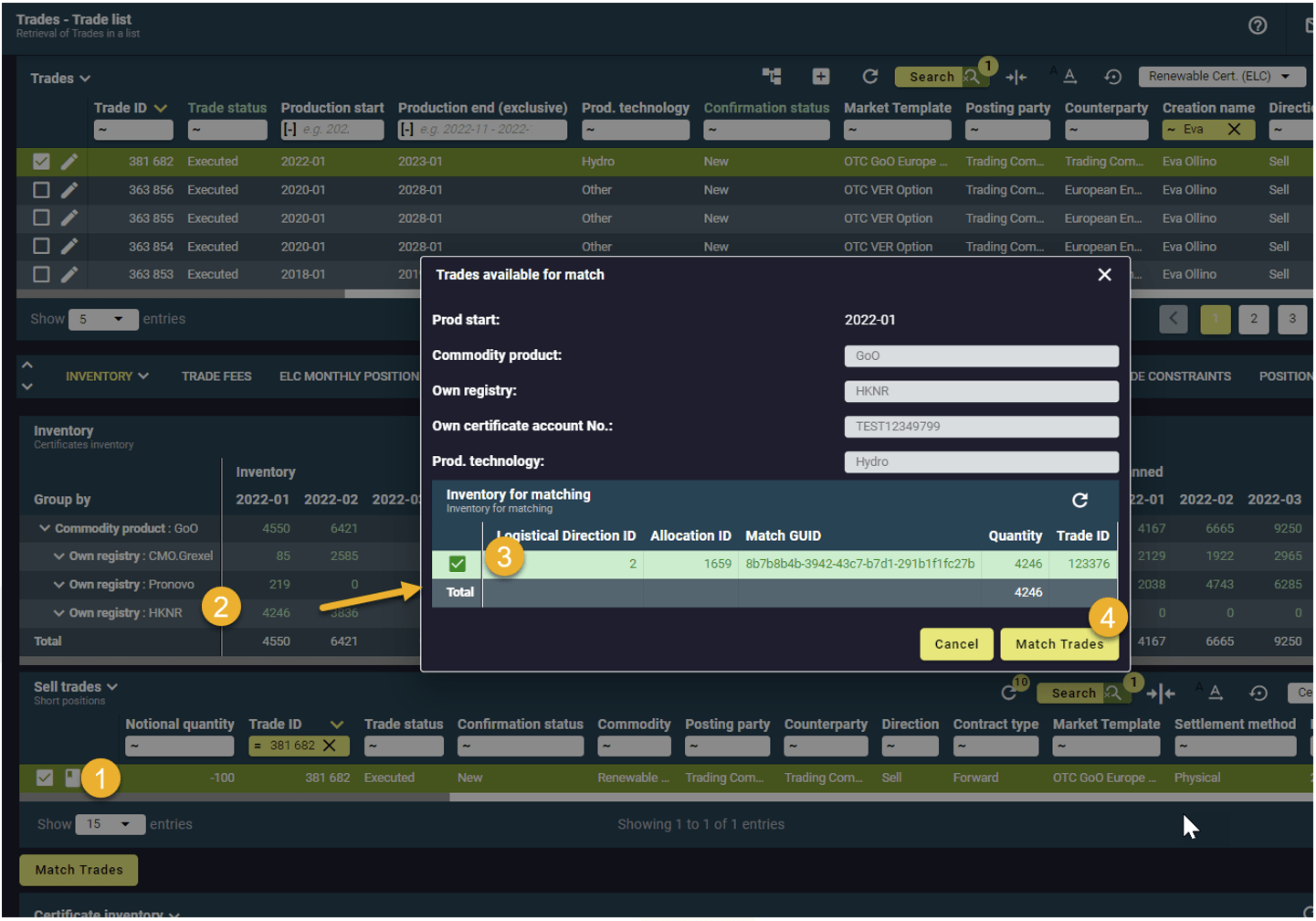

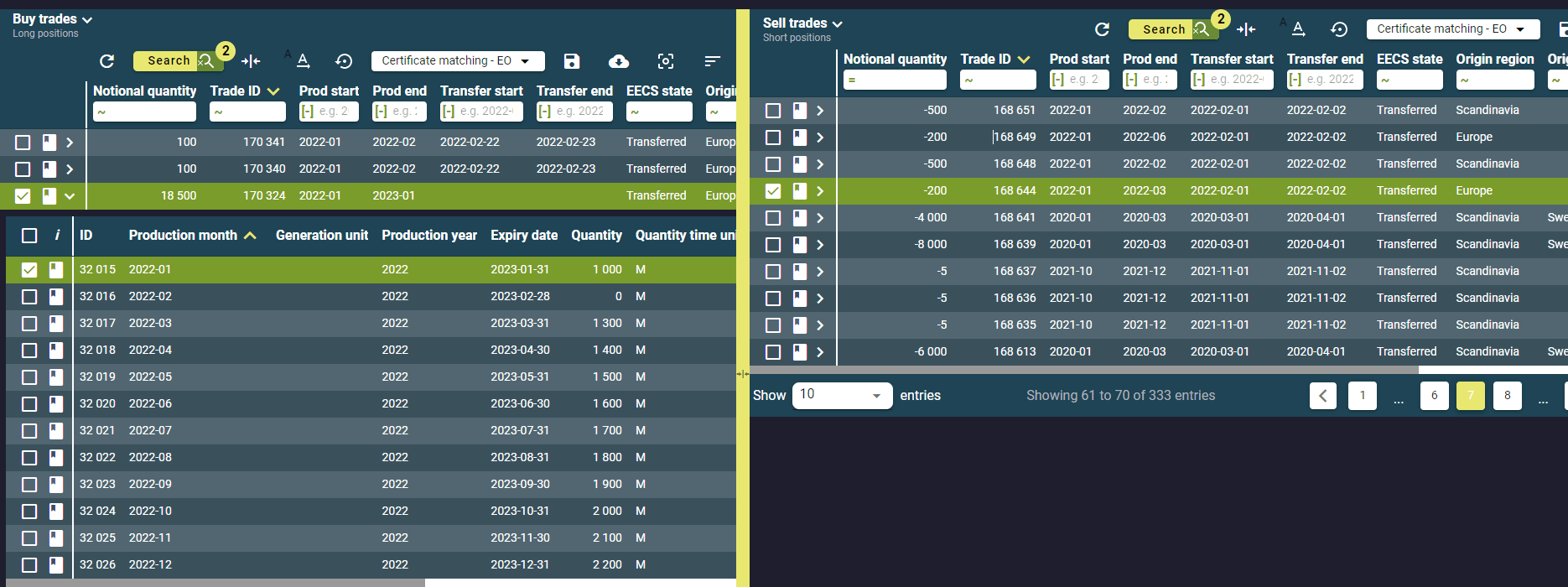

BUY and SELL Trades Selection for Matching

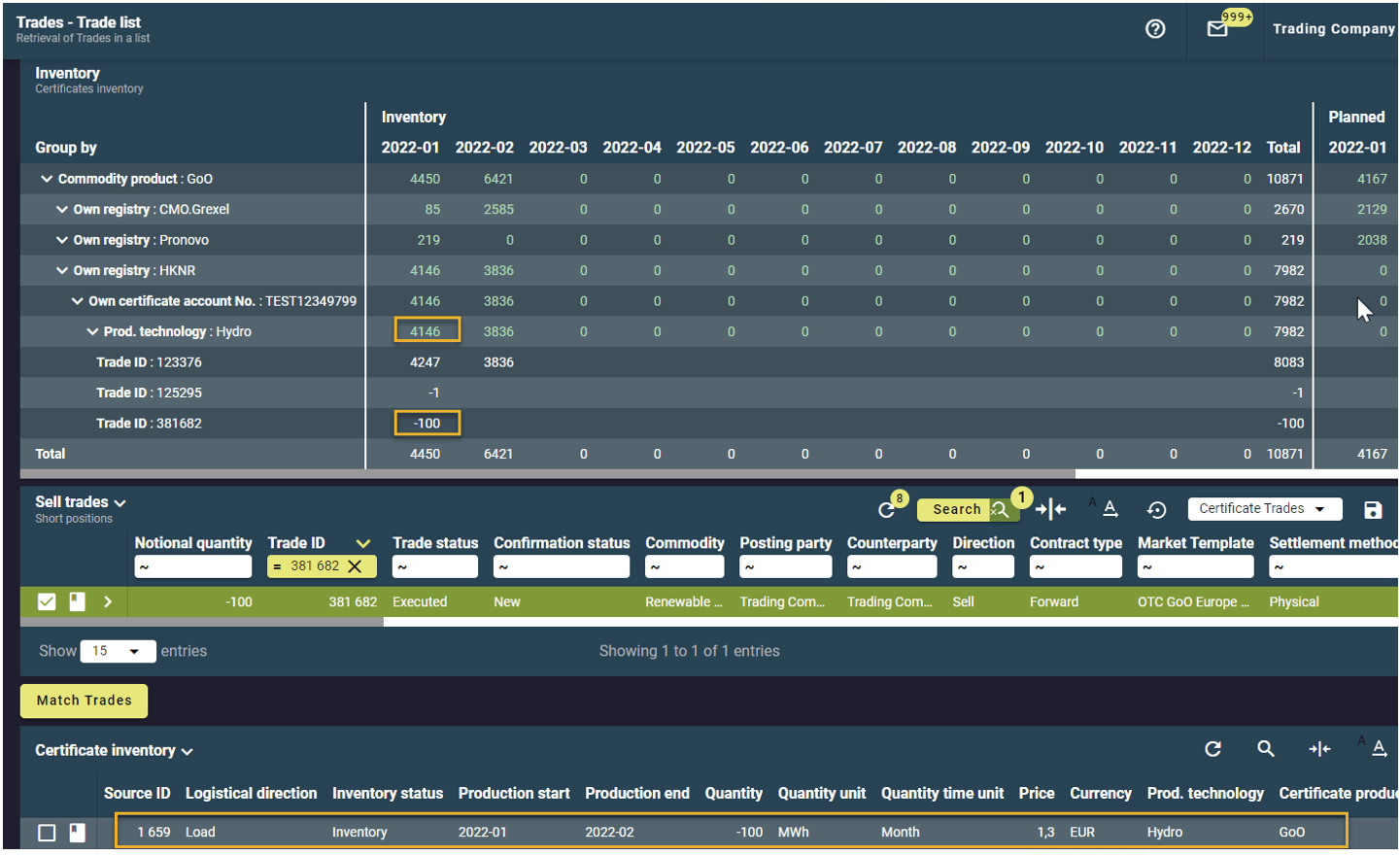

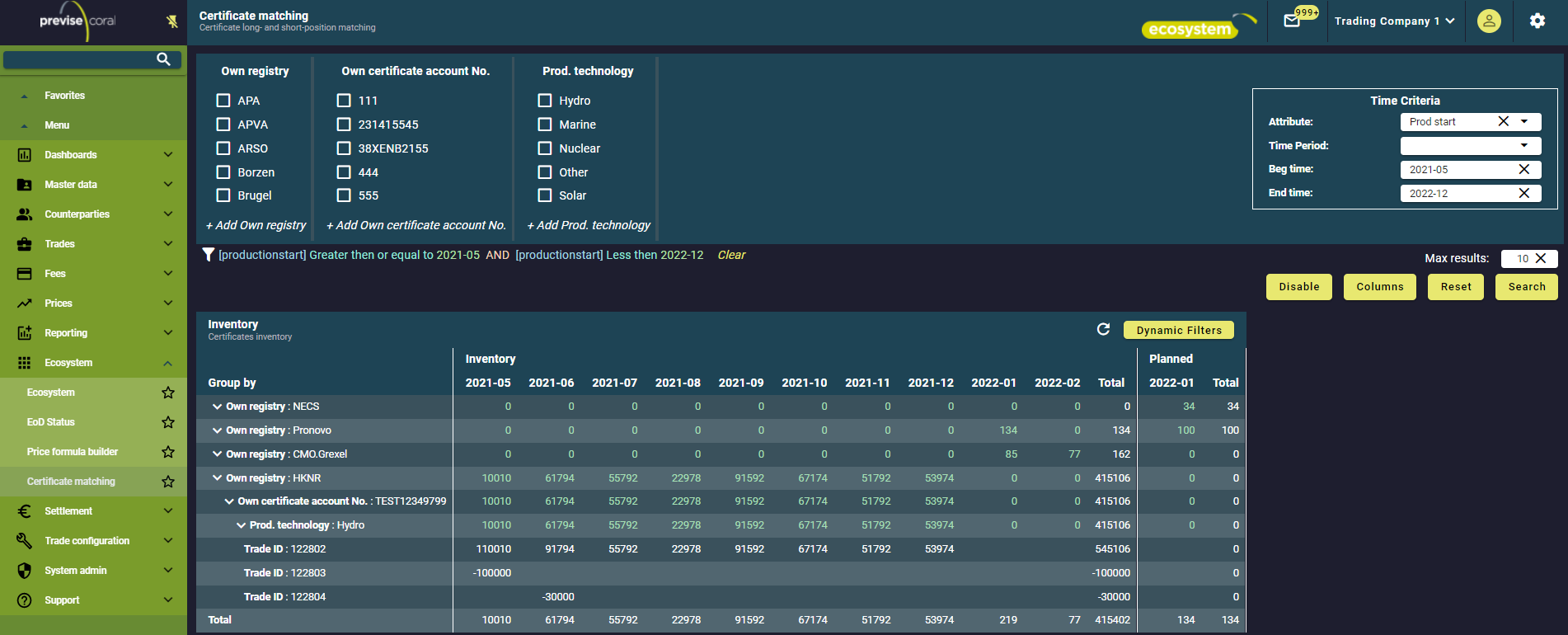

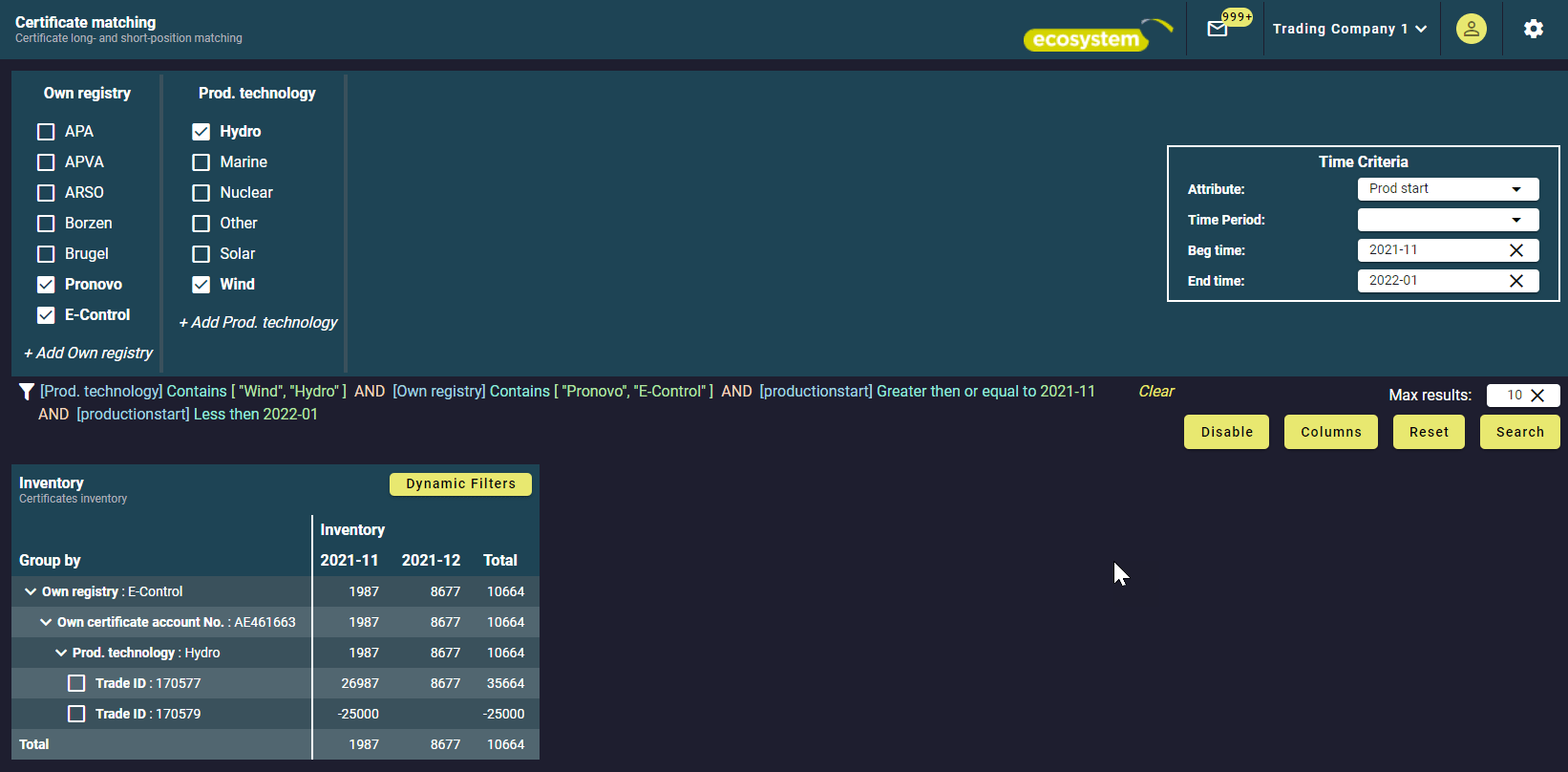

Certificate Matching View with Inventory

Inventory Position

Transferred Registry Certificates Movement to Inventory

Q4 2021 Newsletter

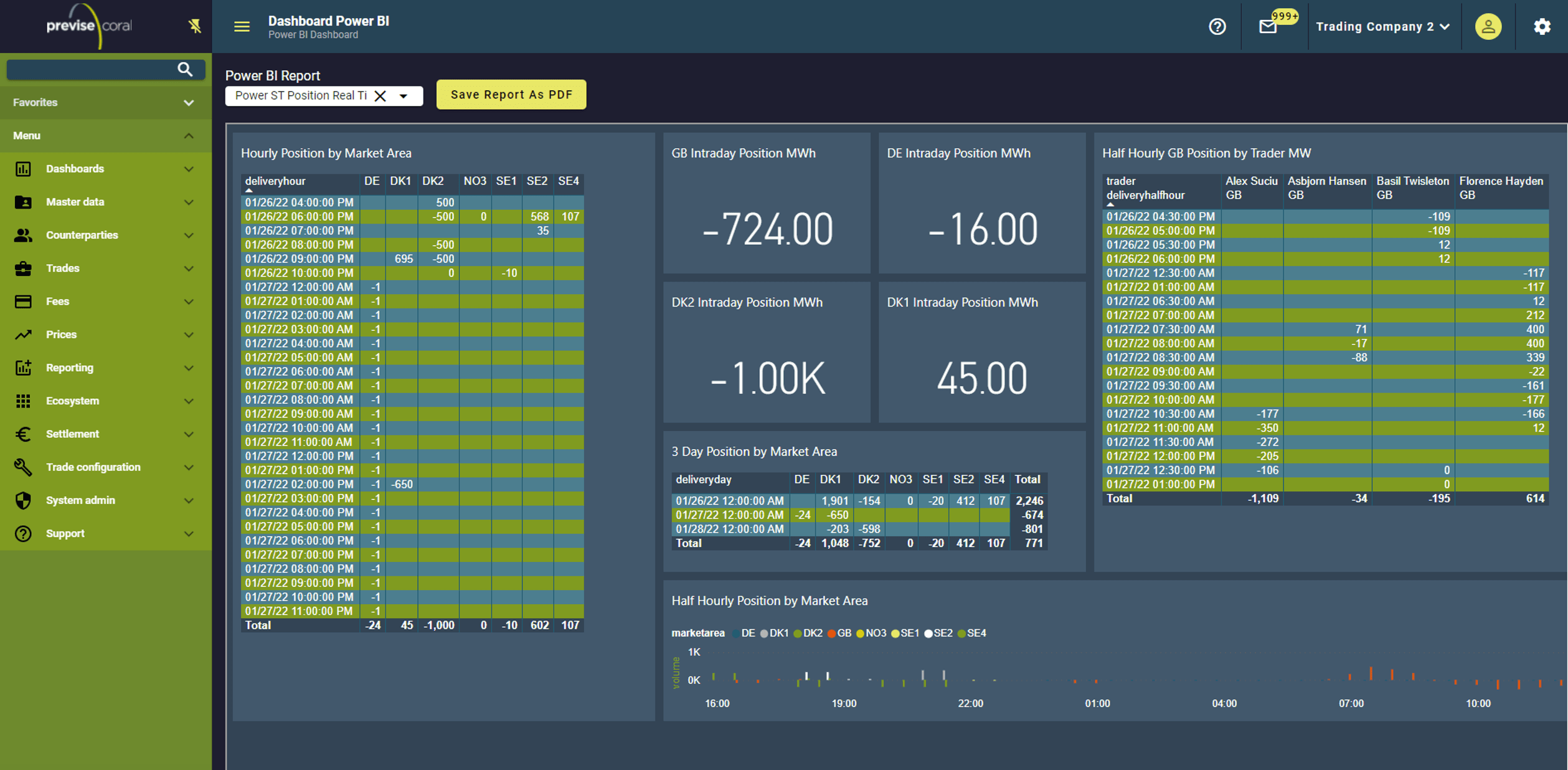

Sample Real-Time Position

JAO Financial Capacity Options

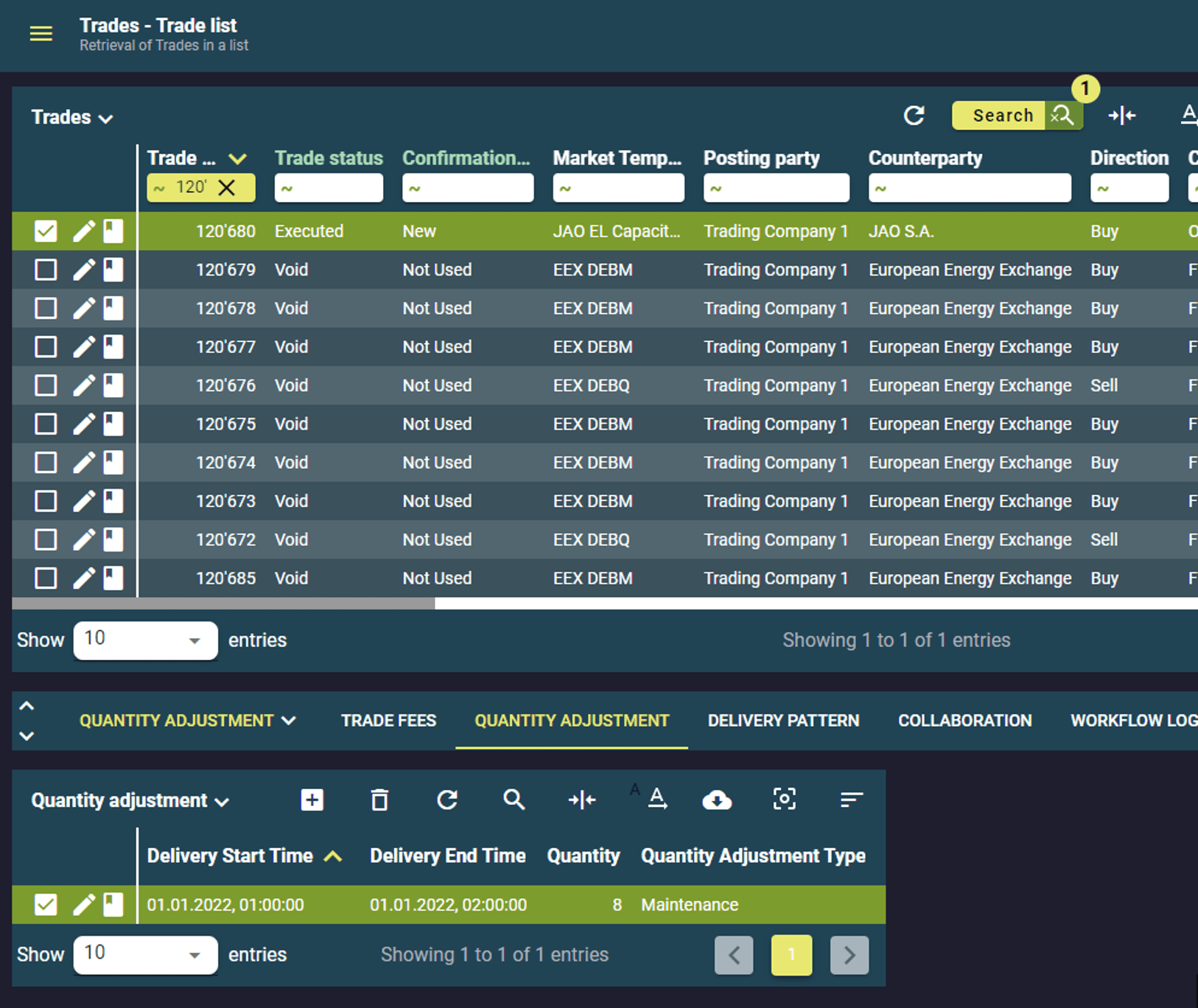

JAO Options – Quantity Adjustments

Q3 2021 Newsletter

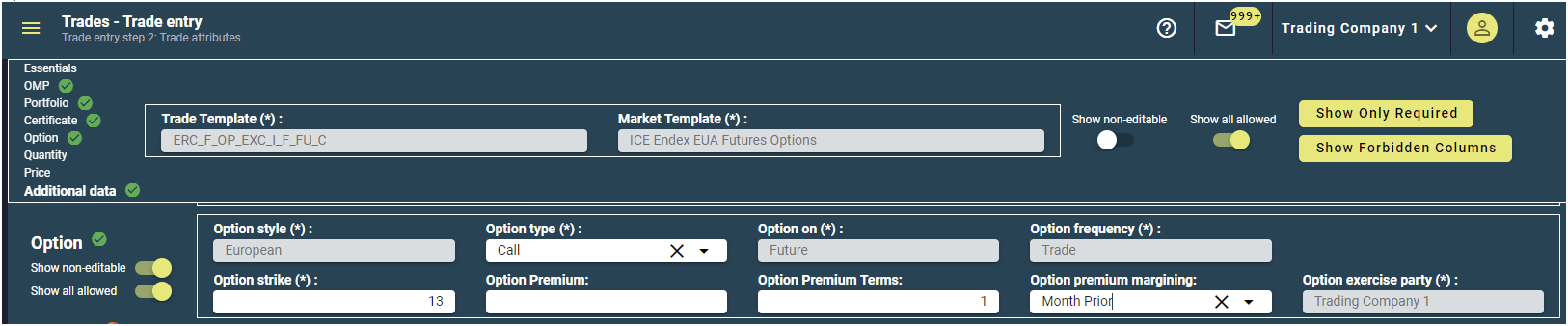

Options

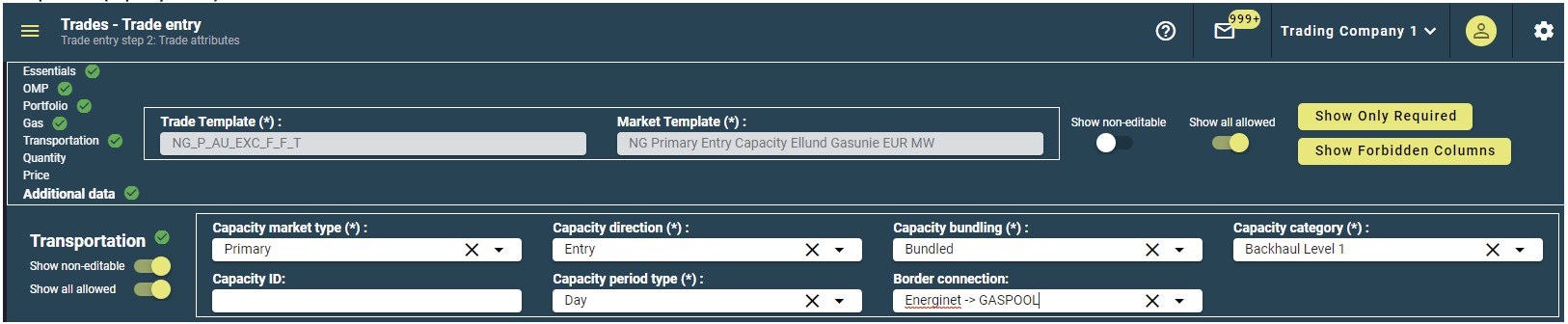

Transportation (Capacity Trades)

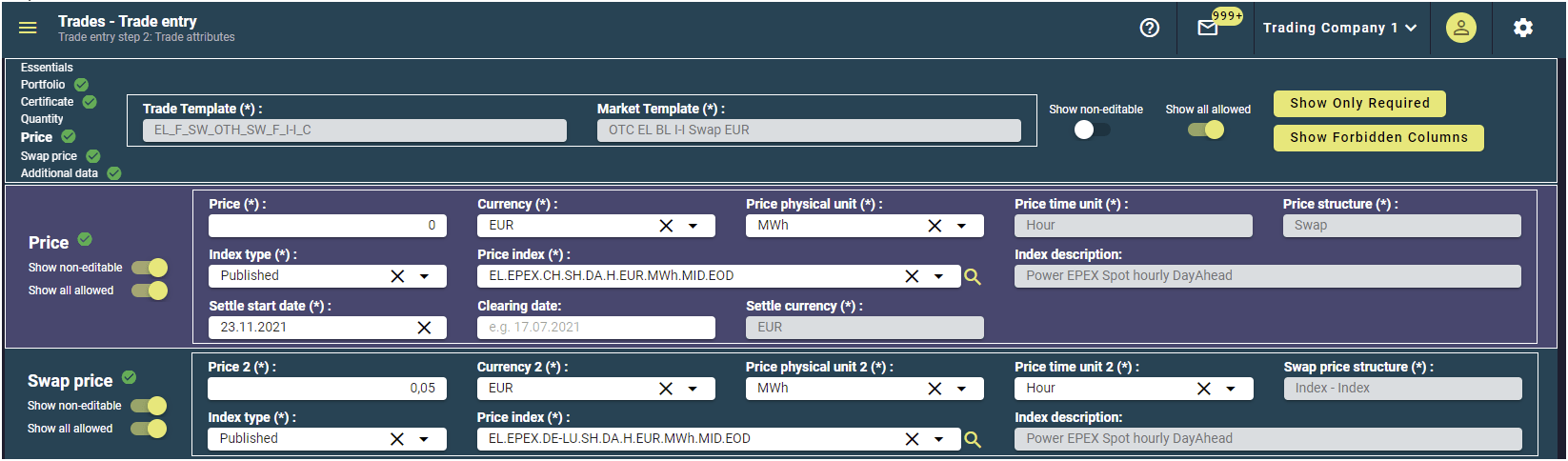

Swaps

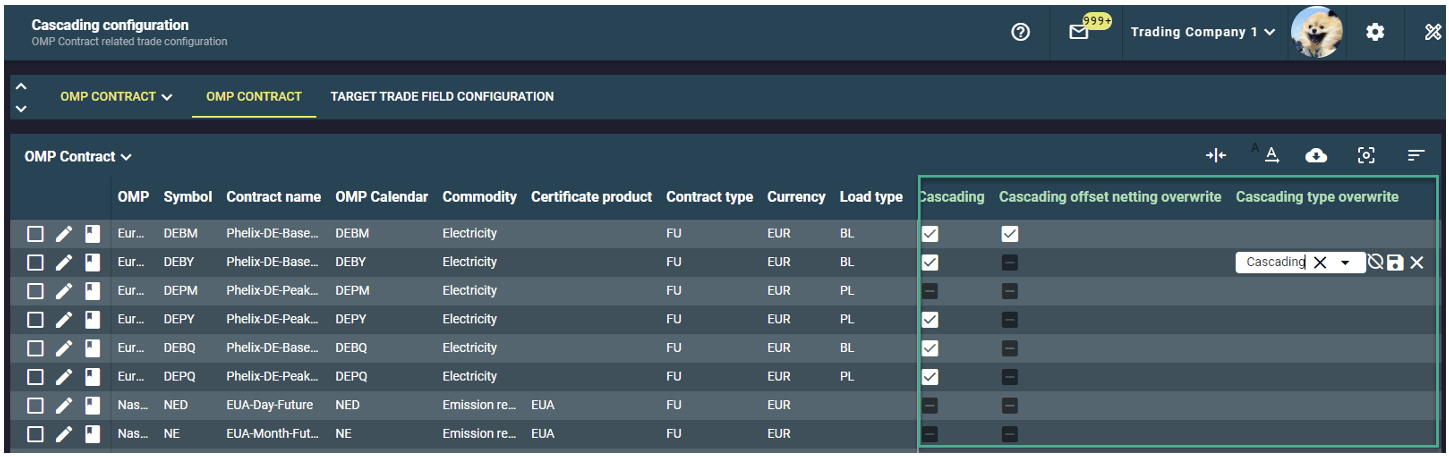

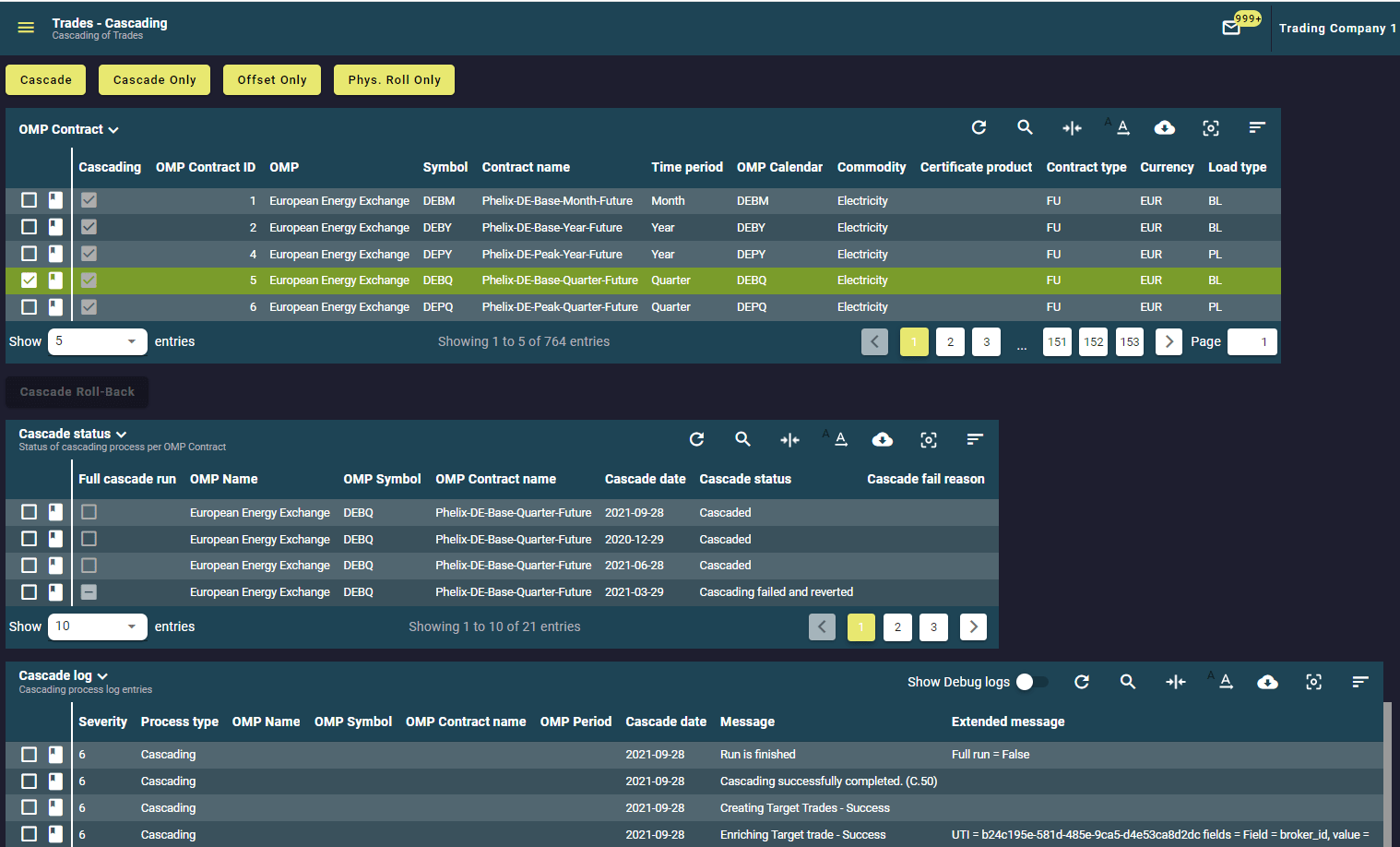

Cascading

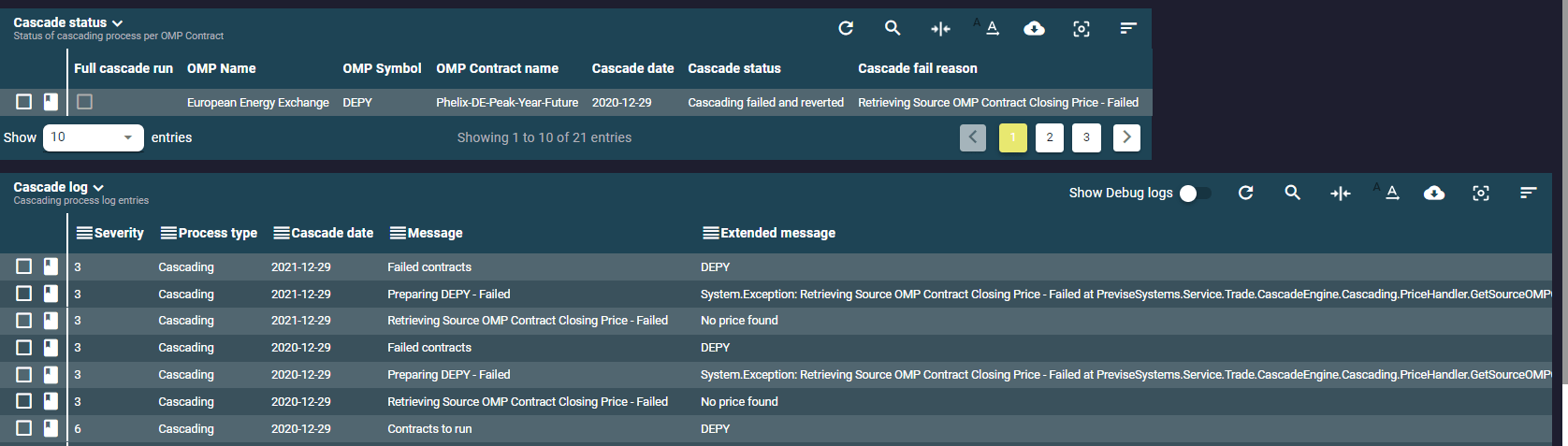

Cascading Process (Status & Log)

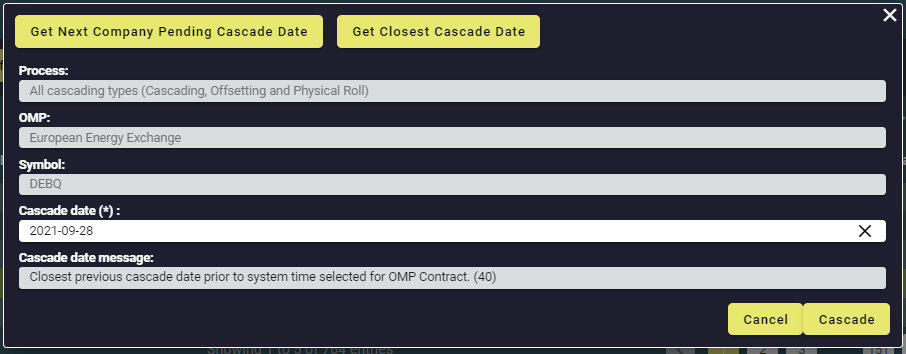

Trigger Cascading

Cascading Logs

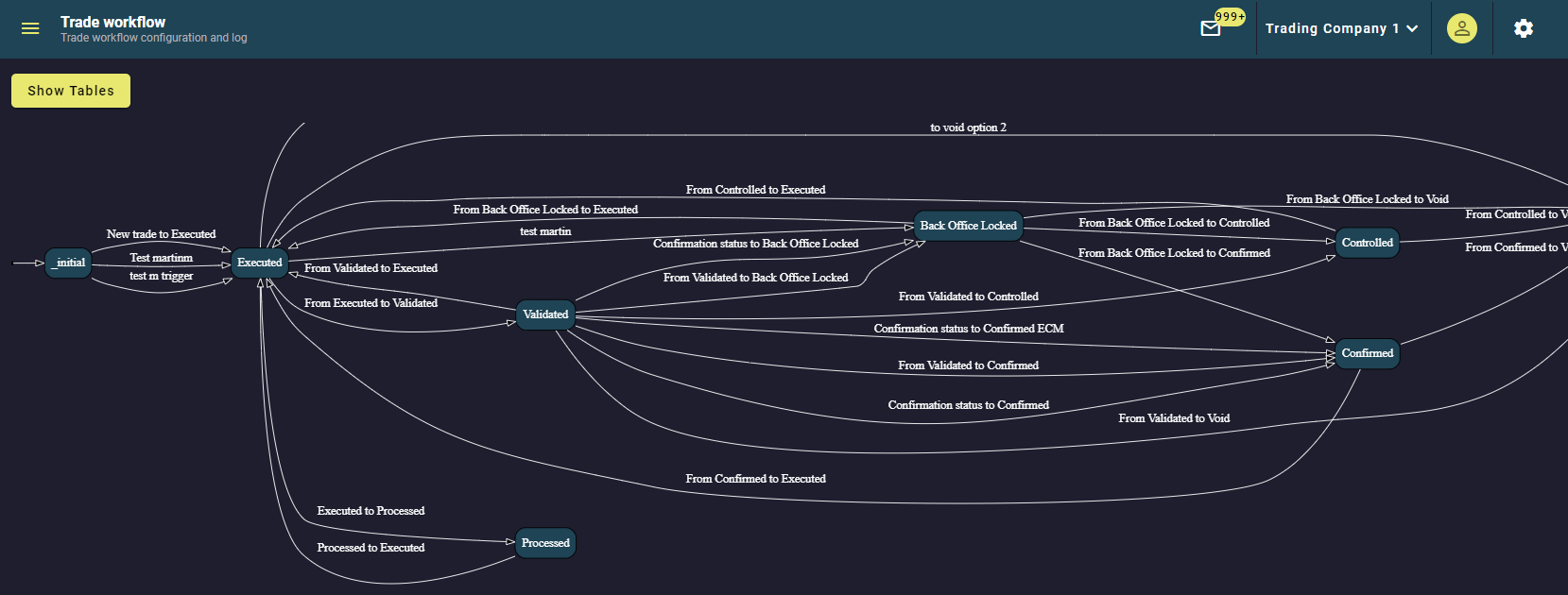

Workflow Visualisation

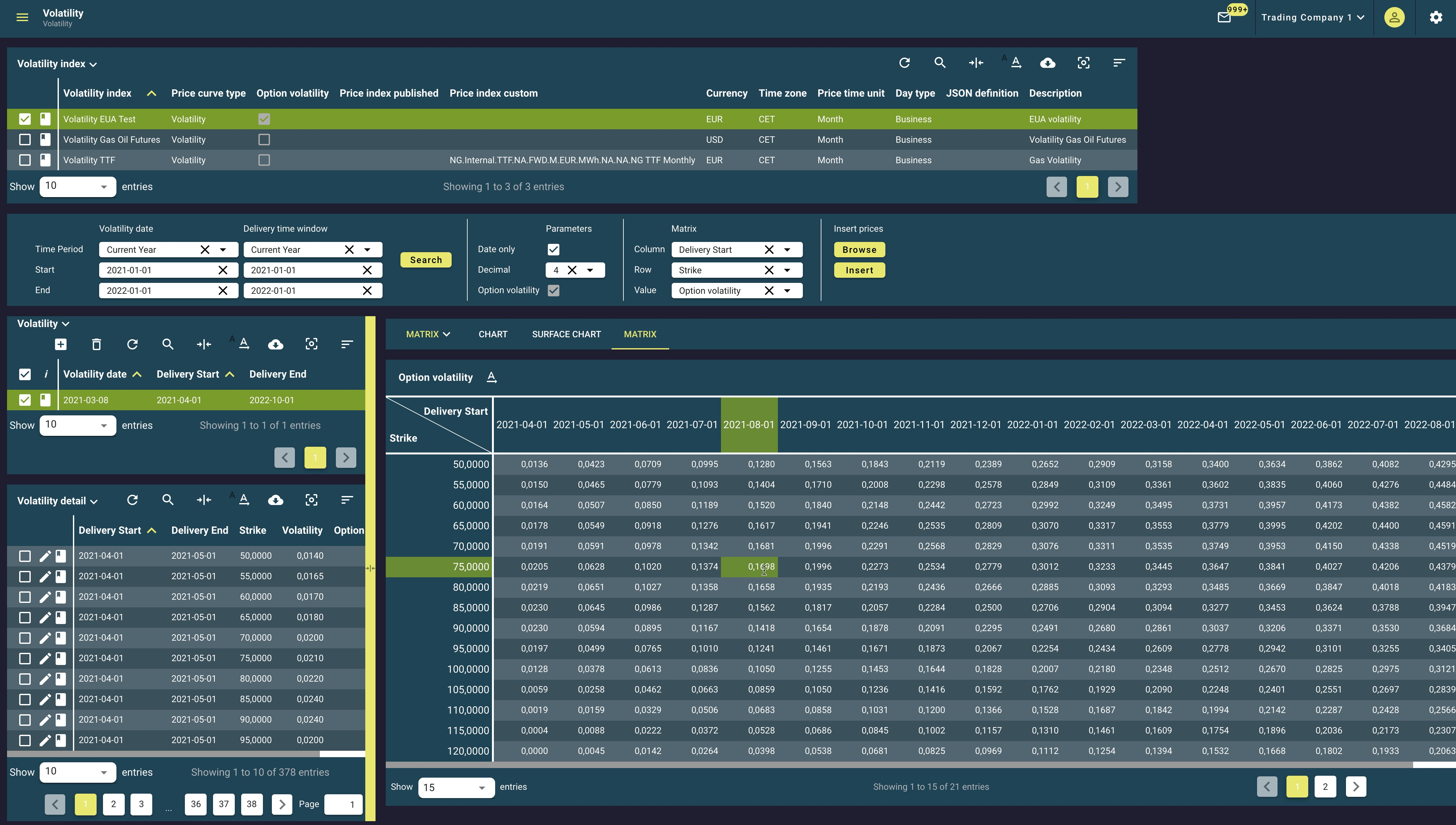

Volatility Surface Visualisation

Option Volatilities Matrix

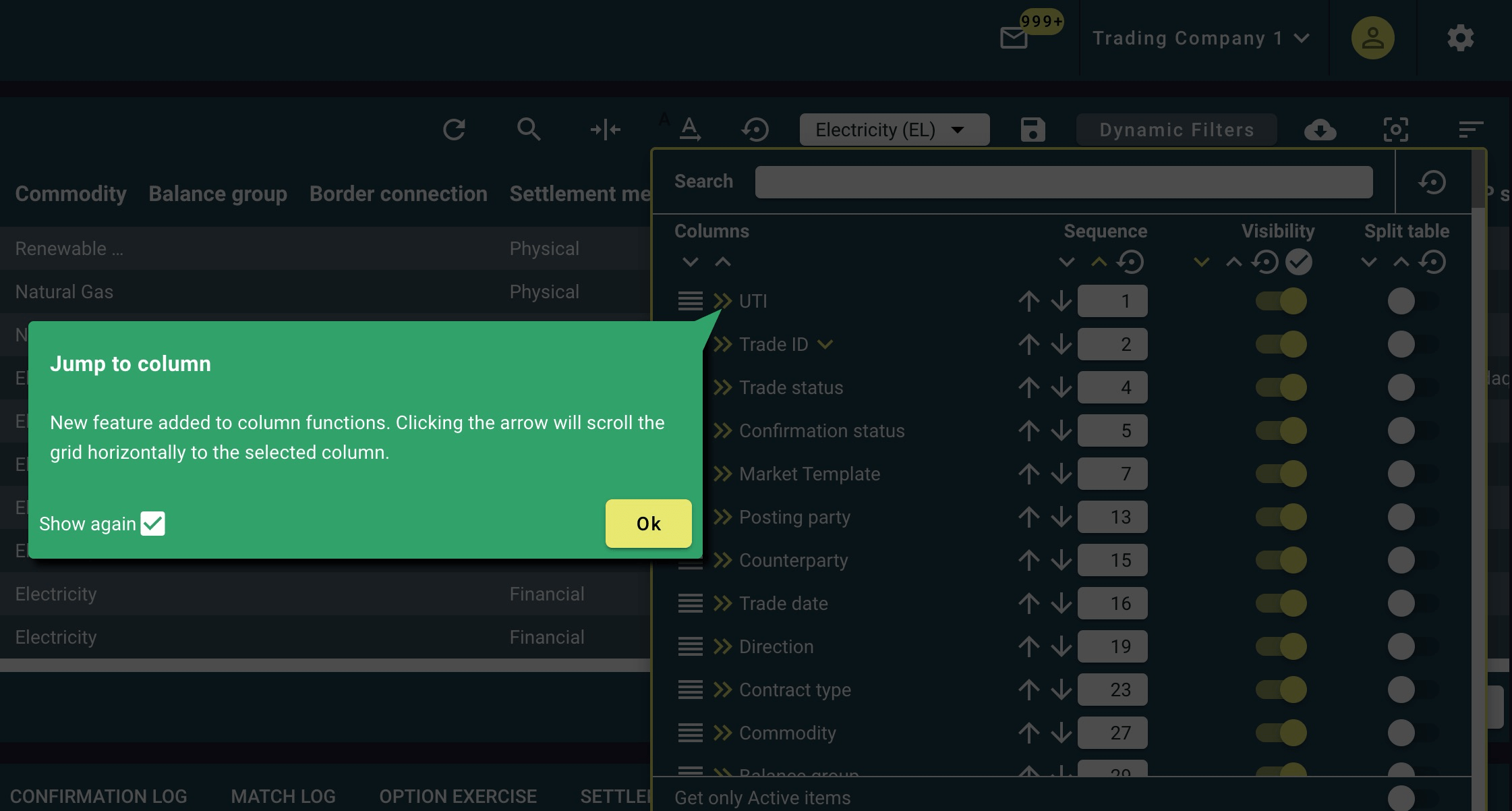

Release Note Pop-up Notifications

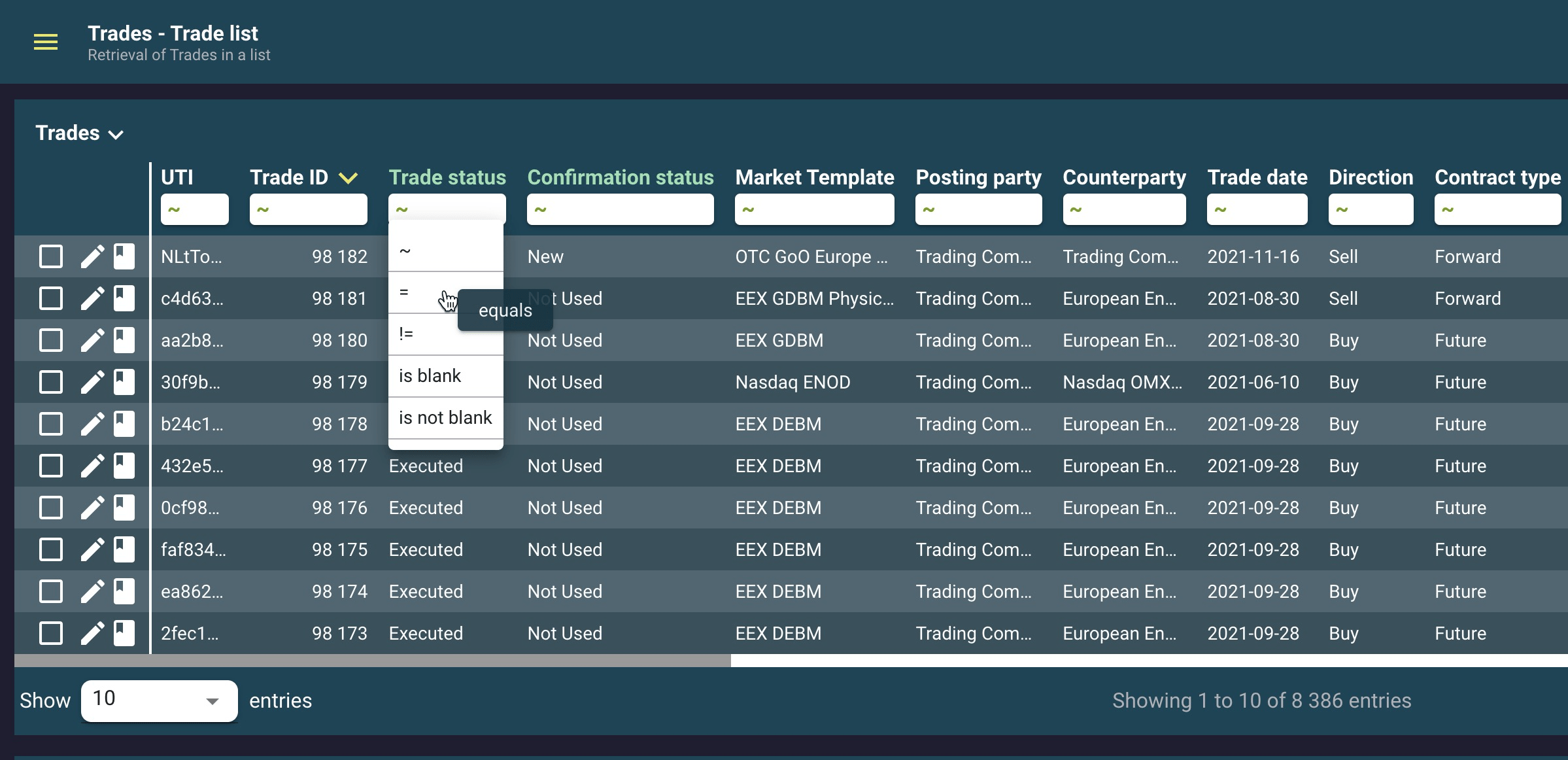

Search via Operator

New Dynamic Filter Design

“Bubble View”

Q2 2021 Newsletter

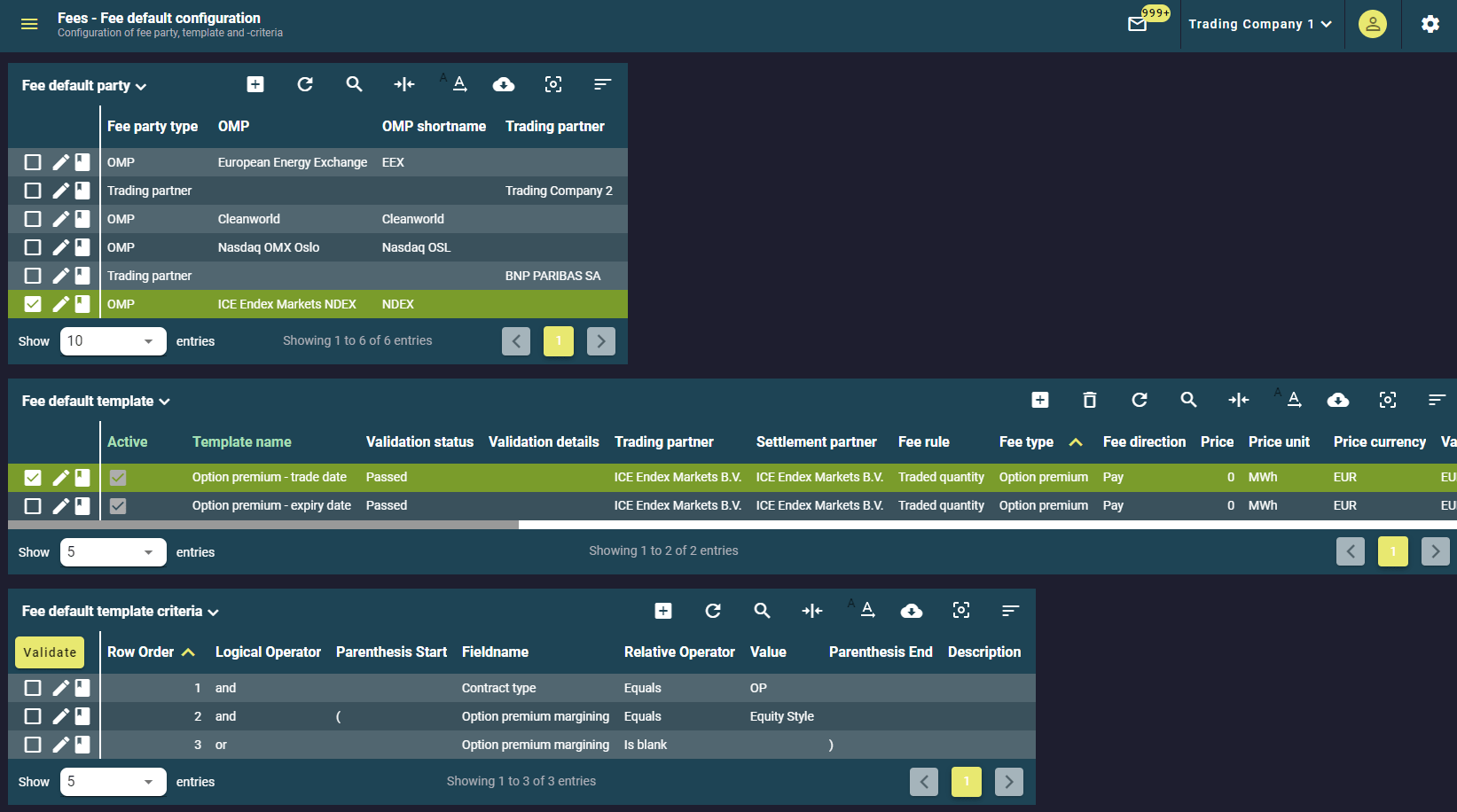

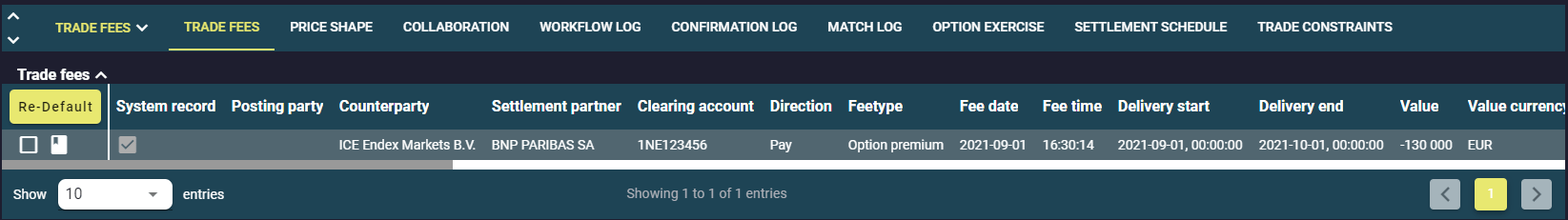

Fees and Fee Defaulting

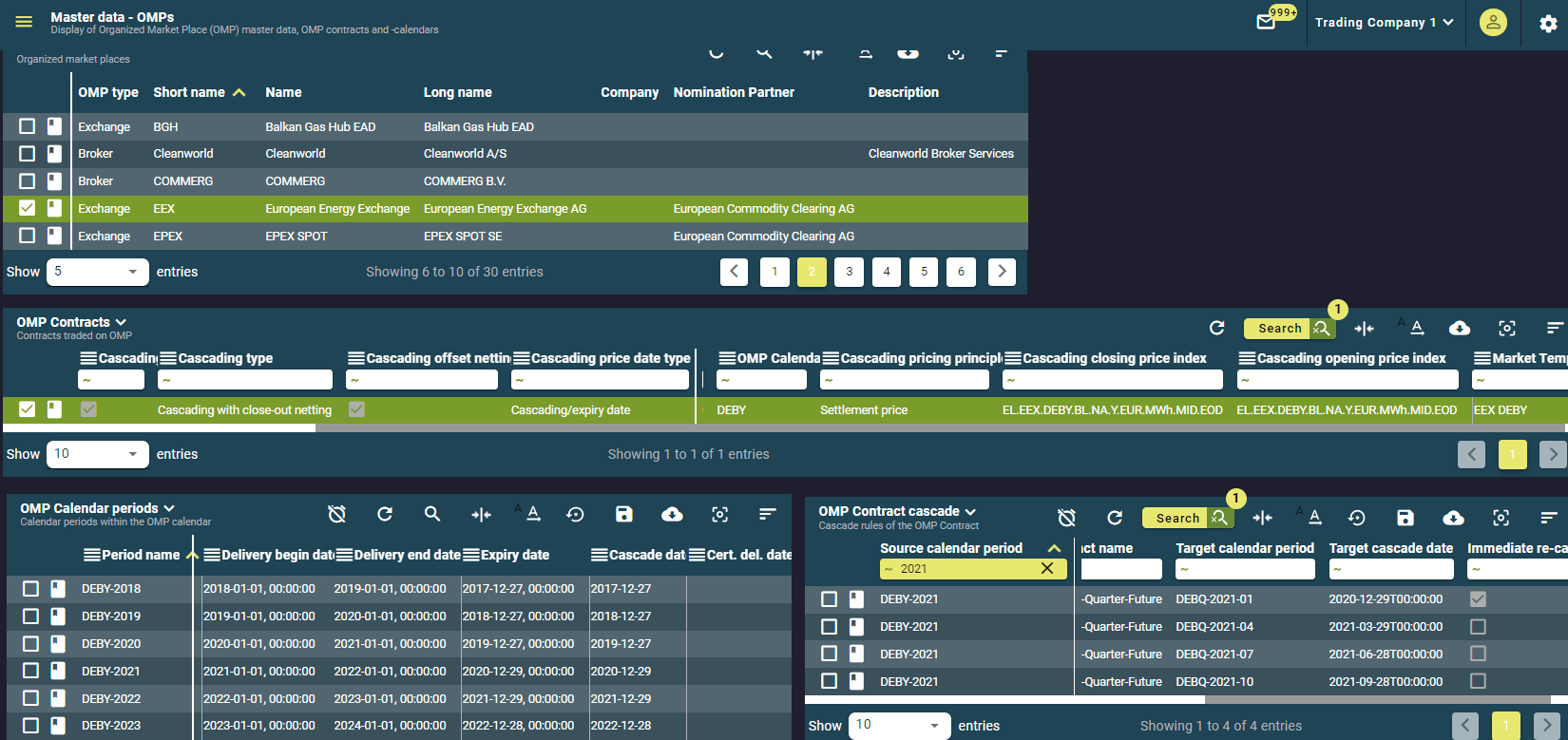

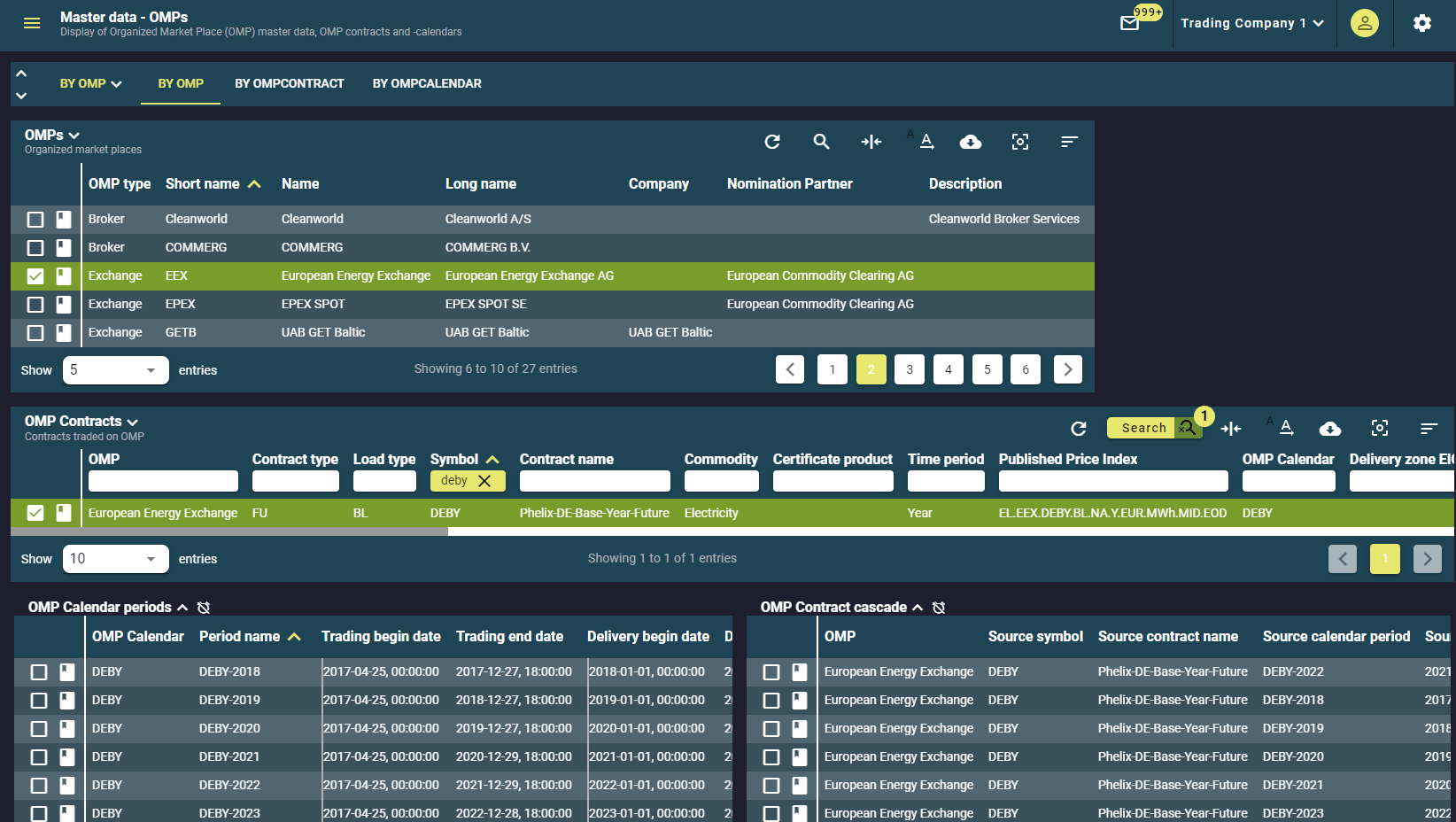

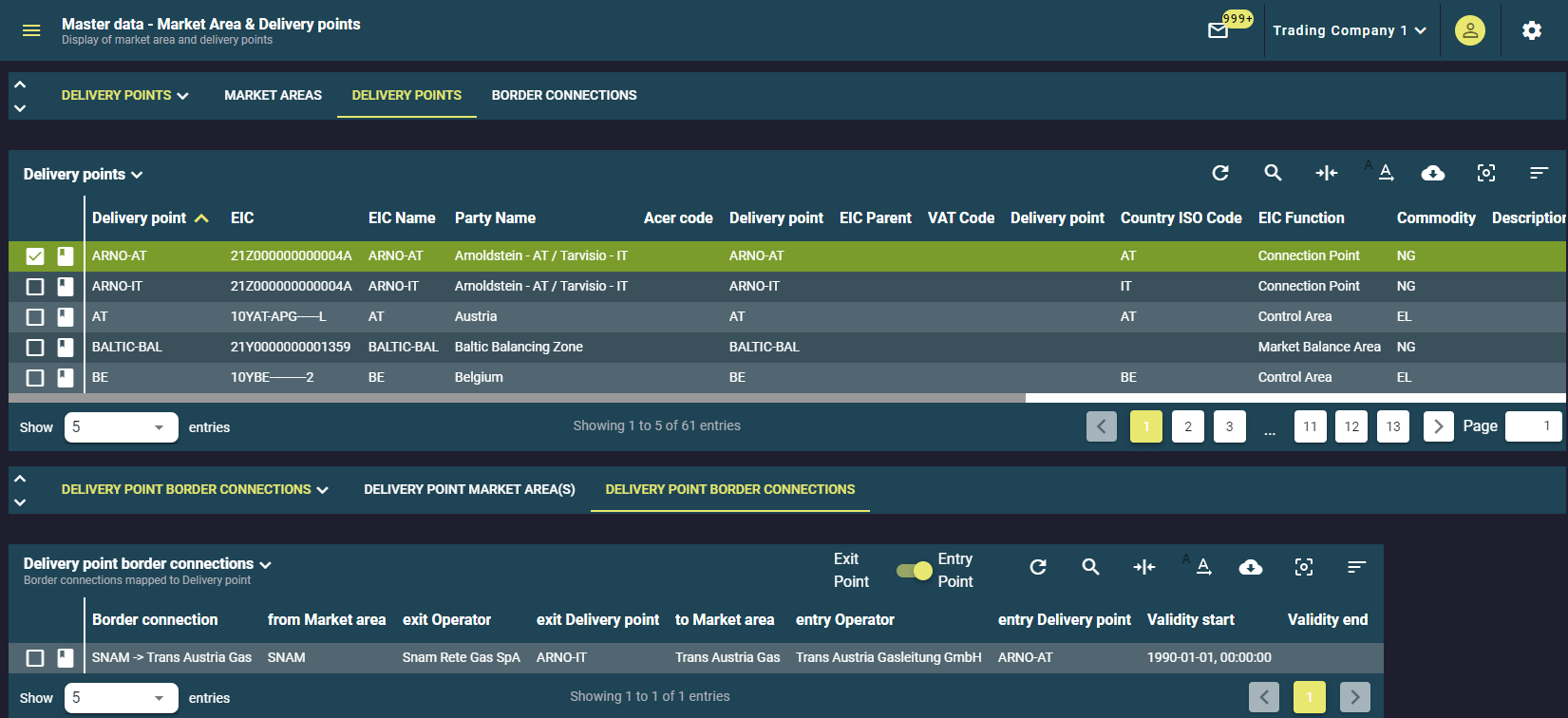

Master Data (OMP Data)

Master Data (Market Modell Enhancements)

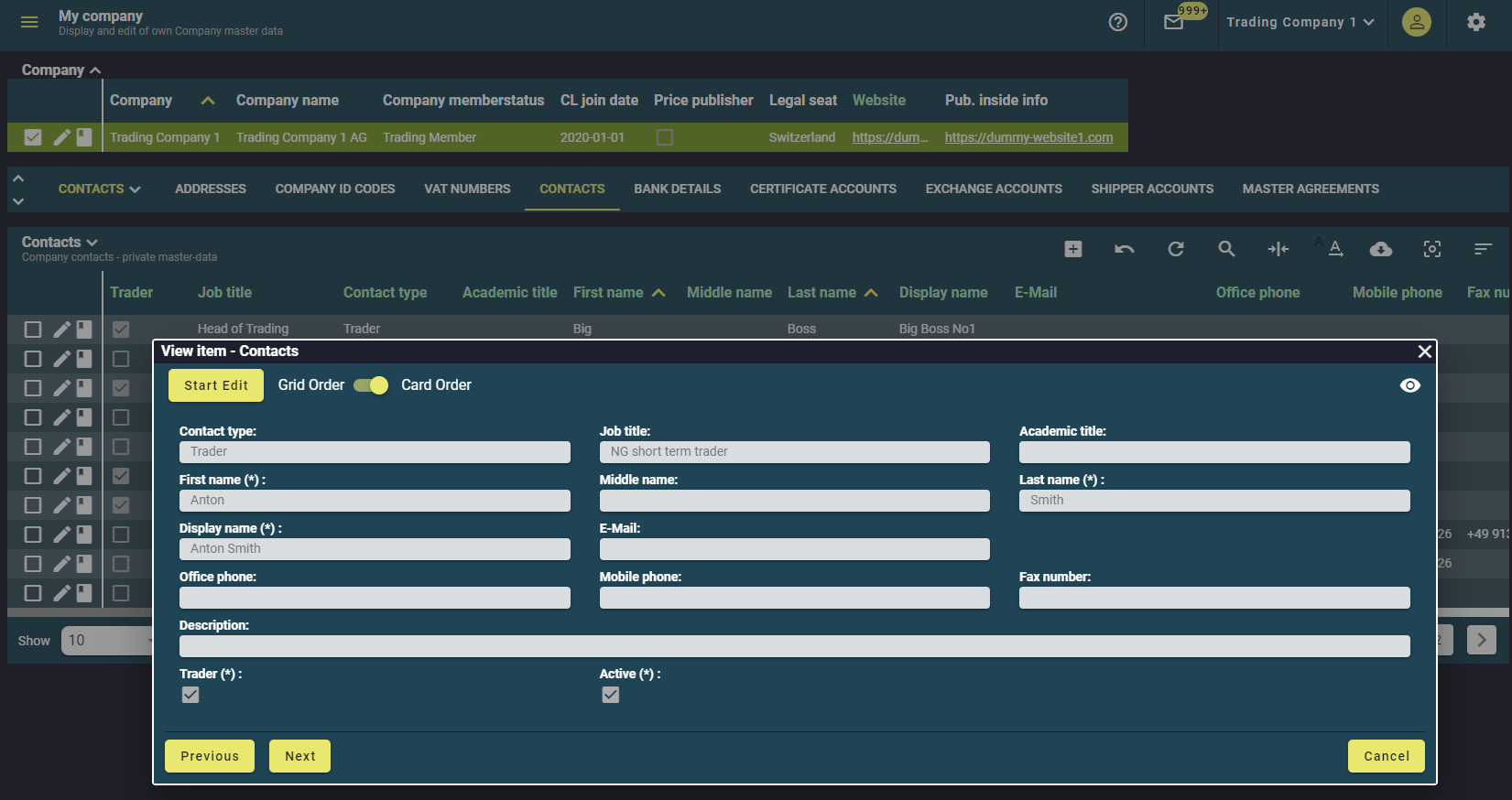

Counterparty data repository

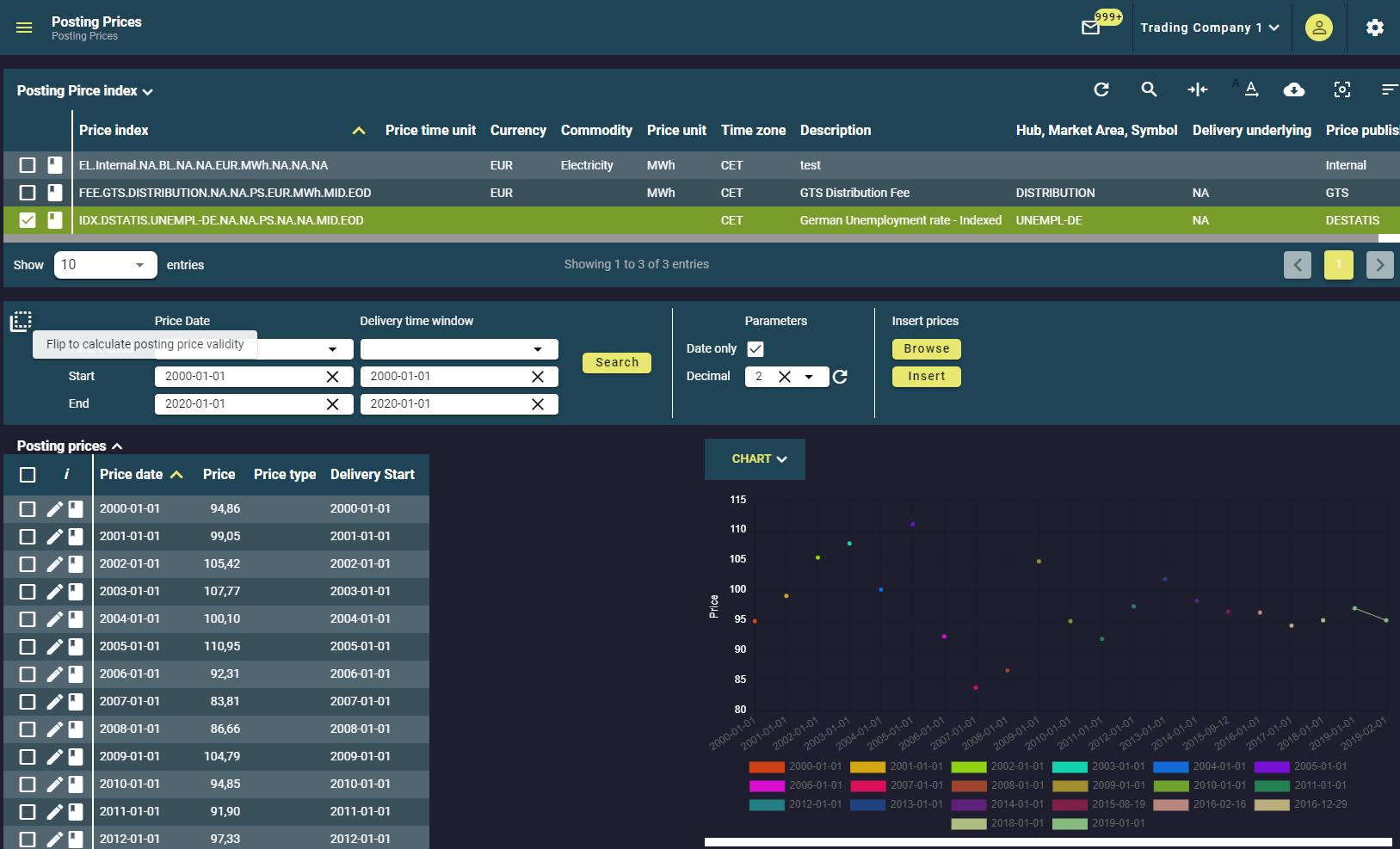

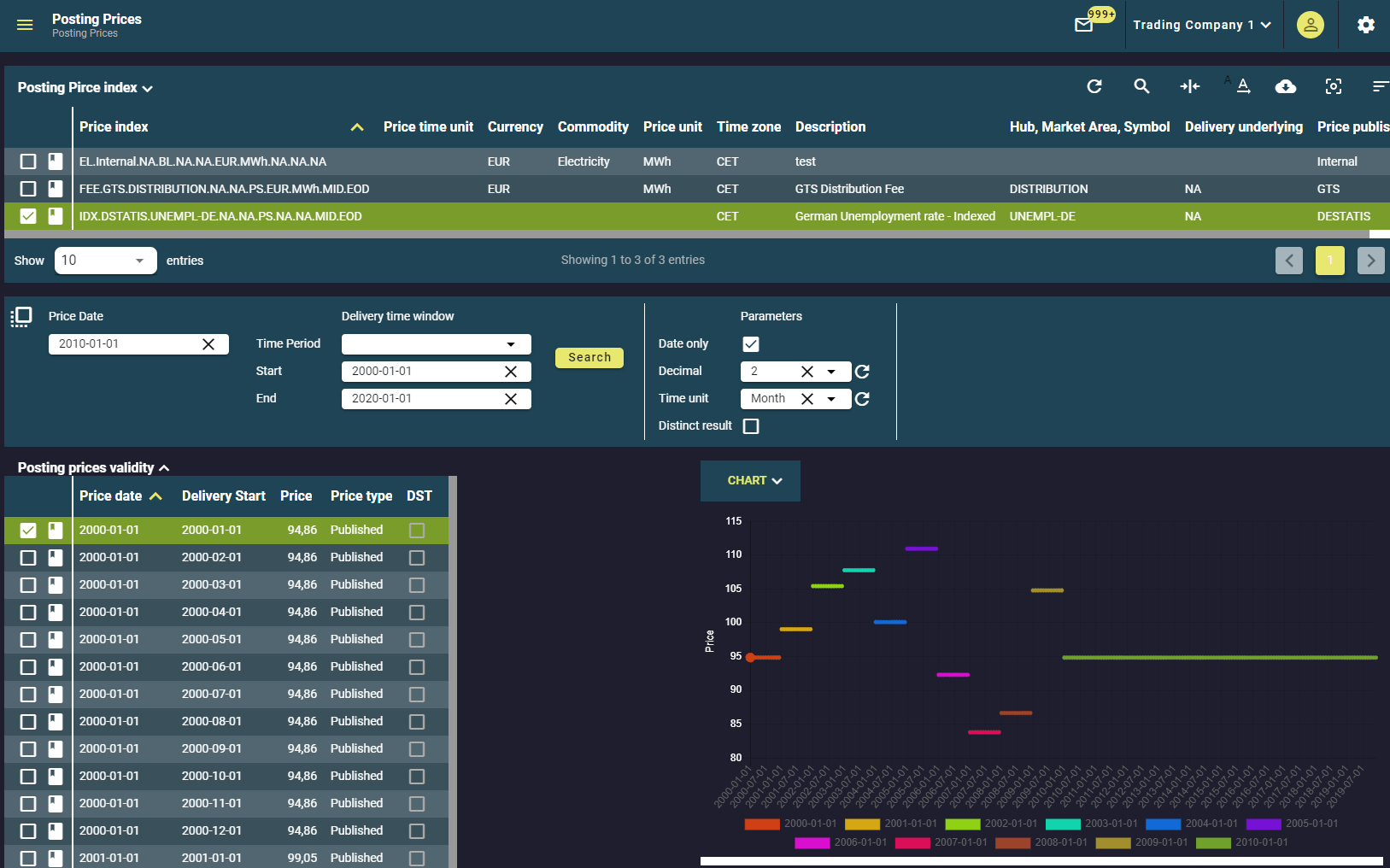

Posting Prices

Posting Prices

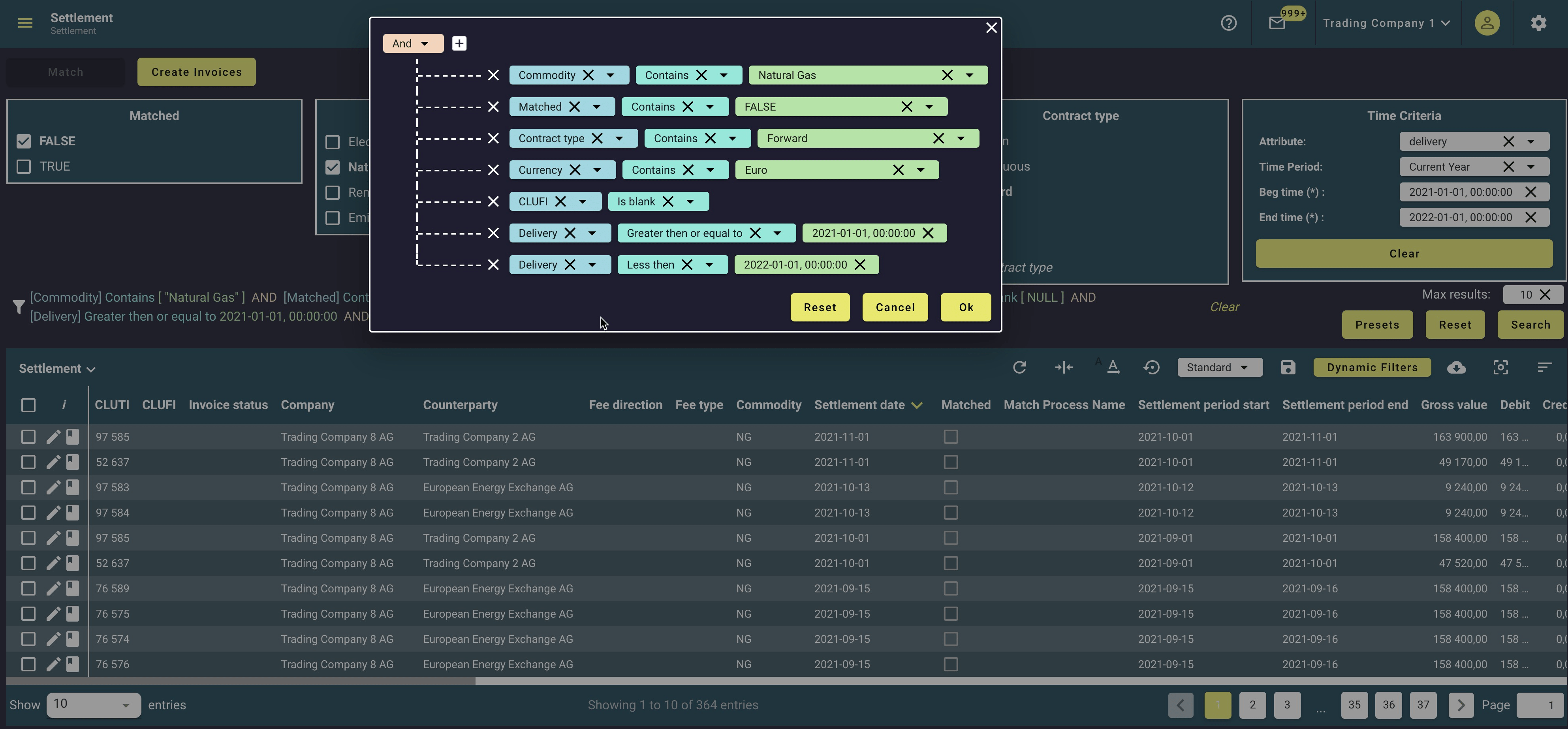

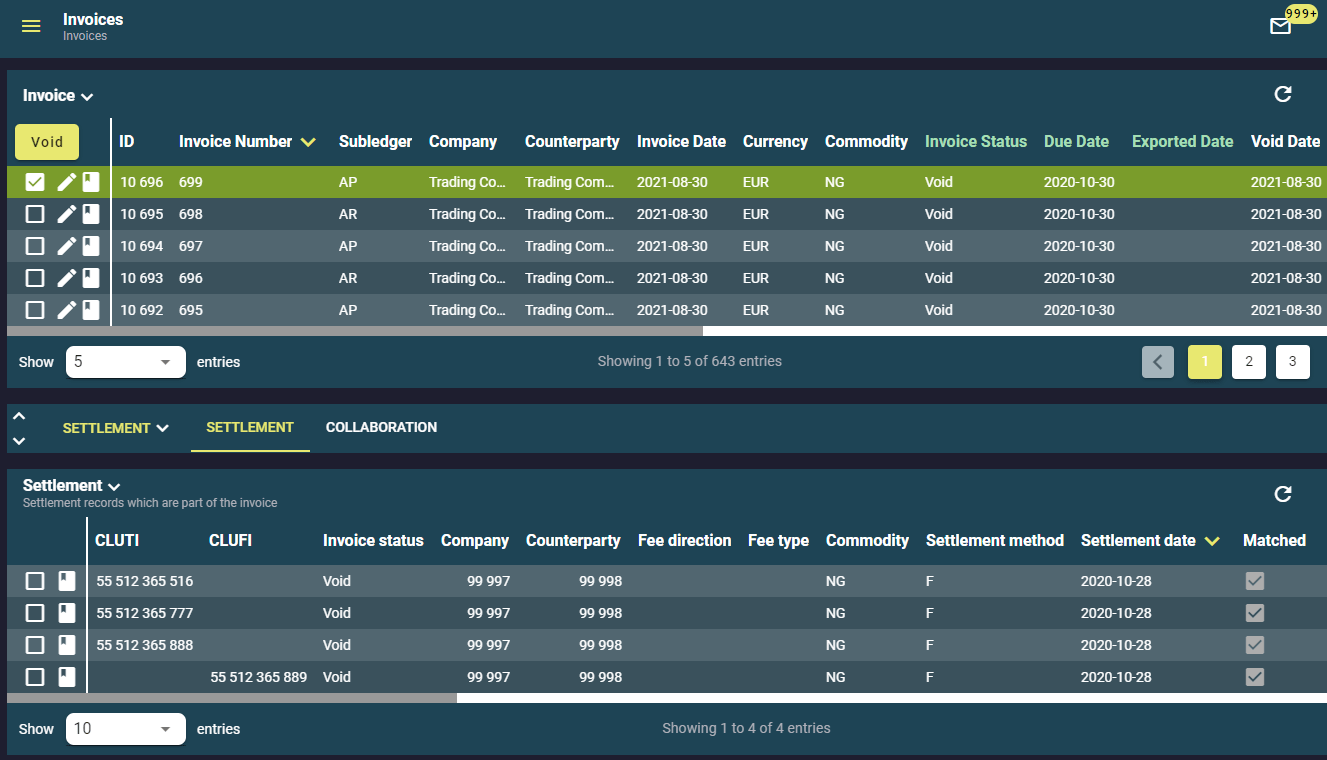

Settlement

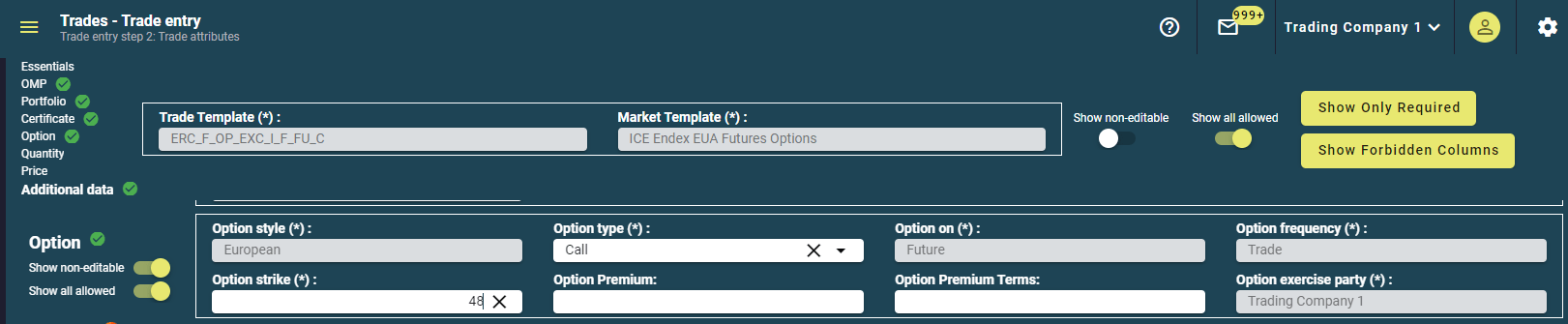

Options Trade Capture

Options Trade Capture

Options Trade Capture

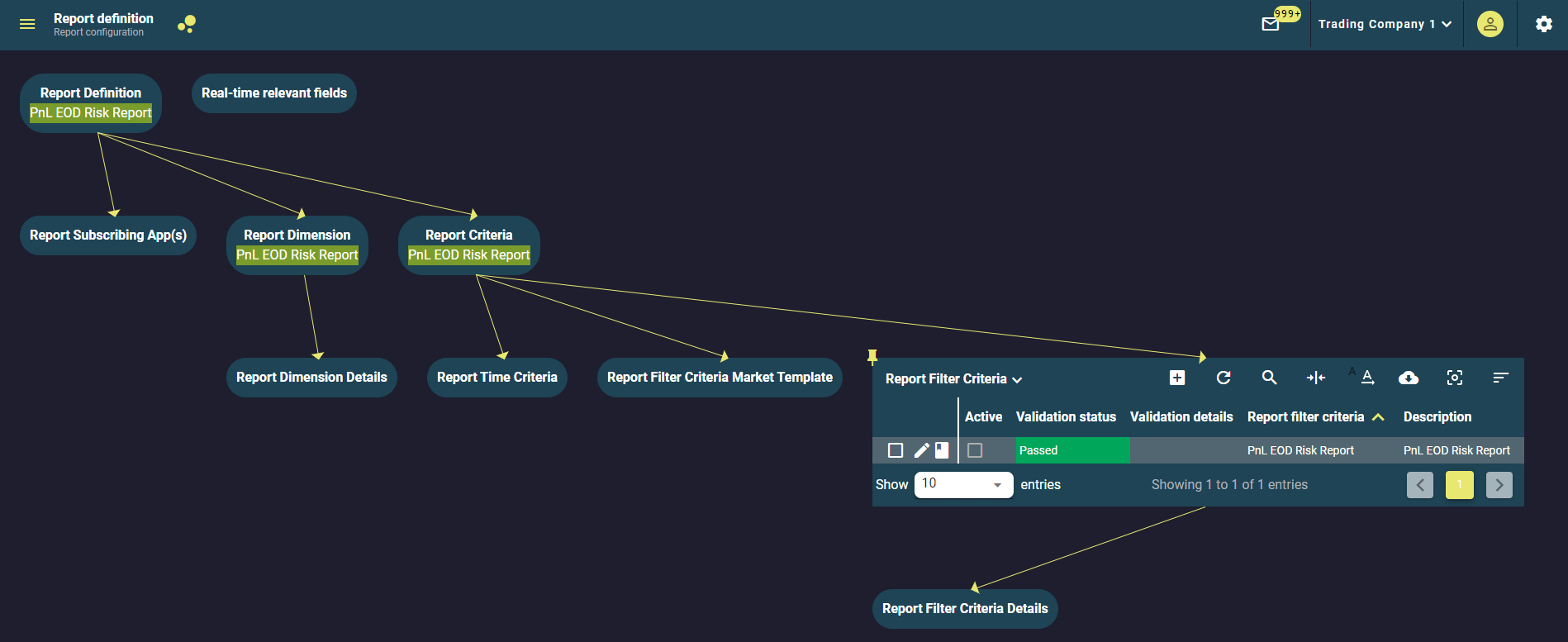

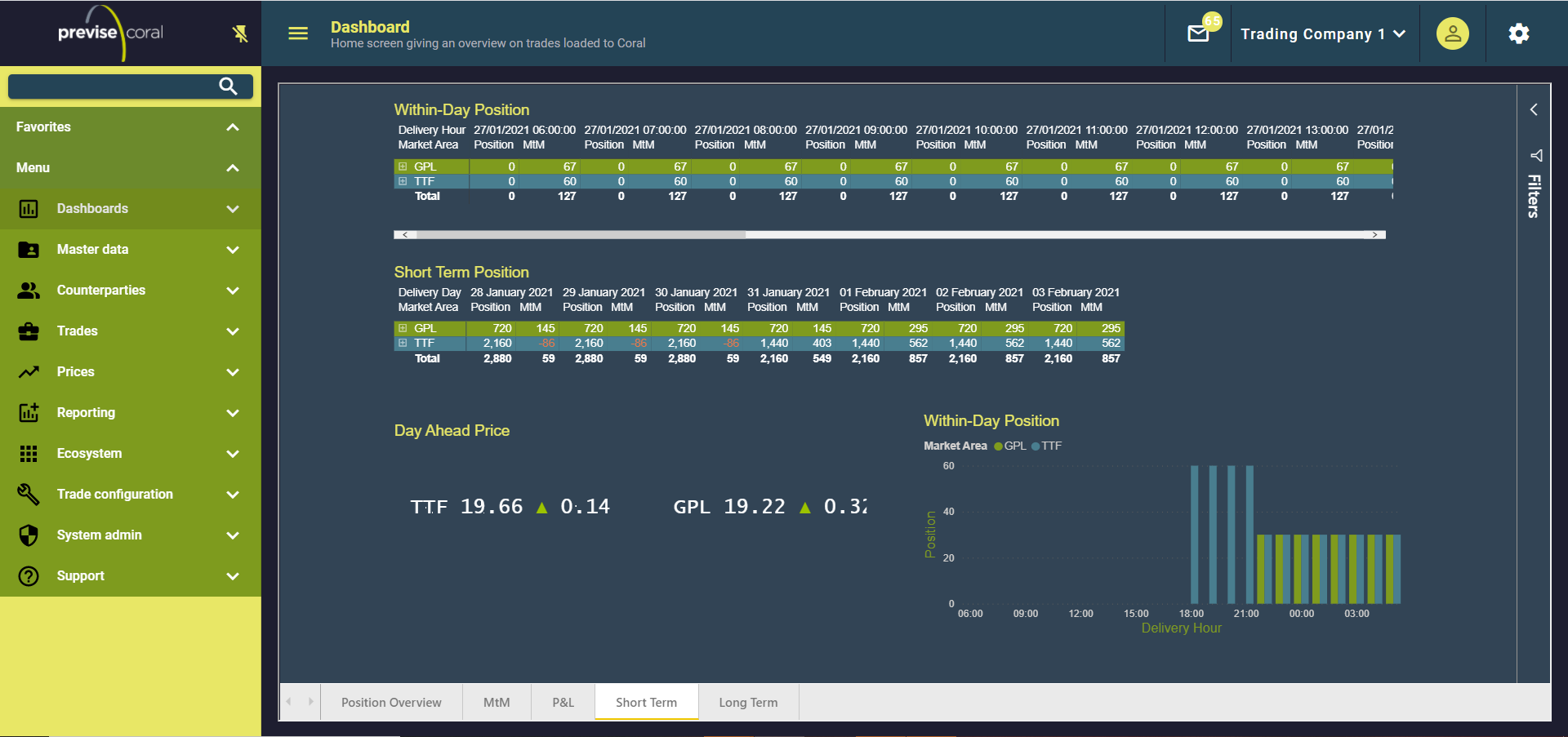

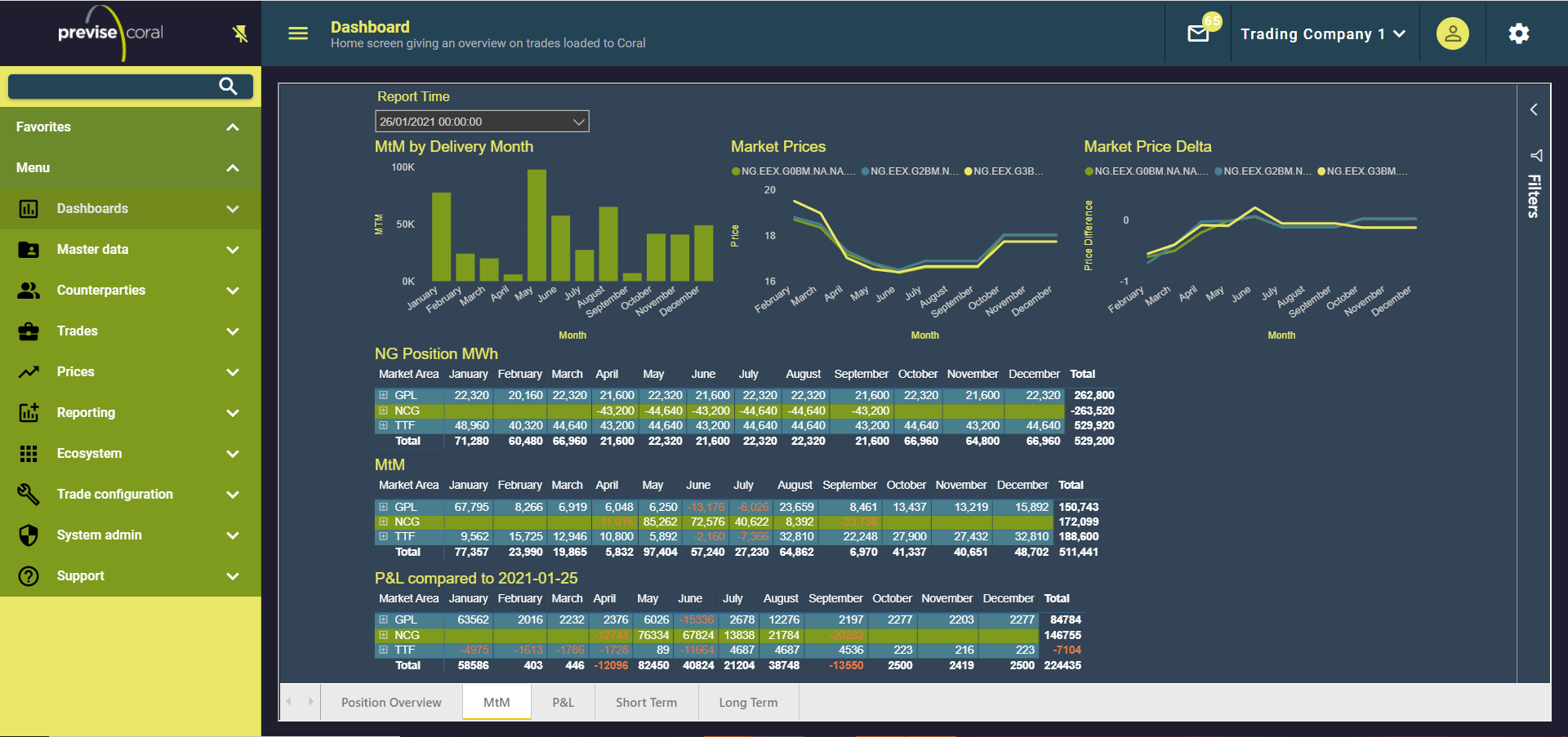

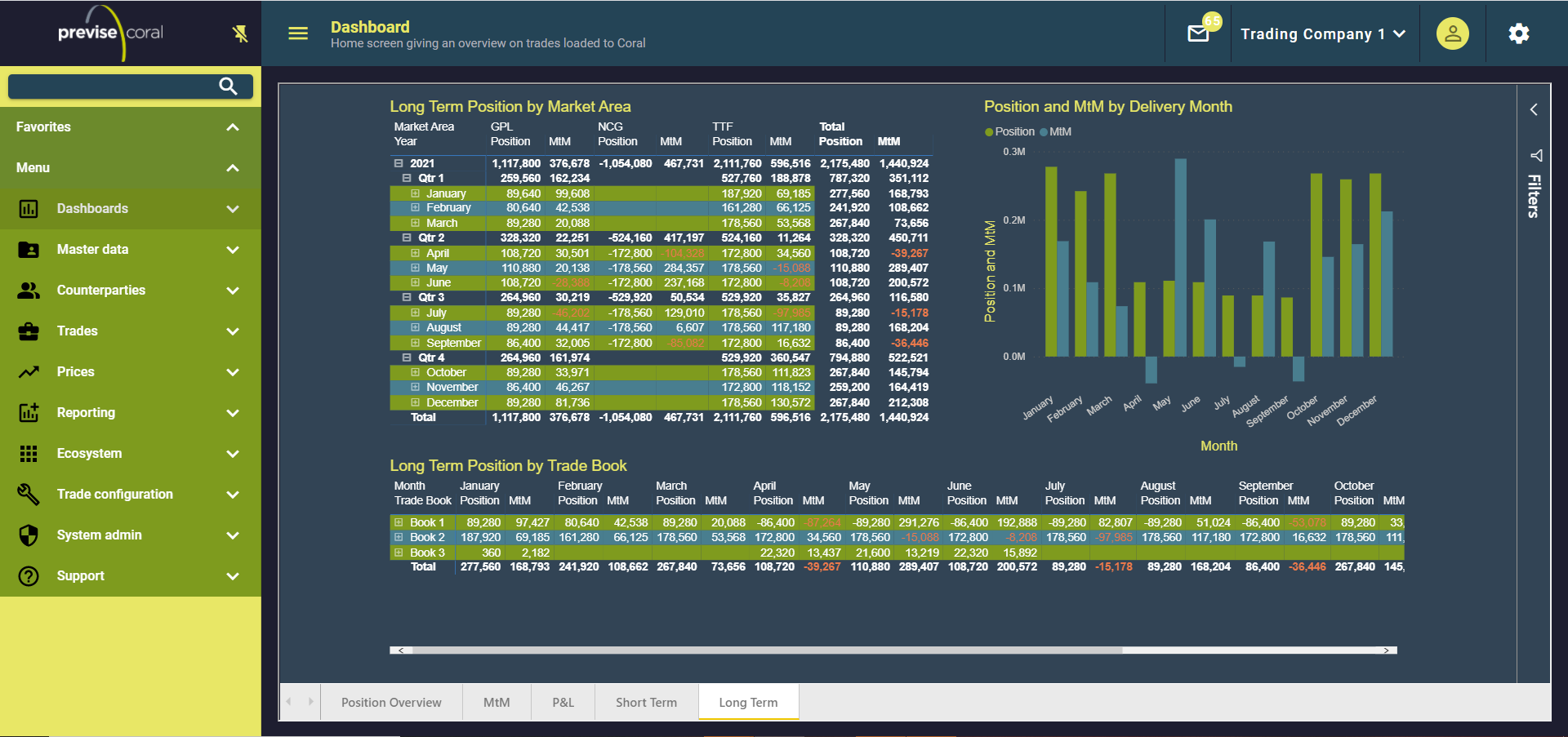

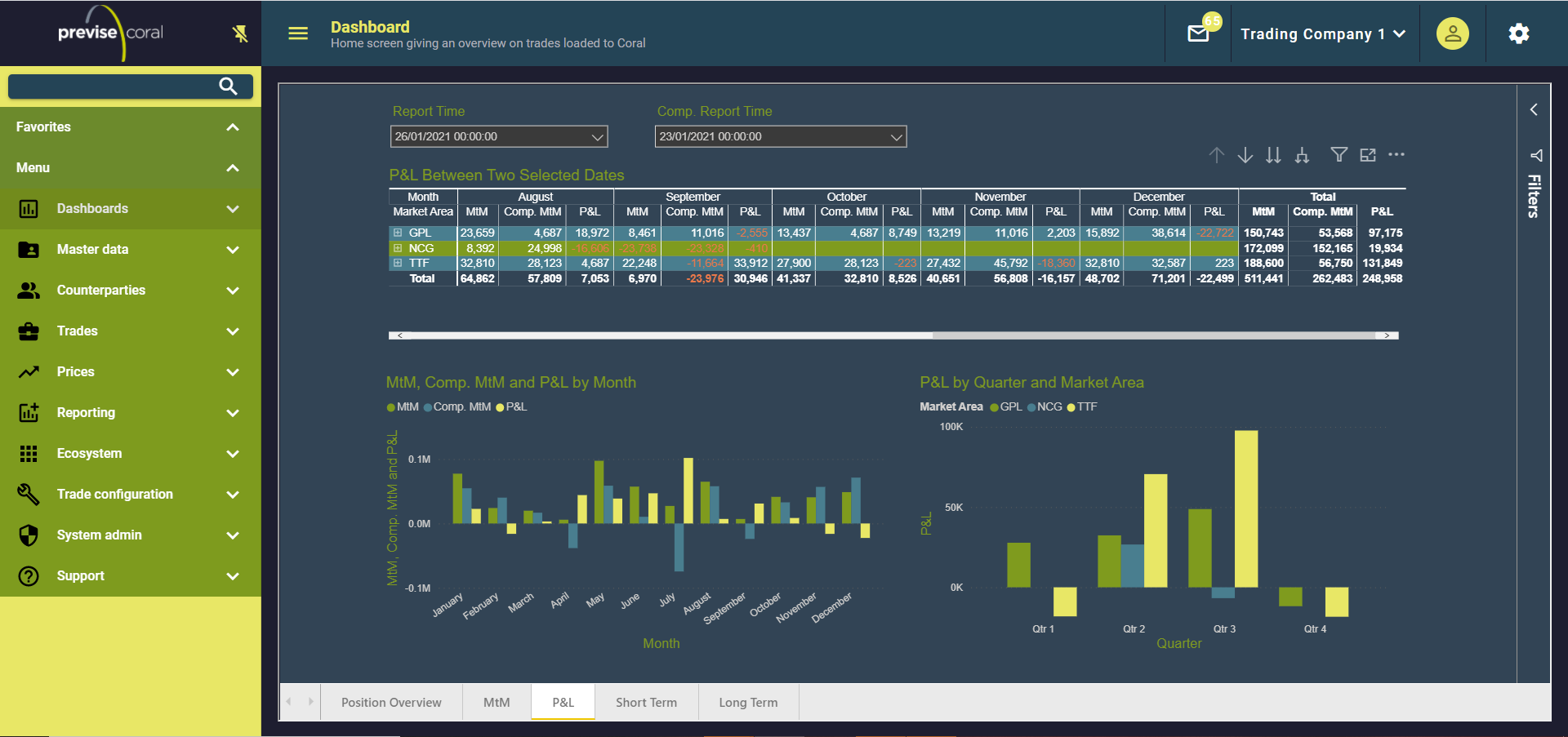

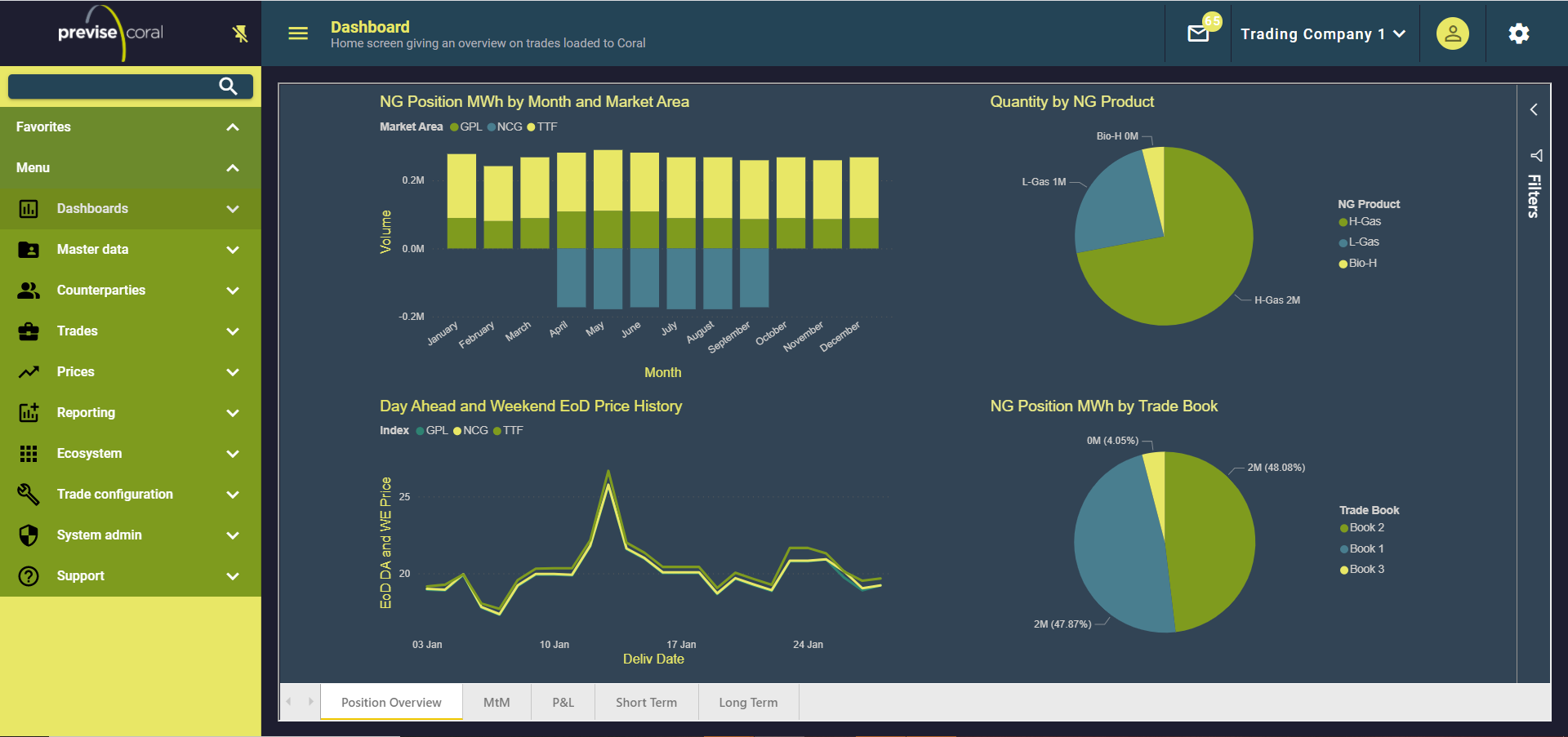

Sample Natural Gas Position Reports

Example of a combined hourly and daily NG position report

Example of a combined MtM, position and P&L report

Example of a monthly NG position report (grouped by Market Area & Tradebook)

Example of a report to view P&L by comparing two specific dates

Example of NG position overview report

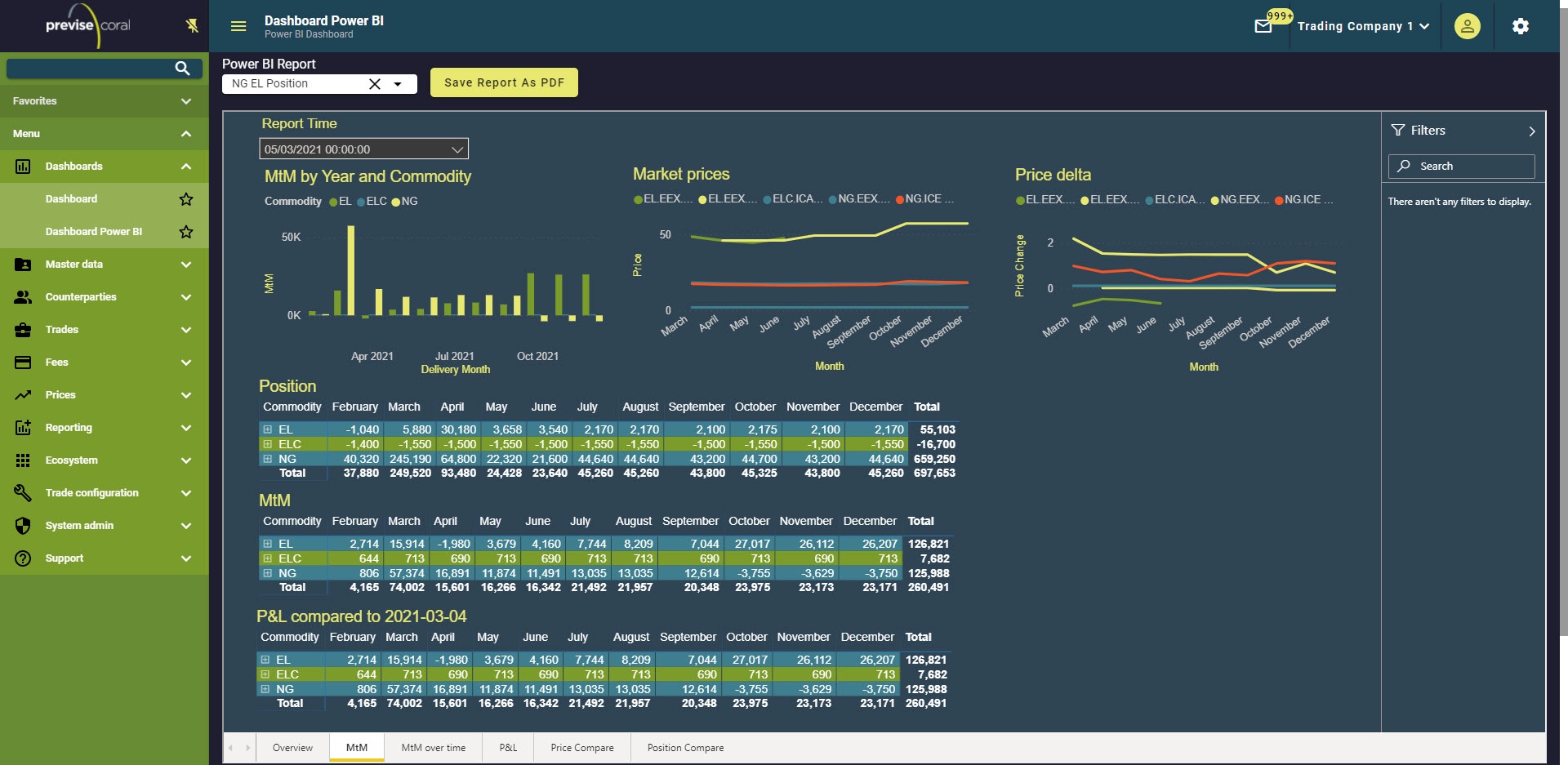

Sample Multi-Commodity Position Reports

Comparing market prices from two indexes for two specific report times

Comparing positions across multiple commodities between two specific report dates

Embedded Power BI overview of NG, EL and ELC positions with export into PDF

Example of MtM and Position overview for NG, EL and ELC portfolios

Example of a P&L report with the ability to compare the latest MTM results with previously executed valuations

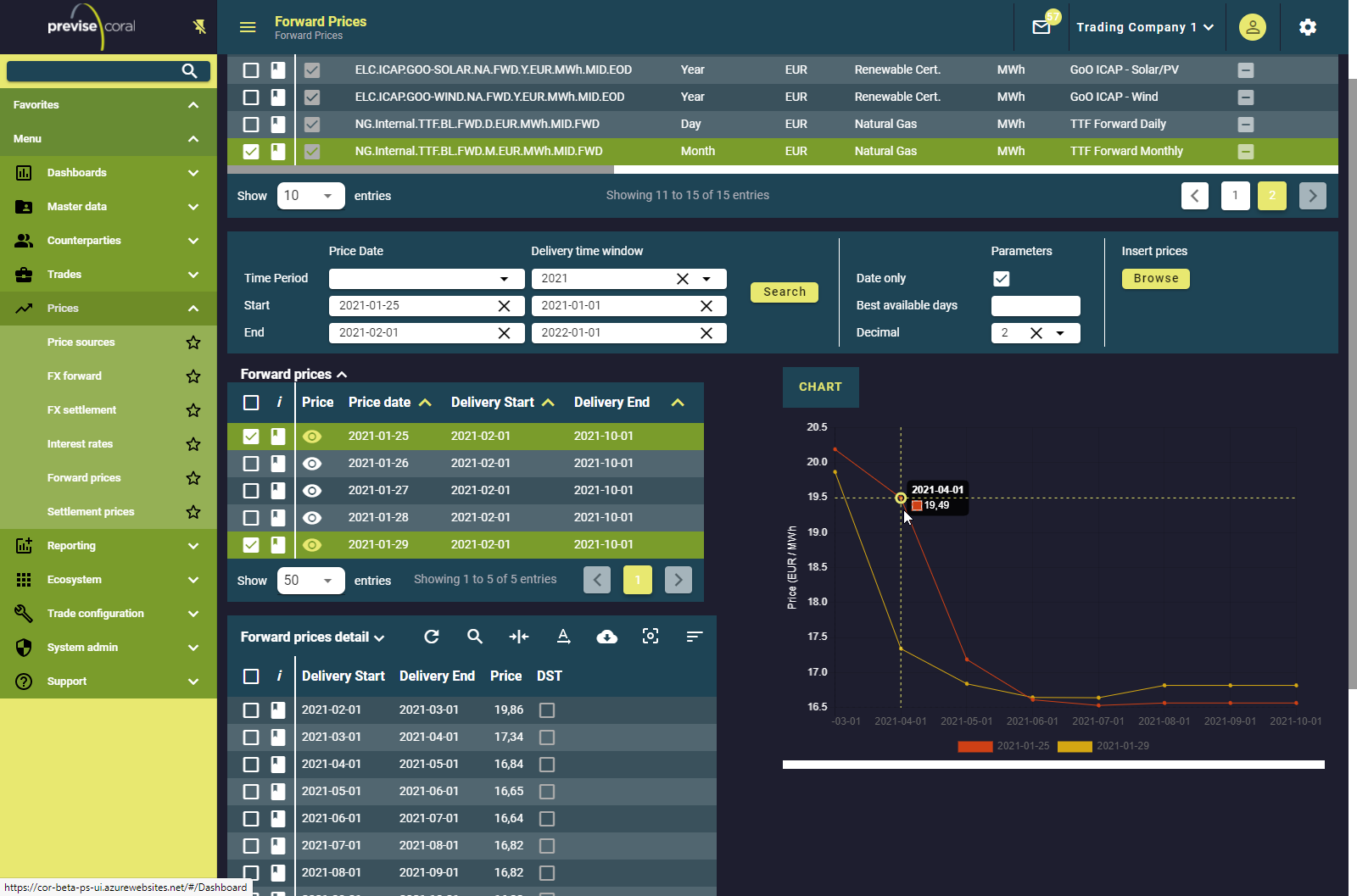

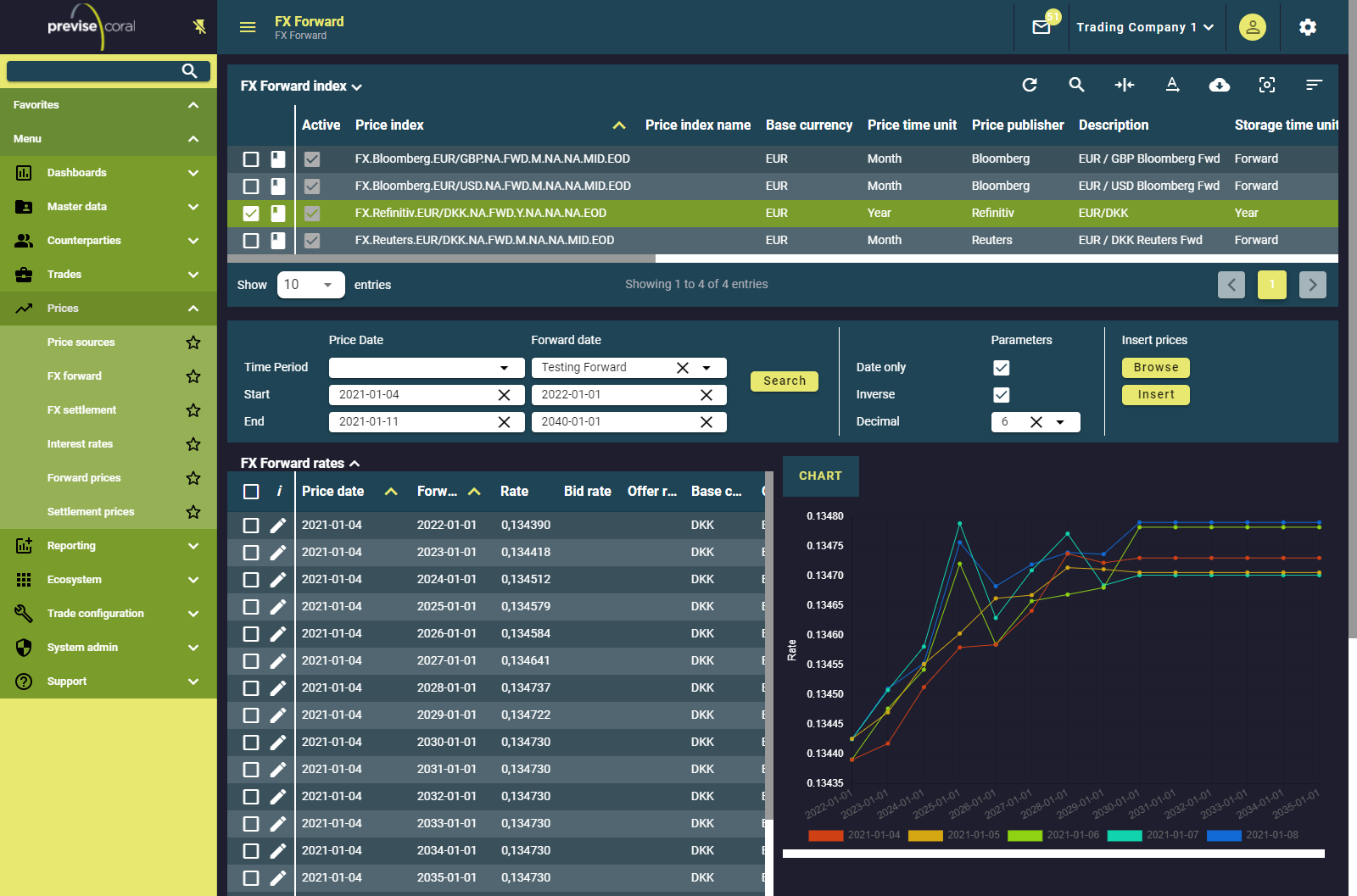

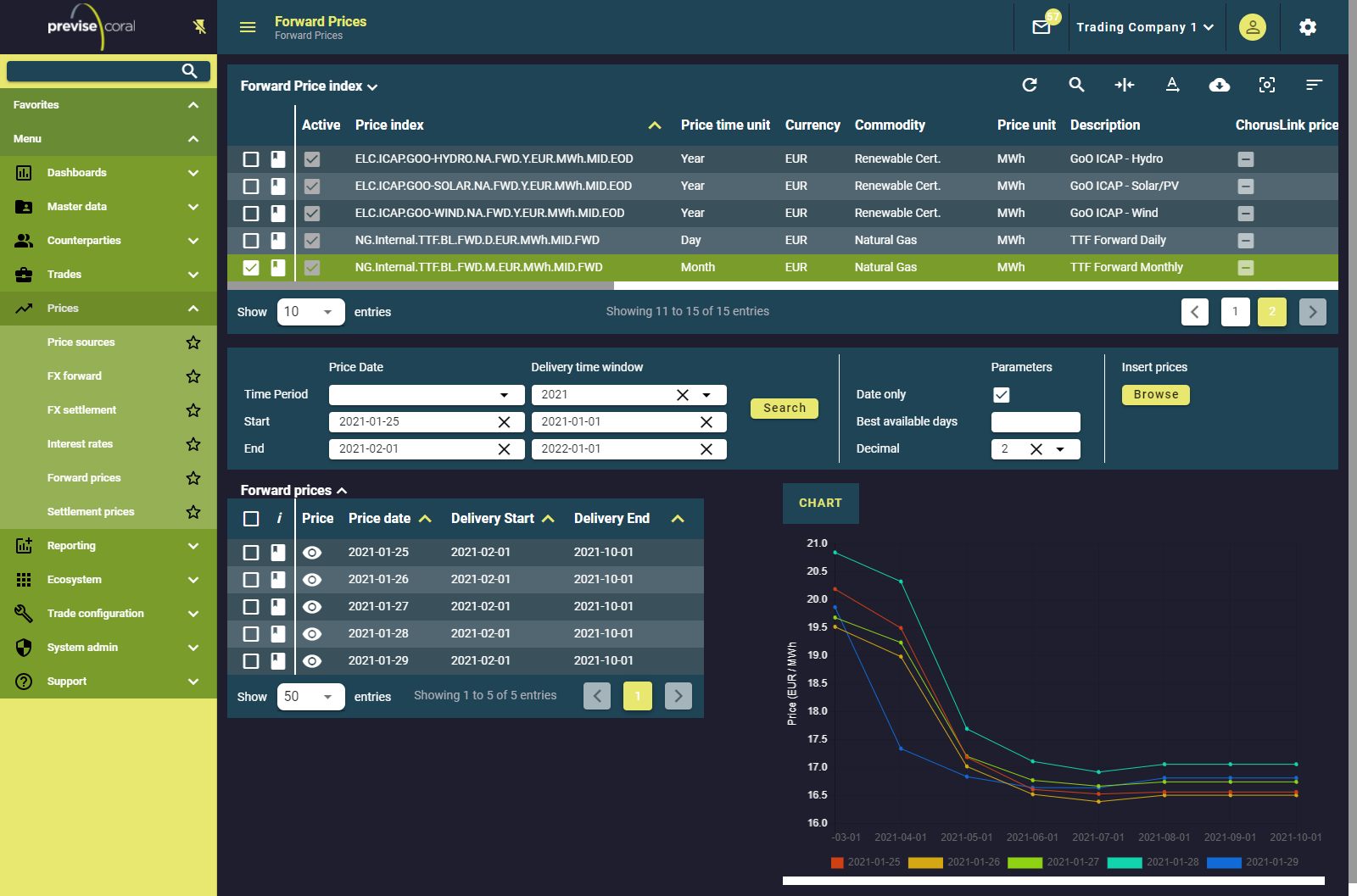

Prices

Price chart example selecting two sets of prices for an internal NG index in the forward prices view

Price chart example selecting the inverse FX forward rates for the EUR-DKK index

Price chart example selecting internal NG forward curve prices loaded for specified days

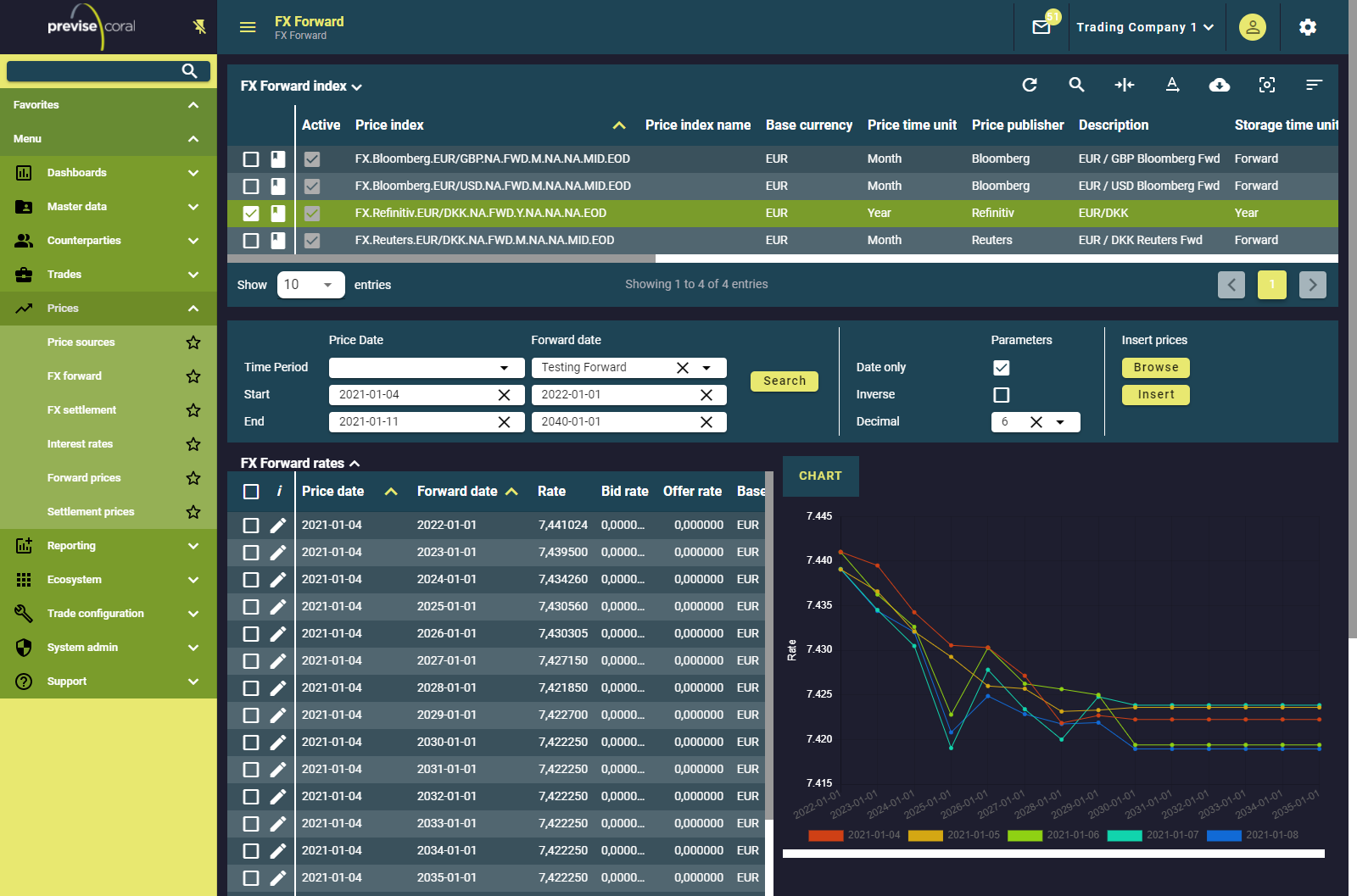

Price chart example selecting FX forward rates for the EUR-DKK index